Gold and silver exchange leading roles in the market quite often, especially on the short term charts. Last time I wrote about it silver saved gold from collapse at the start of this month. The white metal unexpectedly bounced off the earlier low reversing the drop of the yellow metal.

This time gold took the lead as its failure to break below the Bear Flag let silver lick its wounds and return above the $14 handle.

Get These Articles in Your Inbox Daily....Right Here

Both metals are still trapped in the middle of the range set by the earlier heavy drop, which first occurred in gold and then it was repeated in the silver market. In this post, I have focused on the local structure as the bigger picture remains unchanged.

The top metal couldn’t break below the trendline support of a Bear Flag (orange) and then quickly restored most of its losses coming back above $1200. It is interesting that the forecasted drop unfolded quite differently in each metal. Silver tagged the earlier trough, but gold failed even to breach the vertically sloped trendline. It looks like strong demand appeared right at the round number of the gold price in the $1200 area.

This move up could build another leg of a prolonged correction, which is labeled as third 3rd (blue line) on the chart. The target for this leg is located on the upside of the trend channel ($1260-$1270), and it perfectly matches with the earlier top established this July. It is worth to mention that the triple legged corrections are not as regular as simple AB/CD double leg moves.

Currently, gold shows signs of a minor correction, therefore, I put the Fibonacci retracement levels to highlight the area where the last move up within the 3rd leg up could emerge. This area is located between $1209 and $1213, and it coincides with the trendline support contact point.

The break below $1190 is needed to invalidate the current growth structure.

Silver has a lot of tricks on the chart, and from the very beginning of this horizontal consolidation, I was puzzled to break down the initial structure, although gold has been hinting clearly at the large consolidation in both metals. The main assistant of the trader is time, as more time passes, the chart the structure of the instrument becomes clearer.

As gold didn’t confirm the end of the consolidation, then we should consider the continuation of it for silver as well despite that it retested the earlier low to establish the fresh one at $13.88.

It looks like we got a very complex BC junction, which consists of two counter-trend moves down (small red down arrows). The complexity emerged due to the additional pro-trend (counter-trend relative to red down arrows) sub-junction (small blue up arrows), which let silver synchronize the move with gold as earlier it has been lagging. What was considered to be a second CD leg up, turned out to be a lesser degree CD leg up of a sub-junction. The complexity of the silver chart structure was caused by the unstable nature of the market demand as central banks favor gold, and only cross-market bargain hunters eliminate the excessive miscorrelation.

The second leg (CD segment) up could finally retest the $15 round level to complete this large flat correction. The minor correction that started at the end of last week already hit below the 50% Fibonacci retracement level ($14.21) and could dip further to the $14 round level as gold have more room down for the same minor retracement.

The drop below $13.88 would terminate this leg up.

Aibek Burabayev

Contributor, Metals

Trade ideas, analysis and low risk set ups for commodities, Bitcoin, gold, silver, coffee, the indexes, options and your retirement. We'll help you keep your emotions out of your trading.

Monday, November 26, 2018

Gold Extends Consolidation Giving Silver Another Chance

Friday, November 23, 2018

Crude Oil and Bitcoin Hit New Yearly Lows

For the first time in a year WTI crude oil is traded below $54 a barrel hitting a low of $53.63. Oil fell as much as 6% as fears are surfacing that OPEC's planned production cuts will do little to stave off a surge in global stockpiles.

Bitcoin finally made a significant move to break out of the tight trading range that it had been trapped in. Unfortunately for Bitcoin bulls, it was not the move that they were looking for as it dropped almost 13% on Monday and continued lower Tuesday shedding another 4.8% to trade at the new yearly low of $4,547.00. The cryptocurrency is now down more than 60% year to date and more than 70% since its all time high. Where will it stop? $3000, $2000 or $1000?

Not to be outdone by oil and Bitcoin, stocks are all continuing the sell off that started Monday with the S&P 500 dropping 1.6%, the DOW is once again below 25k, shedding 2% and the NASDAQ is trading back below 7,000 losing 1.6%. The recent sell off has once again pushed the stock market back below the yearly open, shedding all of the gains that came with record highs earlier in the year which has driven all three indexes into correction/bear market territory. It's looking more and more like we have a good to chance to end the year lower unless we get the Santa Clause rally.

Jeremy Lutz

INO/MarketClub

Bitcoin finally made a significant move to break out of the tight trading range that it had been trapped in. Unfortunately for Bitcoin bulls, it was not the move that they were looking for as it dropped almost 13% on Monday and continued lower Tuesday shedding another 4.8% to trade at the new yearly low of $4,547.00. The cryptocurrency is now down more than 60% year to date and more than 70% since its all time high. Where will it stop? $3000, $2000 or $1000?

Not to be outdone by oil and Bitcoin, stocks are all continuing the sell off that started Monday with the S&P 500 dropping 1.6%, the DOW is once again below 25k, shedding 2% and the NASDAQ is trading back below 7,000 losing 1.6%. The recent sell off has once again pushed the stock market back below the yearly open, shedding all of the gains that came with record highs earlier in the year which has driven all three indexes into correction/bear market territory. It's looking more and more like we have a good to chance to end the year lower unless we get the Santa Clause rally.

Jeremy Lutz

INO/MarketClub

Monday, November 12, 2018

Will Crude Oil Find Support Near $60 Dollars

Our research team warned of this move in crude oil back on October 7, 2018. At that time, we warned that oil may follow a historical price pattern, moving dramatically lower and that lows near $65 may become the ultimate bottom for that move. Here we are with a price below that level and many are asking “where will it go from here?”.

We believe the support near $65, although clearly broken, may eventually become resistance for a future upside price move. Our proprietary Fibonacci price modeling system is suggesting a new target near $52.00 - $53.00 and we believe this downside move in crude oil is far from over at this point.

The current global climate for oil is that suppliers are pumping more and more oil into the market at a time when, historically, prices should continue to decline. One of our research tools includes the ability to identify overall bias models for each week, month or quarter. Historically, crude oil is dramatically weaker in the month of November and relatively flat for the month of December.

Analysis for the month of November = 11

* Total Monthly Sum : -44.52000000000001 across 36 bars

Analysis for the month of December = 12

* Total Monthly Sum : -0.699999999999922 across 36 bars

We believe the price of oil will continue to drift lower to target the $52.00 - $53.00 Fibonacci support level before attempting to find any real price support. This equates to an addition -6 to -8% price decline for skilled traders. We will alert you with a new research post as this downward price move continues or new research becomes available.

We have been calling these types of market moves all year and recently called the top in the U.S. equity markets nearly 40 days before it happened. Want to know what we think is going to happen for the rest of 2018 and into early 2019? Visit the Technical Traders Free Research to read all of our public research posts. Isn’t it time you invested in a team of researchers and tools to assist you in finding greater trading success?

Chris Vermeulen

We believe the support near $65, although clearly broken, may eventually become resistance for a future upside price move. Our proprietary Fibonacci price modeling system is suggesting a new target near $52.00 - $53.00 and we believe this downside move in crude oil is far from over at this point.

The current global climate for oil is that suppliers are pumping more and more oil into the market at a time when, historically, prices should continue to decline. One of our research tools includes the ability to identify overall bias models for each week, month or quarter. Historically, crude oil is dramatically weaker in the month of November and relatively flat for the month of December.

Analysis for the month of November = 11

* Total Monthly Sum : -44.52000000000001 across 36 bars

Analysis for the month of December = 12

* Total Monthly Sum : -0.699999999999922 across 36 bars

We believe the price of oil will continue to drift lower to target the $52.00 - $53.00 Fibonacci support level before attempting to find any real price support. This equates to an addition -6 to -8% price decline for skilled traders. We will alert you with a new research post as this downward price move continues or new research becomes available.

We have been calling these types of market moves all year and recently called the top in the U.S. equity markets nearly 40 days before it happened. Want to know what we think is going to happen for the rest of 2018 and into early 2019? Visit the Technical Traders Free Research to read all of our public research posts. Isn’t it time you invested in a team of researchers and tools to assist you in finding greater trading success?

Chris Vermeulen

Labels:

Chris Vermeulen,

Crude Oil,

Drilling,

fibonacci,

Gas,

investing,

resistance,

stocks,

support,

USO

Thursday, November 8, 2018

U.S. Equities Roar to Life After Elections

Our research team is writing this message to alert all investors and traders of a pending rotation in the U.S. stock market that may happen between now and November 15th. The upside price breakout that is occurring on November 7th, the day after the US mid-term elections, is an incredible display of global investor sentiment regarding the GOP success in the Senate and the continued business friendly expectations originating out of Washington DC. The move, today, shows how clearly a global capital market shift is still engaged in the U.S. markets and how much global investors are counting on the US to drive ROI and economic growth going forward.

Yet, we feel it is important to urge investors that our modeling systems are still suggesting an ultimate price bottom should be setting up near November 8th - 15th and that we could still see a bit of downward price rotation over the next few days before this ultimate price bottom completes. It might be too easy to get caught up in this move, today, and fail to properly understand the price rotation risks that are still active in the time/price horizon.

The ES is currently +48.00 as of the creation of this post (+1.74%). This is an incredible move higher and the 2790 level becomes critical support for the markets as long as price is able to stay above that level.

The NQ is currently +172.50 (+2.45%) and shows just how clearly investors are piling into technology, healthcare and bio-tech after the US elections. This is a real vote from investors that they believe President Trump will be able to navigate any issues going forward and that the US economy will continue to push out strong numbers.

Follow our analysis to read our most recent research posts. We have already positioned our members for this “ultimate bottom” that our predictive modeling systems suggest is in the midst of forming. We called this entire downside move, bottom rotation and the ultimate bottom pattern setting up near November 12th back on September 17. If you want to learn how we can help you find and execute better trades, visit The Technical Traders to learn more.

Chris Vermeulen

Check out Chris' "Three Hour Mastery Trading Course" Right Here

Yet, we feel it is important to urge investors that our modeling systems are still suggesting an ultimate price bottom should be setting up near November 8th - 15th and that we could still see a bit of downward price rotation over the next few days before this ultimate price bottom completes. It might be too easy to get caught up in this move, today, and fail to properly understand the price rotation risks that are still active in the time/price horizon.

The ES is currently +48.00 as of the creation of this post (+1.74%). This is an incredible move higher and the 2790 level becomes critical support for the markets as long as price is able to stay above that level.

The NQ is currently +172.50 (+2.45%) and shows just how clearly investors are piling into technology, healthcare and bio-tech after the US elections. This is a real vote from investors that they believe President Trump will be able to navigate any issues going forward and that the US economy will continue to push out strong numbers.

Follow our analysis to read our most recent research posts. We have already positioned our members for this “ultimate bottom” that our predictive modeling systems suggest is in the midst of forming. We called this entire downside move, bottom rotation and the ultimate bottom pattern setting up near November 12th back on September 17. If you want to learn how we can help you find and execute better trades, visit The Technical Traders to learn more.

Chris Vermeulen

Check out Chris' "Three Hour Mastery Trading Course" Right Here

Labels:

Chris Vermeulen,

Crude Oil,

gold,

investors,

money,

QQQ,

Silver,

stocks,

The Technical Traders,

USO

Monday, October 29, 2018

Where's the Capitulation in Precious Metals?

Over the past 20+ years of research and trading in the markets, our team of traders and researchers know one thing is certain, when fear hits the global markets, precious metals react by rocketing higher. We’ve seen this happen over and over again – even when non-US geopolitical concerns spark some true fear in the markets.

If you’ve followed our research this week, we’ve been warning about how we believe this move is purely price and technical based and not really a fear based global price collapse. In other words, our technical systems, price modeling systems, and other advanced price analysis tools are suggesting this move is nearing an end and was likely a function of price rotation and less a function of true fear in the global markets.

Yes, there were a couple of key factors the precipitated this price move; the Fed, Earnings, Housing Data, Trade, and Geopolitical concerns and the US Elections. Yet the biggest concern for traders was the “deja vu” feeling that Housing could present another massive crash near an election. We’ve been through that and we know how ugly that can be if it were to unfold again.

Our researchers, at The Technical Traders, spent quite a bit of time going over the data and we continue to believe this downside price rotation in the global stock markets was nothing more than a technical price correction WITHOUT any real capitulation from other commodities. If the recent downside price collapse sowed any real fear into investors, then precious metals should have skyrocketed higher over the past 3+ weeks.

This Weekly Gold chart shows how prices advanced moderately over the past few weeks and failed to originate any real broad upside move as equity prices collapsed. Weeks ago, we predicted Gold would climb to near $1235, the CYAN line on this chart, before weakening to near $1200 again near the US mid term elections. After the elections, we believe that Gold will begin another price advance toward a price target near $1310 headed into 2019.

The YELLOW arrow showing the massive upside projections are based on our Fibonacci price modeling system and suggest that Gold may ultimately have an upside potential near $1435 or $1565 eventually. These upside targets, if reached, would be the result of REAL FEAR entering the global markets associated with a much greater contagion/capitulation event taking place. This may be something that happens in the future, as some point, but we don’t believe this is taking place now.

This Weekly Silver chart further illustrates the weakness in the precious metals sector throughout this recent global stock market collapse. The price of Silver actually fell slightly over the past few weeks and stayed near $14.75. A recent double bottom formation in Silver near $13.95 is a very strong indication that Silver is establishing a long-term base near the $14.00 level. You can see from our draws arrows that we believe Silver will continue to contract headed into the US mid-term elections, then begin a moderate advance higher.

We are actively searching for new trades within the precious metals sector that present clear opportunities for our members/subscribers as we believe this upside move in the metals will be one of the best trades in 2019. Although, right now, these trades are “set up trade” in the sense that we don’t expect any true fear to change price at the moment. We do expect investors to continue to look towards the precious metals markets as a form of protection from global events in the future and we believe that when the dam breaks and fear really does enter the markets, traders need to already be positioned within the precious metals sector – not chasing after the move.

Overall, our question still remains valid – where’s the capitulation in the precious metals? If this downside price movement within the global markets was “the top”, we have yet to see any real capitulation in precious metals, which we believe would be the first place to reflect this true fear. Without this capitulation, our researchers continue to believe this is a technical “reversion” move where price is moving lower to re-establish support for another upside price advance.

In conclusion, we do expect moderate price advances in the precious metals sector over the next 4~6+ months. We believe this sector will continue to attract investors as a means of protection against a sudden and more structural price collapse event in the future. Right now, though, we just don’t see the capitulation that would need to be in place if the downside equities move instilled any real fear in traders. It’s just not there – yet. Therefore, this recent downside swing appears to be a capital shift or reversion event where price will quickly attempt to find support, based (headed into the US mid-term elections – as we’ve been suggesting) and begin to move higher after November 12th.

Please visit The Technical Traders here for our Free Research to see all of our recent research posts and to help you understand what our researchers believe is really transpiring within the global markets.

Additionally, please visit The Technical Traders to learn how we can help you find and execute better trades and stay ahead of these market moves. Learn how we help our subscribers by delivering specialized content, video, research, trading signals and more. The next few years are going to be full of fantastic trading opportunities. Now is the time to start to take advantage of these setups and create greater success for your future.

Chris Vermeulen

If you’ve followed our research this week, we’ve been warning about how we believe this move is purely price and technical based and not really a fear based global price collapse. In other words, our technical systems, price modeling systems, and other advanced price analysis tools are suggesting this move is nearing an end and was likely a function of price rotation and less a function of true fear in the global markets.

Yes, there were a couple of key factors the precipitated this price move; the Fed, Earnings, Housing Data, Trade, and Geopolitical concerns and the US Elections. Yet the biggest concern for traders was the “deja vu” feeling that Housing could present another massive crash near an election. We’ve been through that and we know how ugly that can be if it were to unfold again.

Our researchers, at The Technical Traders, spent quite a bit of time going over the data and we continue to believe this downside price rotation in the global stock markets was nothing more than a technical price correction WITHOUT any real capitulation from other commodities. If the recent downside price collapse sowed any real fear into investors, then precious metals should have skyrocketed higher over the past 3+ weeks.

This Weekly Gold chart shows how prices advanced moderately over the past few weeks and failed to originate any real broad upside move as equity prices collapsed. Weeks ago, we predicted Gold would climb to near $1235, the CYAN line on this chart, before weakening to near $1200 again near the US mid term elections. After the elections, we believe that Gold will begin another price advance toward a price target near $1310 headed into 2019.

The YELLOW arrow showing the massive upside projections are based on our Fibonacci price modeling system and suggest that Gold may ultimately have an upside potential near $1435 or $1565 eventually. These upside targets, if reached, would be the result of REAL FEAR entering the global markets associated with a much greater contagion/capitulation event taking place. This may be something that happens in the future, as some point, but we don’t believe this is taking place now.

This Weekly Silver chart further illustrates the weakness in the precious metals sector throughout this recent global stock market collapse. The price of Silver actually fell slightly over the past few weeks and stayed near $14.75. A recent double bottom formation in Silver near $13.95 is a very strong indication that Silver is establishing a long-term base near the $14.00 level. You can see from our draws arrows that we believe Silver will continue to contract headed into the US mid-term elections, then begin a moderate advance higher.

We are actively searching for new trades within the precious metals sector that present clear opportunities for our members/subscribers as we believe this upside move in the metals will be one of the best trades in 2019. Although, right now, these trades are “set up trade” in the sense that we don’t expect any true fear to change price at the moment. We do expect investors to continue to look towards the precious metals markets as a form of protection from global events in the future and we believe that when the dam breaks and fear really does enter the markets, traders need to already be positioned within the precious metals sector – not chasing after the move.

Overall, our question still remains valid – where’s the capitulation in the precious metals? If this downside price movement within the global markets was “the top”, we have yet to see any real capitulation in precious metals, which we believe would be the first place to reflect this true fear. Without this capitulation, our researchers continue to believe this is a technical “reversion” move where price is moving lower to re-establish support for another upside price advance.

In conclusion, we do expect moderate price advances in the precious metals sector over the next 4~6+ months. We believe this sector will continue to attract investors as a means of protection against a sudden and more structural price collapse event in the future. Right now, though, we just don’t see the capitulation that would need to be in place if the downside equities move instilled any real fear in traders. It’s just not there – yet. Therefore, this recent downside swing appears to be a capital shift or reversion event where price will quickly attempt to find support, based (headed into the US mid-term elections – as we’ve been suggesting) and begin to move higher after November 12th.

Please visit The Technical Traders here for our Free Research to see all of our recent research posts and to help you understand what our researchers believe is really transpiring within the global markets.

Additionally, please visit The Technical Traders to learn how we can help you find and execute better trades and stay ahead of these market moves. Learn how we help our subscribers by delivering specialized content, video, research, trading signals and more. The next few years are going to be full of fantastic trading opportunities. Now is the time to start to take advantage of these setups and create greater success for your future.

Chris Vermeulen

Labels:

Chris Vermeulen,

commodities,

gold,

investing,

precious metals,

Silver,

stocks,

Technical Traders

Thursday, October 18, 2018

Detailed Map of Expected Price Movement Before the Breakout

Our research team was hard at work over the past few days. Not only were they able to call this downside price swing 3+ weeks in advance, they also called the market bottom within 0.5% of the absolute lows. Now, they have put together a suggested “map” of what to expect in regards to price rotation, support, resistance and the eventual price breakout that we are expecting to happen near or after November 8~12. Today, we are sharing this detailed map with all of our followers.

Our research team, at The Technical Traders, have honed their skills over the past few decades by studying market correlations, price relationships, advanced price modeling and more. Our objective is to be able to identify price patterns, opportunities, and setups while attempting to accurately predict the future of price so that we can keep our followers and members uniquely aware of future opportunities. As you can imagine, it is not an easy job and we often take heat for some of our research posts.

Today, we are sticking out neck out (again) and attempting to predict the future of the ES price rotation as this deeper rotation continues to play out. Our research team believes it has identified key price levels and dates/times that are relevant to this future price rotation. By no means is this research set in stone in regards to exact dates/times. These are suggestions which we believe to be accurate based on our research and analysis of the markets. Use them as guides to how this price rotation plays out.

This first chart is a Daily ES chart that shows three very important components of the current market price rotation.

* The Support Zone below the recent lows is actually very critical to the true understanding of price rotation. As long as this support zone is not completely breached, prices should continue to push higher overall.

* The Rotation Zone is where we believe the price will continue to consolidate within a fairly tight range before the November 8 - 12 bottom sets up. Volatility will continue to be greater than normal throughout this Rotation Zone.

* The post November 8 -12 breakout is likely to attempt to target 3131 initially (a Fibonacci extension target) and we believe this move higher could explode fairly quickly.

Now that we have explained the general sense of our research, let’s dig into the numbers a bit.

Our expectation is that a price peak will occur near early morning trading on October 26 (morning session in NY). We believe this peak will end near 2830 (a Fibonacci 50% retracement level) and we believe an extended basing pattern will precede this price peak. The extended basing pattern, which is expected to end near 2770 (a Fibonacci 25% retracement level) is already starting to form and should last from now until near October 23 or 24. We believe the upside move between the end of the basing pattern and the October 26th peak will be very fast and end fairly quickly – so be prepared.

The October 26th price peak will set up a very important component of our final analysis – the peak-to-peak price channel (highlighted in YELLOW now) and will allow us to determine when and where price volatility predicts the breakout move to occur. Our research team believes another bout of extended basing will occur after the October 26th peak that will likely push just below the 2771 support levels (to near 2750) retesting the Support Zone and presenting a “false low price breakout” pattern that may sucker many longs out of the market (and potentially set up massive short seller pressures in the market). This move may be critical to the eventual upside breakout that we are predicting.

Think of it like this, Fibonacci price theory suggests that price MUST attempt to establish new higher high prices or lower low prices at all times. Failure to accomplish these new price levels results in a consolidating/congesting price trend that typically forms as Pennants or Flags in price. Near the Apex of these pennant/flag formations, false breakouts (or what we call “washout lows or highs”) are common. These are price functions that operate as a “shakeout move” where price searches for direction and where buyers and sellers are stacked on top of one another attempting to ride the next wave. Price MUST attempt to establish a new higher high or lower low – so it must attempt to rally up and break the 2945 level or it must sell off and attempt to break the 2712 level. We expect extreme volatility near or after the November 8 - 12 apex setup. Price could fall deep into the Support Zone before reversing higher with a bigger rally that attempts to run well above the 2945 level.

The vertical blue line is the November 8 date where we expect the absolute bottom to form and where we expect the next big price rally to initiate. Near after this date, we expect the price to rotate with greater volatility and attempt an upside breakout move near or after November 12. The key Fibonacci levels at 2771 & 2829 are certain to become key price rotation levels near this November 8 - 12 price breakout.

At this point, we have outlined some very detailed and structured price rotation levels that should clearly help you understand what is transpiring within the US Equities markets right now. If you take only one thing away from reading this article, please understand the Support Zone that we’ve highlighted on our charts is super critical to the ability for the US Equities markets to continue to push higher. If this level is completely breached by lower prices (prices falling all the way below these price channels on the Daily chart, above), then our predictions of price rotation, extended basing and an ultimate upside price breakout are invalid. This Support Zone MUST hold for our analysis to become valid.

This level of research and understanding as related to technical and price analysis is not something one stumbles upon blindly. This takes years of study, practice, research, and understanding to be able to “see into the future” as we do. Sure, anyone that understands basic trend lines and Fibonacci concepts can draw some lines on a chart – but their overall success rate will quickly illustrate their true understanding of the markets. Take a minute to visit the Technical Traders website and read some of our recent research posts and pay attention to how we accurately predicted a 5 - 8% price correction 3+ weeks before this recent move happened.

Ask yourself, how did we know it was going to happen and how did we know it would stop near 2700? Visit The Technical Traders "Free Research"

To read all of our recent research posts or read how we predicted this downside price move by clicking here: Trading Model Suggests Falling Stock Prices for U.S. Elections

Chris Vermeulen

Our research team, at The Technical Traders, have honed their skills over the past few decades by studying market correlations, price relationships, advanced price modeling and more. Our objective is to be able to identify price patterns, opportunities, and setups while attempting to accurately predict the future of price so that we can keep our followers and members uniquely aware of future opportunities. As you can imagine, it is not an easy job and we often take heat for some of our research posts.

Today, we are sticking out neck out (again) and attempting to predict the future of the ES price rotation as this deeper rotation continues to play out. Our research team believes it has identified key price levels and dates/times that are relevant to this future price rotation. By no means is this research set in stone in regards to exact dates/times. These are suggestions which we believe to be accurate based on our research and analysis of the markets. Use them as guides to how this price rotation plays out.

This first chart is a Daily ES chart that shows three very important components of the current market price rotation.

* The Support Zone below the recent lows is actually very critical to the true understanding of price rotation. As long as this support zone is not completely breached, prices should continue to push higher overall.

* The Rotation Zone is where we believe the price will continue to consolidate within a fairly tight range before the November 8 - 12 bottom sets up. Volatility will continue to be greater than normal throughout this Rotation Zone.

* The post November 8 -12 breakout is likely to attempt to target 3131 initially (a Fibonacci extension target) and we believe this move higher could explode fairly quickly.

Now that we have explained the general sense of our research, let’s dig into the numbers a bit.

Our expectation is that a price peak will occur near early morning trading on October 26 (morning session in NY). We believe this peak will end near 2830 (a Fibonacci 50% retracement level) and we believe an extended basing pattern will precede this price peak. The extended basing pattern, which is expected to end near 2770 (a Fibonacci 25% retracement level) is already starting to form and should last from now until near October 23 or 24. We believe the upside move between the end of the basing pattern and the October 26th peak will be very fast and end fairly quickly – so be prepared.

The October 26th price peak will set up a very important component of our final analysis – the peak-to-peak price channel (highlighted in YELLOW now) and will allow us to determine when and where price volatility predicts the breakout move to occur. Our research team believes another bout of extended basing will occur after the October 26th peak that will likely push just below the 2771 support levels (to near 2750) retesting the Support Zone and presenting a “false low price breakout” pattern that may sucker many longs out of the market (and potentially set up massive short seller pressures in the market). This move may be critical to the eventual upside breakout that we are predicting.

Think of it like this, Fibonacci price theory suggests that price MUST attempt to establish new higher high prices or lower low prices at all times. Failure to accomplish these new price levels results in a consolidating/congesting price trend that typically forms as Pennants or Flags in price. Near the Apex of these pennant/flag formations, false breakouts (or what we call “washout lows or highs”) are common. These are price functions that operate as a “shakeout move” where price searches for direction and where buyers and sellers are stacked on top of one another attempting to ride the next wave. Price MUST attempt to establish a new higher high or lower low – so it must attempt to rally up and break the 2945 level or it must sell off and attempt to break the 2712 level. We expect extreme volatility near or after the November 8 - 12 apex setup. Price could fall deep into the Support Zone before reversing higher with a bigger rally that attempts to run well above the 2945 level.

The vertical blue line is the November 8 date where we expect the absolute bottom to form and where we expect the next big price rally to initiate. Near after this date, we expect the price to rotate with greater volatility and attempt an upside breakout move near or after November 12. The key Fibonacci levels at 2771 & 2829 are certain to become key price rotation levels near this November 8 - 12 price breakout.

At this point, we have outlined some very detailed and structured price rotation levels that should clearly help you understand what is transpiring within the US Equities markets right now. If you take only one thing away from reading this article, please understand the Support Zone that we’ve highlighted on our charts is super critical to the ability for the US Equities markets to continue to push higher. If this level is completely breached by lower prices (prices falling all the way below these price channels on the Daily chart, above), then our predictions of price rotation, extended basing and an ultimate upside price breakout are invalid. This Support Zone MUST hold for our analysis to become valid.

This level of research and understanding as related to technical and price analysis is not something one stumbles upon blindly. This takes years of study, practice, research, and understanding to be able to “see into the future” as we do. Sure, anyone that understands basic trend lines and Fibonacci concepts can draw some lines on a chart – but their overall success rate will quickly illustrate their true understanding of the markets. Take a minute to visit the Technical Traders website and read some of our recent research posts and pay attention to how we accurately predicted a 5 - 8% price correction 3+ weeks before this recent move happened.

Ask yourself, how did we know it was going to happen and how did we know it would stop near 2700? Visit The Technical Traders "Free Research"

To read all of our recent research posts or read how we predicted this downside price move by clicking here: Trading Model Suggests Falling Stock Prices for U.S. Elections

Chris Vermeulen

Labels:

Chris Vermeulen,

ES,

investing,

investors,

money,

SPY,

stocks,

The Technical Traders

Saturday, October 13, 2018

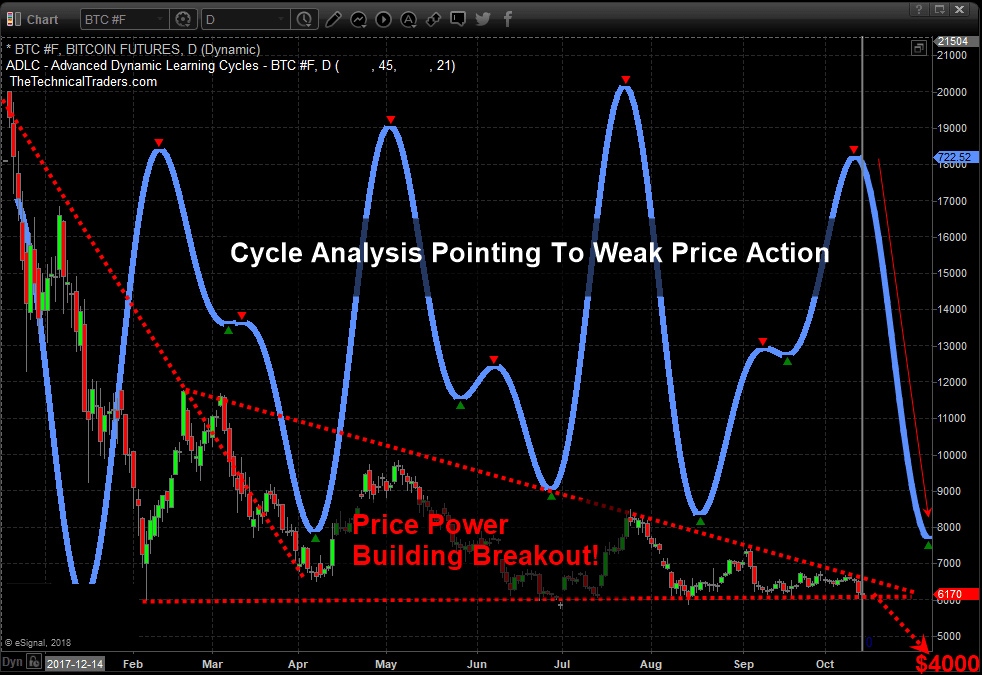

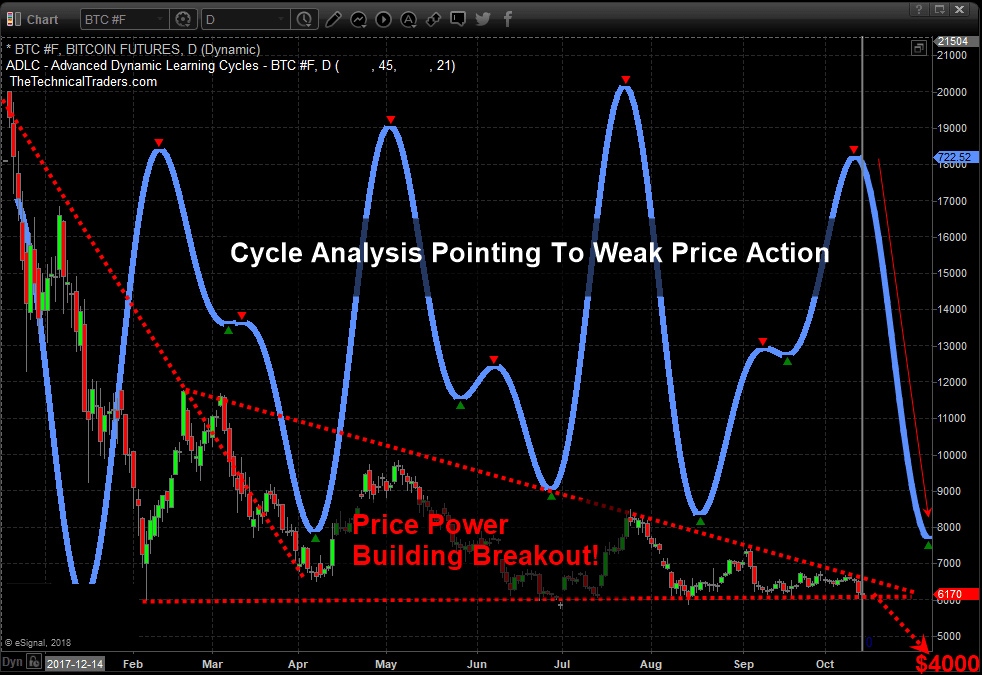

Why the Bitcoin Breakdown May Push Prices Below $5000

Recent market turmoil across the global stock markets has refocused investors on the concerns of global economics, trade, and geopolitical issues – away from cryptocurrencies. The biggest, Bitcoin, has been under extended pricing pressure recently and our research team believes Bitcoin will breach the $6000 level to the downside fairly quickly as extended global market downtrends continue.

The premise of our analysis is simple, the factors weighing on foreign investors and Bitcoin investors are that currencies are fluctuating wildly, local stock markets are declining and local economies may be contracting. All of this operates as a means for investors to turn to a “protectionism” stance where they attempt to protect capital/cash and attempt to limit downside risks.

The fact that Bitcoin has yet to break higher and has continued to fall under further pricing and adoption pressure means those investors that were hungry for the next great rally may be getting tired of waiting for this next move – if it ever happens. Our belief is that any downside pressure in Bitcoin below $5800 will likely push many crypto enthusiasts over the end and prompt them to sell out before prices attempt to move down further.

Our research team believes a deeper downside price rotation is setting up in Bitcoin that will push prices below the $5000 level before the end of this year. The uncertainty of the global equities markets are creating an environment where cryptos have simply lost their appeal. There has been no real substantial upside price move over the past 6+ months and the FLAG formation setting up is a very real warning sign that the eventual breakout move could be very dangerous.

Additionally, when we add our proprietary Advanced Learning Cycle system to the research, which points to much lower price rotation over the next 30+ days, we begin to see the very real possibility that Bitcoin could fall below $5000 very quickly and potentially target $4000 as an ultimate low.

As much as we would like to inform our followers that we believe Bitcoin will rally back to $18k fairly quickly, that is simply not the case. All of our indicators are suggesting that Bitcoin will fall to below $5000, and possibly towards $4000, before any real support is found. If you are a bitcoin believer, be aware that you may have a substantial opportunity to use your skills at this price swing plays out. Looking to buy back in near $4000 is much better than trying to hold for an additional $2000 loss.

Visit The Technical Traders to learn more about our research team and resources to help you become a better trader. Be prepared and build your skills to target greater success with our dedicated team. Read some of our other research to see for yourself how well we’ve been calling these recent market moves. Isn’t it time you invested in your future success?

Chris Vermeulen

The premise of our analysis is simple, the factors weighing on foreign investors and Bitcoin investors are that currencies are fluctuating wildly, local stock markets are declining and local economies may be contracting. All of this operates as a means for investors to turn to a “protectionism” stance where they attempt to protect capital/cash and attempt to limit downside risks.

The fact that Bitcoin has yet to break higher and has continued to fall under further pricing and adoption pressure means those investors that were hungry for the next great rally may be getting tired of waiting for this next move – if it ever happens. Our belief is that any downside pressure in Bitcoin below $5800 will likely push many crypto enthusiasts over the end and prompt them to sell out before prices attempt to move down further.

Our research team believes a deeper downside price rotation is setting up in Bitcoin that will push prices below the $5000 level before the end of this year. The uncertainty of the global equities markets are creating an environment where cryptos have simply lost their appeal. There has been no real substantial upside price move over the past 6+ months and the FLAG formation setting up is a very real warning sign that the eventual breakout move could be very dangerous.

Additionally, when we add our proprietary Advanced Learning Cycle system to the research, which points to much lower price rotation over the next 30+ days, we begin to see the very real possibility that Bitcoin could fall below $5000 very quickly and potentially target $4000 as an ultimate low.

As much as we would like to inform our followers that we believe Bitcoin will rally back to $18k fairly quickly, that is simply not the case. All of our indicators are suggesting that Bitcoin will fall to below $5000, and possibly towards $4000, before any real support is found. If you are a bitcoin believer, be aware that you may have a substantial opportunity to use your skills at this price swing plays out. Looking to buy back in near $4000 is much better than trying to hold for an additional $2000 loss.

Visit The Technical Traders to learn more about our research team and resources to help you become a better trader. Be prepared and build your skills to target greater success with our dedicated team. Read some of our other research to see for yourself how well we’ve been calling these recent market moves. Isn’t it time you invested in your future success?

Chris Vermeulen

Labels:

Bitcoin,

BTC,

Chris Vermeulen,

cryptocurrency,

Ethereum,

Litecoin,

LTC. ETH,

Technical Traders

Monday, October 8, 2018

Will Crude Oil Follow These Historical Patterns?

Our research team and partners at Technical Traders Ltd., has been very interested in crude oil recently as the current rally appears to have rotated lower near a top. Our predictive modeling systems, predictive cycle analysis and other tools suggest Oil/Energy may be setting up for a downward price trend. This may be an excellent opportunity for skilled traders to identify profitable trades as this trend matures.

This Daily Crude Oil Chart shows our Predictive Cycle Modeling system and shows the projected price cycles out into the future. One can see the downside projected price levels very clearly. This cycle analysis tool does not predict price levels, it just predicts price trends. We can’t look at this indicator and think that $72 ppb is a price target (near the right side). We can only assume that a downward price cycle is about to hit and use historical price as a guide to where price may attempt to fall to.

Using our adaptive Fibonacci price modeling tool, we can see from the chart below that downside price targets are currently near $72 ppb, $67 ppb and $65 ppb. Therefore, we believe the $72 price level will become the first level of support, where our price cycle tool suggests a small rotation may occur, and the $67 price level may become the ultimate downside target level.

We believe the current price rotation in Oil/Energy may be setting up for a decent downside price move with a lower price target at or below $67 ppb. Historical data shows that this type of price action, downward, at this time is historically accurate and predictable. If you want to know how you can profit from this move and learn how our research team continues to find and execute superior trades for our members, visit The Technical Traders to learn more.

Chris Vermeulen

This Daily Crude Oil Chart shows our Predictive Cycle Modeling system and shows the projected price cycles out into the future. One can see the downside projected price levels very clearly. This cycle analysis tool does not predict price levels, it just predicts price trends. We can’t look at this indicator and think that $72 ppb is a price target (near the right side). We can only assume that a downward price cycle is about to hit and use historical price as a guide to where price may attempt to fall to.

Using our adaptive Fibonacci price modeling tool, we can see from the chart below that downside price targets are currently near $72 ppb, $67 ppb and $65 ppb. Therefore, we believe the $72 price level will become the first level of support, where our price cycle tool suggests a small rotation may occur, and the $67 price level may become the ultimate downside target level.

We believe the current price rotation in Oil/Energy may be setting up for a decent downside price move with a lower price target at or below $67 ppb. Historical data shows that this type of price action, downward, at this time is historically accurate and predictable. If you want to know how you can profit from this move and learn how our research team continues to find and execute superior trades for our members, visit The Technical Traders to learn more.

Chris Vermeulen

Labels:

Chris Vermeulen,

Crude Oil,

Dollar,

Drilling,

energy,

Natural Gas,

stocks,

The Technical Traders

Friday, October 5, 2018

Our New Target Levels for the Coming Gold and Silver Rally

Our modeling systems are suggesting that Gold and Silver will begin a new upside rally very quickly. We wrote about how our modeling systems are suggesting this upside move could be a tremendous opportunity for investors over 2 weeks ago. Our initial target is near the $1245 level and our second target is near the $1309 level. Recent lows help to confirm this upside projection as the most recent low prices created a price rotation that supports further upside price action. What is needed right now is a push above $1220 before we begin to see the real acceleration higher.

The Daily Gold chart, below, shows our Fibonacci modeling system suggesting that $1235 to $1250 are the upside target ranges. Near these levels, we should expect some price rotation before another leg higher begins. Currently, support near $1180 is the floor in Gold.

If you are a fan of the shiny metals and want to know what we believe is likely to happen over the next 8+ months, then please take a moment to join the Wealth Building Newsletter to learn how we can help you find and execute better trades. We provide even more detailed research and predictive price modeling for our subscribers and we believe this bottom setting up in Gold may be the last time you see $1200 prices for a while. Check out The Technical Traders today.

Chris Vermeulen

The Daily Gold chart, below, shows our Fibonacci modeling system suggesting that $1235 to $1250 are the upside target ranges. Near these levels, we should expect some price rotation before another leg higher begins. Currently, support near $1180 is the floor in Gold.

If you are a fan of the shiny metals and want to know what we believe is likely to happen over the next 8+ months, then please take a moment to join the Wealth Building Newsletter to learn how we can help you find and execute better trades. We provide even more detailed research and predictive price modeling for our subscribers and we believe this bottom setting up in Gold may be the last time you see $1200 prices for a while. Check out The Technical Traders today.

Chris Vermeulen

Labels:

Chris Vermeulen,

commodities,

Gas,

gld,

gold,

investing,

Oil,

Silver,

slv,

stocks,

Technical Traders

Tuesday, October 2, 2018

Why We Expect a 3rd Quarter Earnings Surprise

Our focus is on developing and deploying very specialized price modeling and predictive analysis systems. Our objective is to inform our members of these potential price moves and to assist them in finding successful trading opportunities. We are alerting all of our followers of a potential move today, because we believe this move could frighten some investors as we expect price rotation as Q3 earnings data is released just before the November 2018 mid-term elections.

The weekly $INDU (Dow Industrial Average) chart shows our Adaptive Predictive Learning (ADL) modeling system at work. In this example, we asked our ADL system what it believed would be the most likely outcome originating from July 23, 2018. The reason we selected this date is because this weekly price bar prompted the current upside price move. This type of price trigger can often generate highly accurate future predictive price data.

This bar consisted of 11 unique price markers that predict future price moves, first lower, then back to the upside, with a range of probability from 83% to 96%. The initial downside price move suggests that an initial -800 to -1000 pt move (-4%) will take place before November 10, 2018. Subsequently, price should begin to move upward again after the US mid-term elections and through the end of 2018.

In conclusion, October is known as a weak month for US equities so get ready for price volatility and expect the Tech heavy NASDAQ to rotate in a larger range than the S&P and the $INDU. Additionally, expect the VIX to increase in value over the next 30+ days as October passes.

I will admit the charts in July/Early September were showing signs of a market correction in mind September but no bearish reversal pattern formed and price continued higher. During this time we closed out a position in YINN for 14% profit and another 4.3% in the IYT ETF. This goes to show how we can profit to the long side even when we are expecting a sell off the markets. We trade based on technical analysis and use our ADL and other forecasting analysis to add more conviction to a move, but we don’t trade based on predictions along.

If you want to know how we help our members find and execute for greater success, visit The Technical Traders to see our completed trades for this year and learn how we can help you find great opportunities now and in the future.

Chris Vermeulen

The weekly $INDU (Dow Industrial Average) chart shows our Adaptive Predictive Learning (ADL) modeling system at work. In this example, we asked our ADL system what it believed would be the most likely outcome originating from July 23, 2018. The reason we selected this date is because this weekly price bar prompted the current upside price move. This type of price trigger can often generate highly accurate future predictive price data.

This bar consisted of 11 unique price markers that predict future price moves, first lower, then back to the upside, with a range of probability from 83% to 96%. The initial downside price move suggests that an initial -800 to -1000 pt move (-4%) will take place before November 10, 2018. Subsequently, price should begin to move upward again after the US mid-term elections and through the end of 2018.

In conclusion, October is known as a weak month for US equities so get ready for price volatility and expect the Tech heavy NASDAQ to rotate in a larger range than the S&P and the $INDU. Additionally, expect the VIX to increase in value over the next 30+ days as October passes.

I will admit the charts in July/Early September were showing signs of a market correction in mind September but no bearish reversal pattern formed and price continued higher. During this time we closed out a position in YINN for 14% profit and another 4.3% in the IYT ETF. This goes to show how we can profit to the long side even when we are expecting a sell off the markets. We trade based on technical analysis and use our ADL and other forecasting analysis to add more conviction to a move, but we don’t trade based on predictions along.

If you want to know how we help our members find and execute for greater success, visit The Technical Traders to see our completed trades for this year and learn how we can help you find great opportunities now and in the future.

Chris Vermeulen

Subscribe to:

Posts (Atom)