This week’s investor insight will make you think twice about the current stock and bond rally as we head into the end of the year.

We get a lot of questions about if the stock market has bottomed or if it is headed lower and how they can take advantage of the next Major market move. Over the next 6 to 12 months, I expect the market to have violent price swings that will either make or break your financial future. So let me show a handful of charts and show what I expect to unfold.

Let’s dive in....Continue Reading Here.

Trade ideas, analysis and low risk set ups for commodities, Bitcoin, gold, silver, coffee, the indexes, options and your retirement. We'll help you keep your emotions out of your trading.

Showing posts with label financial. Show all posts

Showing posts with label financial. Show all posts

Monday, November 28, 2022

After This Holiday Rally, You Better Know When To Walk Away

Thursday, April 18, 2019

Watch the Financial Sector for the Next Topping Pattern

A very interesting price pattern is setting up in the financial sector that could lead to a very big move in the US & Global markets. Remember how in 2008-09, the Financial sector and Insurance sector were some of the biggest hit stock sectors to prompt a global market crisis? Well, the next few weeks and months for the financial sector are setting up to be critical for our future expectations of the US stock market and global economy.

Right now, many of the financial sector stocks are poised near an upper price channel that must be breached/broken before any further upside price advance can take place. The current trend has been bullish as prices have rallied off the December 2018 lows. Yet, we are acutely aware of the bigger price channels that could become critical to our future decision making. If there is any price weakness near these upper price channel levels and any downside price rotation, the downside potential for the price is massive and could lead to bigger concerns.

Let’s start off by taking a look at these Monthly charts…

This first Monthly Bank Of America chart is best at showing the price channel (in YELLOW) as well as a key Fibonacci price level (highlighted by the MAGENTA line). We’ve also highlighted a price zone with a green shaded box that we believe is key support/resistance for the current price trend.

As you can see from this chart, since early February 2018, the overall trend has shifted into a sideways bearish trend. The price recovery from December 2018 was impressive, yes, but it is still rotating within this sideways/bearish price channel. Our belief is that this YELLOW upper price channel level MUST be broken in order for the price to continue higher at this point. Any failure to accomplish this will result in a price reversal that could precipitate a 30% price decline in the value of BAC. In other words, “it is do-or-die time – again”.

This Monthly JPM chart shows a similar pattern, yet the price channel is a bit more narrow visually. We have almost the same setup in JPM as we do in BAC. The same channels, the same type of Fibonacci price support level, the same type of sideways price support zone (the shaded box) and the same overall setup. As traders, we have to watch for these types of setup and be aware of the risks that could unfold with a collapse of the financial sector over the next few weeks.

We believe the next few weeks could be critical for the financial sector and for the overall markets. If weakness hits the financial sector as global growth continues to stagnate we could enter a period where the global perception of the future 12~24 months may change. Right now, perception has been relatively optimistic in the global stock markets. Most traders have been optimistic that the markets will recover and a US/China trade deal will get settled. The biggest concern has been the EU and the growth of the European countries.

What if that suddenly changed?

We are not saying it will or that we know anything special about this setup. We are just suggesting that the Monthly charts, above, are suggesting that price will either break above this upper price channel or fail to break this level and move lower. We are suggesting that, as skilled traders, we need to be acutely aware of the risks within the financial sector right now and prepare for either outcome.

This last chart, a Weekly FAS chart, shows a more detailed view of this same price rotation and sideways expanding wedge/channel formation. Pay very close attention to the shaded support channel shown with the GREEN BOX on this chart. Any price rotation within this level should be considered “within a support channel” and not a real risk initially. We want to see price break above the upper price channel fairly quickly, within the next 2 to 5+ weeks, and we can to see it establish a new high (above $78 on this chart) to confirm a new bullish price trend. Once this happens, we’ll be watching for further price rotation and setups. If it fails to happen, then the RED DOWN ARROW is the most likely outcome given the current price setup.

Any downside price move in the Financial sector would have to be associated with some decreased future expectations by investors. Thus, our bigger concern is that something is lurking just below the surface right now that could pull the floor out from under this sector. Is it a surprise Fed rate increase? Is it some news from the EU? Is it a sudden increase in credit defaults? What is the “other shoe” – so to say.

Be prepared. If all goes well, then we’ll know within a few more weeks if the upside price rally will continue or if we need to start digging for clues as to why the support for the financial sector is eroding. This really is a “do or die” setup in the financial sector and we urge all traders to pay very close attention to this sector going forward. We believe it will be the leading sector for any major price weakness across the global markets.

Do you want to find a team of dedicated researchers and traders that can help you find and execute better trades in 2019 and beyond? Please visit The Technical Traders to learn how we can help you prepare for the big moves in the global markets and find better opportunities for greater success in the future. Our team of researchers and traders continue to scan the markets for new trades and incredible research for all our members and followers.

Chris Vermeulen

Right now, many of the financial sector stocks are poised near an upper price channel that must be breached/broken before any further upside price advance can take place. The current trend has been bullish as prices have rallied off the December 2018 lows. Yet, we are acutely aware of the bigger price channels that could become critical to our future decision making. If there is any price weakness near these upper price channel levels and any downside price rotation, the downside potential for the price is massive and could lead to bigger concerns.

Let’s start off by taking a look at these Monthly charts…

This first Monthly Bank Of America chart is best at showing the price channel (in YELLOW) as well as a key Fibonacci price level (highlighted by the MAGENTA line). We’ve also highlighted a price zone with a green shaded box that we believe is key support/resistance for the current price trend.

As you can see from this chart, since early February 2018, the overall trend has shifted into a sideways bearish trend. The price recovery from December 2018 was impressive, yes, but it is still rotating within this sideways/bearish price channel. Our belief is that this YELLOW upper price channel level MUST be broken in order for the price to continue higher at this point. Any failure to accomplish this will result in a price reversal that could precipitate a 30% price decline in the value of BAC. In other words, “it is do-or-die time – again”.

This Monthly JPM chart shows a similar pattern, yet the price channel is a bit more narrow visually. We have almost the same setup in JPM as we do in BAC. The same channels, the same type of Fibonacci price support level, the same type of sideways price support zone (the shaded box) and the same overall setup. As traders, we have to watch for these types of setup and be aware of the risks that could unfold with a collapse of the financial sector over the next few weeks.

We believe the next few weeks could be critical for the financial sector and for the overall markets. If weakness hits the financial sector as global growth continues to stagnate we could enter a period where the global perception of the future 12~24 months may change. Right now, perception has been relatively optimistic in the global stock markets. Most traders have been optimistic that the markets will recover and a US/China trade deal will get settled. The biggest concern has been the EU and the growth of the European countries.

What if that suddenly changed?

We are not saying it will or that we know anything special about this setup. We are just suggesting that the Monthly charts, above, are suggesting that price will either break above this upper price channel or fail to break this level and move lower. We are suggesting that, as skilled traders, we need to be acutely aware of the risks within the financial sector right now and prepare for either outcome.

This last chart, a Weekly FAS chart, shows a more detailed view of this same price rotation and sideways expanding wedge/channel formation. Pay very close attention to the shaded support channel shown with the GREEN BOX on this chart. Any price rotation within this level should be considered “within a support channel” and not a real risk initially. We want to see price break above the upper price channel fairly quickly, within the next 2 to 5+ weeks, and we can to see it establish a new high (above $78 on this chart) to confirm a new bullish price trend. Once this happens, we’ll be watching for further price rotation and setups. If it fails to happen, then the RED DOWN ARROW is the most likely outcome given the current price setup.

Any downside price move in the Financial sector would have to be associated with some decreased future expectations by investors. Thus, our bigger concern is that something is lurking just below the surface right now that could pull the floor out from under this sector. Is it a surprise Fed rate increase? Is it some news from the EU? Is it a sudden increase in credit defaults? What is the “other shoe” – so to say.

Be prepared. If all goes well, then we’ll know within a few more weeks if the upside price rally will continue or if we need to start digging for clues as to why the support for the financial sector is eroding. This really is a “do or die” setup in the financial sector and we urge all traders to pay very close attention to this sector going forward. We believe it will be the leading sector for any major price weakness across the global markets.

Do you want to find a team of dedicated researchers and traders that can help you find and execute better trades in 2019 and beyond? Please visit The Technical Traders to learn how we can help you prepare for the big moves in the global markets and find better opportunities for greater success in the future. Our team of researchers and traders continue to scan the markets for new trades and incredible research for all our members and followers.

Chris Vermeulen

Labels:

bearish,

bullish,

Chris Vermeulen,

downside,

fibonacci,

financial,

rotation,

The Technical Traders,

Trend,

upside

Monday, January 21, 2019

Why You Should Be Paying Attention to the Russell and Financial Sectors

For those that still believe the U.S. markets are weak and poised for a total collapse, we want to bring something to your attention. Throughout weeks of uncertainty about China trade deals, the US government shutdown, continued Brexit issues and who knows what else… oh yeah US Q4 Earnings data, guess what has been taking place in some US sectors?

That’s right, a rather solid price recovery.

Two of our favorite sectors to watch for signs of strength and weakness have been rocketing higher over the past few weeks after setting up a very deep price low near Christmas 2018. The Russell 2000 ETF (IWM) and the Financial Sector ETF (XLF). While the ES, NQ, and others are still waffling around trying to find the momentum to break out to the upside, pay attention to the other sectors that could be leading the way.

This first Weekly IWM (Russell 2000) chart clearly shows the support zone that was set up in early 2018 after the February 2018 price collapse. Yes, the recent October 2018 price collapse drove price below that support level, but it appears this is a “wash out” low price reversal where traders panicked on the news and other events. The fact that this recovery has taken place may cause some to consider this a “dead cat bounce”, but we’re not seeing that in our research. This could/should be the start of something that pushes prices sideways/higher for a few months, at which time we will need to see to these sectors and the rest of the markets are performing to determine if the overall market is still I a bull market or about to drop into its first bear market leg down.

This next chart is a Weekly XLF (Financial Sector) ETF showing our Fibonacci price modeling system and a similar Support Zone. One thing that is rather interesting about these charts is that they are both moving substantially higher this week while recently breaking above our Fibonacci bullish trigger level (shown near the right side of the chart as a GREEN LINE). The XLF chart also shows that the current price is well above the BLUE and CYAN Fibonacci projected target levels. This indicates that price may be attempting to move back into the earlier Fibonacci price range (retracement range) to establish more rotation. This new price rotation will set up new Fibonacci modeling system trigger points and tell us where the next move is likely to target.

Yes, we do expect some downside rotation near current levels. We don’t expect this rotation to be very deep or concerning. Price must move in waves, up and down, to support future momentum higher or lower. Our Fibonacci modeling system is suggesting any current downside rotation will likely result in a new momentum move to the upside. Still, these sectors are on fire right now and we urge traders to be cautious of any longs because we are expecting some downside price rotation over the next week or two before the next rally.

Pay attention to these markets moves. 2019 is poised to be a very exciting and profitable year for skilled traders and wise investors. Visit The Technical Traders to get our daily and weekly analysis forecast complete with long term investing swing trading, and index day trade signals.

53 years experience in researching and trading makes analyzing the complex and ever changing financial markets a natural process. We have a simple and highly effective way to provide our customers with the most convenient, accurate, and timely market forecasts available today.

Our index, stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience.

Chris Vermeulen

That’s right, a rather solid price recovery.

Two of our favorite sectors to watch for signs of strength and weakness have been rocketing higher over the past few weeks after setting up a very deep price low near Christmas 2018. The Russell 2000 ETF (IWM) and the Financial Sector ETF (XLF). While the ES, NQ, and others are still waffling around trying to find the momentum to break out to the upside, pay attention to the other sectors that could be leading the way.

Weekly IWM (Russell 2000) Chart

This first Weekly IWM (Russell 2000) chart clearly shows the support zone that was set up in early 2018 after the February 2018 price collapse. Yes, the recent October 2018 price collapse drove price below that support level, but it appears this is a “wash out” low price reversal where traders panicked on the news and other events. The fact that this recovery has taken place may cause some to consider this a “dead cat bounce”, but we’re not seeing that in our research. This could/should be the start of something that pushes prices sideways/higher for a few months, at which time we will need to see to these sectors and the rest of the markets are performing to determine if the overall market is still I a bull market or about to drop into its first bear market leg down.

Weekly XLF (Financial Sector) Chart

This next chart is a Weekly XLF (Financial Sector) ETF showing our Fibonacci price modeling system and a similar Support Zone. One thing that is rather interesting about these charts is that they are both moving substantially higher this week while recently breaking above our Fibonacci bullish trigger level (shown near the right side of the chart as a GREEN LINE). The XLF chart also shows that the current price is well above the BLUE and CYAN Fibonacci projected target levels. This indicates that price may be attempting to move back into the earlier Fibonacci price range (retracement range) to establish more rotation. This new price rotation will set up new Fibonacci modeling system trigger points and tell us where the next move is likely to target.

Yes, we do expect some downside rotation near current levels. We don’t expect this rotation to be very deep or concerning. Price must move in waves, up and down, to support future momentum higher or lower. Our Fibonacci modeling system is suggesting any current downside rotation will likely result in a new momentum move to the upside. Still, these sectors are on fire right now and we urge traders to be cautious of any longs because we are expecting some downside price rotation over the next week or two before the next rally.

Pay attention to these markets moves. 2019 is poised to be a very exciting and profitable year for skilled traders and wise investors. Visit The Technical Traders to get our daily and weekly analysis forecast complete with long term investing swing trading, and index day trade signals.

53 years experience in researching and trading makes analyzing the complex and ever changing financial markets a natural process. We have a simple and highly effective way to provide our customers with the most convenient, accurate, and timely market forecasts available today.

Our index, stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience.

Chris Vermeulen

Labels:

Chris Vermeulen,

financial,

IWM,

NASDAQ,

NQ,

Russell 2000,

stocks,

The Technical Traders,

XLF

Wednesday, May 17, 2017

Top Two Ways to Store Wealth Abroad

Nick Giambruno sits down with Doug Casey to get his take on what his favorite places and ways to store our wealth abroad.

Nick Giambruno: For centuries, wealthy people have used international diversification to protect their savings and themselves from out of control governments. Now, thanks to modern technology, anyone can implement similar strategies. Doug, I’d like to discuss some of the basic ways regular people can internationally diversify their savings. For an American, what’s the difference between having a bank account at Bank of America and having a foreign bank account?

Doug Casey: I’d say there is possibly all the difference in the world. The entire world’s banking system today is shaky, but if you go international, you can find much more solid banks than those that we have here in the US. That’s important, but beyond that, you’ve got to diversify your political risk. And if you have your bank account in a US bank, it’s eligible to being seized by any number of government agencies or by a frivolous lawsuit. So besides finding a more solid bank, by having your liquid assets in a different political jurisdiction you insulate yourself from a lot of other risks as well.

Nick Giambruno: Moving some of your savings abroad also allows you to preempt capital controls (restrictions on moving money out of the country) and the destructive measures that always follow.

Doug Casey: This is a very serious consideration. When the going gets tough, governments never control themselves, but they do try to control their subjects. It’s likely that the US is going to have official capital controls in the future. This means that if you don’t have money outside of the US, it’s going to become very inconvenient and/or very expensive to get money out.

Nick Giambruno: Why do you think the US government would institute capital controls?

Doug Casey: Well, there are about $7 - 8 trillion, nobody knows for sure, outside of the US, and those are like a ticking time bomb. Foreigners don’t have to hold those dollars. Americans have to hold the dollars. If you’re going to trade within the US, you must use US dollars, both legally and practically. Foreigners don’t have to, and at some point they may perceive those dollars as being the hot potatoes they are. And the US government might say that we can’t have Americans investing outside the country, perhaps not even spending a significant amount outside the country, because they are just going to add to this giant pile of dollars. There are all kinds of reasons that they could come up with.

We already have de facto capital controls, quite frankly, even though there’s no law at the moment saying that an American can’t invest abroad or take money out of the country. The problem is because of other US laws, like FATCA, finding a foreign bank or a foreign broker who will accept your account is very hard. Very, very few of them will take American accounts anymore because the laws make it unprofitable, inconvenient, and dangerous, so they don’t bother. So it’s not currently against the law, but it’s already very hard.

Nick Giambruno: What forms of savings are good candidates to take abroad? Gold coins? Foreign real estate?

Doug Casey: Well, you put your finger on exactly the two that I was going to mention. Everybody should own gold coins because they are money in its most basic form—something that a lot of people have forgotten. Gold is the only financial asset that’s not simultaneously somebody else’s liability.

And if your gold is outside the US, it gives you another degree of insulation should the United States decide that you shouldn’t own it—it’s not a reportable asset currently. If you have $1 million of cash in a bank account abroad, you must report that to the US government every year. If you have $1 million worth of gold coins in a foreign safe deposit box, however, that is not reportable, and that’s a big plus.

So gold is one thing. The second thing, of course is real estate. There are many advantages to foreign real estate. Sometimes it’s vastly cheaper than in the US. Foreign real estate is also not a reportable asset to the US government.

Nick Giambruno: Foreign real estate is a good way to internationally diversify a big chunk of your savings. What are the chances that your home government could confiscate foreign real estate? It’s pretty close to zero.

Doug Casey: I’d say it’s just about zero because they can make you repatriate the cash in your foreign bank account, but what can they make you do with the real estate? Would they tell you to sell it? Well, it’s not likely.

Also, if things go sideways in your country, it’s good to have a second place you can transplant yourself to. And I know that it’s unbelievable for most people to think anything could go wrong in their home country—a lot of Germans thought that in the ’20s, a lot of Russians thought that in the early teens, a lot of Vietnamese thought that in the ’60s, a lot of Cubans thought that in the ’50s. It could happen anywhere.

Nick Giambruno: Besides savings, what else can people diversify? How does a second passport fit into the mix?

Doug Casey: It’s still quite possible—and completely legal—for an American to have a citizenship in a second country, and it offers many advantages. As for opening up foreign bank accounts, if you show them an American passport, they’ll likely tell you to go away. Once again, obtaining a foreign bank or brokerage account is extremely hard for Americans today—that door has been closing for some time and is nearly slammed shut now. But if you show a foreign bank a Paraguayan or a Panamanian or any other passport, they’ll welcome you as a customer.

Nick Giambruno: The police state is metastasizing in the US. Is that a good reason to diversify as well?

Doug Casey: It’s a harbinger, I’m afraid, of what’s to come. The fact is that police forces throughout the US have been militarized. Every little town has a SWAT team, sometimes with armored personnel carriers. All of the Praetorian style agencies on the federal level—the FBI, CIA, NSA, and over a dozen others like them—have become very aggressive.

Every single day in the US, there are scores of confiscations of people’s bank accounts, and dozens having their doors broken down in the wee hours of the night. The ethos in the US really seems to be changing right before our very eyes, and I think it’s quite disturbing.

You can be accused of almost anything by the government and have your assets seized without due process. Every year there are billions of dollars that are seized by various government entities, including local police departments, who get to keep a percentage of the proceeds, so this is a very corrupting thing.

People forget that when the US was founded there were only three federal crimes, and they are listed in the Constitution: treason, counterfeiting, and piracy. Now it’s estimated there are over 5,000 federal crimes, and that number is constantly increasing. This is very disturbing. There is a book called Three Felonies a Day, which estimates that many or most Americans inadvertently commit three felonies a day. So it’s becoming Kafkaesque.

Nick Giambruno: Thanks, Doug. Until next time.

Doug Casey: Thanks, Nick.

Editor’s Note: The US is nearing the worst financial disaster of our lifetimes. It’s inevitable. And it’s the single biggest threat to your financial future.

Fortunately, you can learn the ultimate strategy for turning the coming crisis into a wealth-building opportunity in this urgent video from New York Times best selling author Doug Casey.

Click Here to Watch it Now

Nick Giambruno: For centuries, wealthy people have used international diversification to protect their savings and themselves from out of control governments. Now, thanks to modern technology, anyone can implement similar strategies. Doug, I’d like to discuss some of the basic ways regular people can internationally diversify their savings. For an American, what’s the difference between having a bank account at Bank of America and having a foreign bank account?

Doug Casey: I’d say there is possibly all the difference in the world. The entire world’s banking system today is shaky, but if you go international, you can find much more solid banks than those that we have here in the US. That’s important, but beyond that, you’ve got to diversify your political risk. And if you have your bank account in a US bank, it’s eligible to being seized by any number of government agencies or by a frivolous lawsuit. So besides finding a more solid bank, by having your liquid assets in a different political jurisdiction you insulate yourself from a lot of other risks as well.

Nick Giambruno: Moving some of your savings abroad also allows you to preempt capital controls (restrictions on moving money out of the country) and the destructive measures that always follow.

Doug Casey: This is a very serious consideration. When the going gets tough, governments never control themselves, but they do try to control their subjects. It’s likely that the US is going to have official capital controls in the future. This means that if you don’t have money outside of the US, it’s going to become very inconvenient and/or very expensive to get money out.

Nick Giambruno: Why do you think the US government would institute capital controls?

Doug Casey: Well, there are about $7 - 8 trillion, nobody knows for sure, outside of the US, and those are like a ticking time bomb. Foreigners don’t have to hold those dollars. Americans have to hold the dollars. If you’re going to trade within the US, you must use US dollars, both legally and practically. Foreigners don’t have to, and at some point they may perceive those dollars as being the hot potatoes they are. And the US government might say that we can’t have Americans investing outside the country, perhaps not even spending a significant amount outside the country, because they are just going to add to this giant pile of dollars. There are all kinds of reasons that they could come up with.

We already have de facto capital controls, quite frankly, even though there’s no law at the moment saying that an American can’t invest abroad or take money out of the country. The problem is because of other US laws, like FATCA, finding a foreign bank or a foreign broker who will accept your account is very hard. Very, very few of them will take American accounts anymore because the laws make it unprofitable, inconvenient, and dangerous, so they don’t bother. So it’s not currently against the law, but it’s already very hard.

Nick Giambruno: What forms of savings are good candidates to take abroad? Gold coins? Foreign real estate?

Doug Casey: Well, you put your finger on exactly the two that I was going to mention. Everybody should own gold coins because they are money in its most basic form—something that a lot of people have forgotten. Gold is the only financial asset that’s not simultaneously somebody else’s liability.

And if your gold is outside the US, it gives you another degree of insulation should the United States decide that you shouldn’t own it—it’s not a reportable asset currently. If you have $1 million of cash in a bank account abroad, you must report that to the US government every year. If you have $1 million worth of gold coins in a foreign safe deposit box, however, that is not reportable, and that’s a big plus.

So gold is one thing. The second thing, of course is real estate. There are many advantages to foreign real estate. Sometimes it’s vastly cheaper than in the US. Foreign real estate is also not a reportable asset to the US government.

Nick Giambruno: Foreign real estate is a good way to internationally diversify a big chunk of your savings. What are the chances that your home government could confiscate foreign real estate? It’s pretty close to zero.

Doug Casey: I’d say it’s just about zero because they can make you repatriate the cash in your foreign bank account, but what can they make you do with the real estate? Would they tell you to sell it? Well, it’s not likely.

Also, if things go sideways in your country, it’s good to have a second place you can transplant yourself to. And I know that it’s unbelievable for most people to think anything could go wrong in their home country—a lot of Germans thought that in the ’20s, a lot of Russians thought that in the early teens, a lot of Vietnamese thought that in the ’60s, a lot of Cubans thought that in the ’50s. It could happen anywhere.

Nick Giambruno: Besides savings, what else can people diversify? How does a second passport fit into the mix?

Doug Casey: It’s still quite possible—and completely legal—for an American to have a citizenship in a second country, and it offers many advantages. As for opening up foreign bank accounts, if you show them an American passport, they’ll likely tell you to go away. Once again, obtaining a foreign bank or brokerage account is extremely hard for Americans today—that door has been closing for some time and is nearly slammed shut now. But if you show a foreign bank a Paraguayan or a Panamanian or any other passport, they’ll welcome you as a customer.

Nick Giambruno: The police state is metastasizing in the US. Is that a good reason to diversify as well?

Doug Casey: It’s a harbinger, I’m afraid, of what’s to come. The fact is that police forces throughout the US have been militarized. Every little town has a SWAT team, sometimes with armored personnel carriers. All of the Praetorian style agencies on the federal level—the FBI, CIA, NSA, and over a dozen others like them—have become very aggressive.

Every single day in the US, there are scores of confiscations of people’s bank accounts, and dozens having their doors broken down in the wee hours of the night. The ethos in the US really seems to be changing right before our very eyes, and I think it’s quite disturbing.

You can be accused of almost anything by the government and have your assets seized without due process. Every year there are billions of dollars that are seized by various government entities, including local police departments, who get to keep a percentage of the proceeds, so this is a very corrupting thing.

People forget that when the US was founded there were only three federal crimes, and they are listed in the Constitution: treason, counterfeiting, and piracy. Now it’s estimated there are over 5,000 federal crimes, and that number is constantly increasing. This is very disturbing. There is a book called Three Felonies a Day, which estimates that many or most Americans inadvertently commit three felonies a day. So it’s becoming Kafkaesque.

Nick Giambruno: Thanks, Doug. Until next time.

Doug Casey: Thanks, Nick.

Editor’s Note: The US is nearing the worst financial disaster of our lifetimes. It’s inevitable. And it’s the single biggest threat to your financial future.

Fortunately, you can learn the ultimate strategy for turning the coming crisis into a wealth-building opportunity in this urgent video from New York Times best selling author Doug Casey.

Click Here to Watch it Now

The article Doug Casey’s Top Two Ways to Store Wealth Abroad was originally published at caseyresearch.com.

Labels:

Bank,

Bank of America,

CIA,

dollars,

Doug Casey,

FBI,

financial,

gold,

Nick Giambruno,

NSA,

passport,

risk,

savings,

US,

wealth

Wednesday, September 14, 2016

The Next Big Short

The "Next Big Short" is a collection of looming market risks from The Heisenberg. This 37 page special report will show you the risks in the markets. How to explain The Heisenberg?

Essentially, it's a collective brain trust of skilled traders willing to discuss markets with the freedom of anonymity. You can enjoy Heisenberg's lively market commentary in the TheoDark Report section of their public blog.

Get the "Next Big Short " free special report....Just Click Here

For more backstory, here's Heisenberg in his own words: Heisenberg spent a long time in college. Probably too long. Be that as it may, the experience afforded him extensive cross disciplinary experience. From Aristotle to Kant to Wittgenstein, from Hobbes to Locke to Rousseau, from plain vanilla equities to FX to CDS, Heisenberg is right at home. With degrees in political science and business, as well as extensive post graduate work in political science and public administration, Heisenberg is uniquely positioned to analyze markets from a holistic perspective. He also has a sense of humor, which allows him to fully appreciate how entertaining it is to talk about himself in the third person.

Heisenberg has traded pretty much everything at one time or another and if he hasn’t traded it, he’s studied it enough to drive himself just as crazy as if he had. He doesn’t sleep much because the terminal doesn’t sleep and neither, generally speaking, do currency markets.

Heisenberg once took the law school admission test (LSAT) for fun with no intention of actually going to law school. He then took it again to try and beat his first score. He paid for the second test with profits he made from long calls on a Brazilian water utility ADR that he sold to close from the first iPhone (the 2.5G version that no one remembers) in the middle of a graduate political science class. His score on the verbal section of the graduate management admission test (GMAT) was near perfect. As was his score on the analytical writing portion. Don’t ask about the math section. He got bored after two hours and didn’t care about using the Pythagorean theorem to determine how long Timmy’s shadow was when he was standing next to a 90 degree flag pole.

Professionally, Heisenberg has worked in Manhattan and many other locales and has years of experience generating and monetizing financial web content. He’s continually amused at those who make it seem hard. You provide quality content for users on a consistent basis. Everything else falls into place. Build it, and they will come.

Get the "Next Big Short " free special report....Just Click Here

See you in the markets putting the Next Big Short to work,

Ray C. Parrish

aka the Crude Oil Trader

Sunday, July 24, 2016

How to Profit From These Massive, Brexit Induced Trends

By Justin Spittler

This has the makings of a classic speculative opportunity—one where politically caused distortions are liquidated and prices readjust. But a word of caution. It’s going to take place within the context of the Greater Depression. And, as Richard Russell, who lived through the last depression, observed: In a depression, nobody wins. The winner is just the person who loses the least.The EU will disintegrate. It never made sense from the beginning to try to get Swedes to live by the same rules as Sicilians or Germans by the same rules as Portuguese. Not to mention that the rules are entirely arbitrary. Worse, almost all the rules are economic in nature, with legislated winners and losers. Deals like that always lead to resentment, among both the winners and the losers.

In addition to this, the EU is very problematical when it comes to immigrants. There will be more migrants trying to settle in Europe. Why? Because the Muslim world, the swath of countries extending all across northern Africa, through the Middle East, Central Asia, and the Far East, is likely to become increasingly unstable. The EU, as a very politically correct organization is loathe to turn them away. However, once they’re within Schengen, the migrants can travel anywhere. Perhaps where welfare benefits are best and where other migrants are gathering. Remember, when times get tough, both politicians and the capite censi look for someone to blame.

How to profit from this? Most people don’t think the EU will collapse just because Britain (which has always been closer to the U.S. than the Continent anyway) has left. They’re wrong. For one thing, although Brussels won’t become a ghost town, it’s going to lose scores of thousands of highly paid Eurocrats and their minions. I recall that property there was some of the cheapest in Europe in the early ’80s, it’s going to return to that status. We’ll look for a REIT to sell short, specializing in the Brussels market.

It will accelerate the disintegration of nation-states everywhere.

There are about 200 nation-states in the world. The international “elite,” the “intelligentsia,” the members of the Deep State everywhere, and organizations like the EU in Brussels, would like to see a much smaller number of more powerful states. Orwell anticipated just three mega-states in his dystopia. But the actual trend is in the opposite direction.

It’s not just the UK seceding from the EU, but Scotland from the UK. The Basques and Catalans may eventually secede from Spain. Belgium, a totally artificial country, may eventually break up into Flemish-speaking Flanders and French speaking Wallonia. France has half a dozen secession movements. Italy was only unified into its present form from scores of principalities, duchies, and baronies in 1871 by Garibaldi. It was the same with Germany until Bismarck in 1871.

The break-up of the USSR in 1990 into 13 smaller states was a good start, but Russia itself is a small empire with dozens of distinct ethnic and linguistic groups. You will rarely hear about this in the mass media, but there are dozens of secession movements throughout Europe. That’s one more reason why (in addition to the interest rate risk and the inflation risk, which are both substantial) you should stay away from long-term government bonds.

The euro will cease to exist.....

The Esperanto currency was doomed from the beginning. It was not just an “IOU nothing,” like the U.S. dollar, but a “Who owes you nothing” since it’s not even backed by a specific government’s taxing power. How to profit? I’ve put on long-term futures contracts, long the British pound vs. short the euro. My rationale is simple. Britain will benefit from exiting the EU, attracting capital and strengthening the pound—which is down 11% against the euro since Brexit. The euro, meanwhile, will approach its intrinsic value at an accelerating rate.

A truly major banking crisis.....

Much worse than that of 2007–2009. Governments, who are all bankrupt, borrow money from commercial banks. Commercial banks have lent it to them because they believe it’s a risk free loan. Governments encourage them to lend recklessly, hoping that will jump-start sluggish economies. Central banks, which are the arms of their governments, have taken interest rates to zero and below for that reason and to make it easier for governments to service their debt. This policy has encouraged businesses to take on debt.

It’s an idiotic and reckless experiment that will end—likely in this cycle—with bankrupt central banks and governments bailing out bankrupt commercial banks and businesses. Just the way they did in 2007–2009. Except this time, the situation is much more serious. How to profit? Don’t own European companies, stocks or bonds, and banks in particular. In fact, even though they’re already down considerably, they’re going lower and are excellent candidates for short sales, or the sale of naked calls.

A panic into gold.....

You’ve heard this story many times before here. But it’s truer than ever as we approach a genuine crisis. There are no stable paper currencies anywhere in the world. The dollar has been strong only because it’s liquid. Liquidity is good, but here, we’re talking about liquid like nitroglycerin. Hedge funds will start buying gold in size. As will central banks, who don’t want to hold each other’s paper. As will individual investors. Right now, few people even think about gold, much less understand it. How to profit? Buy gold. I expect we’ll see it well over $5,000 this cycle. Silver should do even better in relative terms. And gold stocks have explosive upside.

An exodus of capital and people from Europe.....

to parts of Latin America, plus to the U.S., Canada, Australia, and New Zealand. This is, obviously, bad for Europe and good for the recipient countries. In recent years, I might not have included Latin America, but things have changed. Argentina and Colombia are liberalizing economically. The continent isn’t involved in any entangling alliances, isn’t on the migration highway, and has low costs. Why a wealthy European would stay in that stagnant and unstable continent when he could live better, and mostly tax free, at a fraction of the cost in Argentina is a mystery to me.

Chaos in Africa.....

Almost every country in Africa is an ex-European colony. Over the last 50 years, Europe, with the U.S. and now China, have shipped over a trillion dollars to the continent. Most of it has been recycled back to Europe by the African elites that stole it, and the rest has mostly been wasted.

That flow is going to stop for a number of reasons, but among them is that it makes no sense in an “every-man for himself” world. At the same time, essentially all of the world’s population growth over the next couple of decades is going to come from sub Saharan Africa. It’s a nasty economic environment that’s a formula for conflict.

Millions of Africans will want to emigrate, especially to the homelands of their ex-colonial masters in Europe. They won’t, however, be welcome. How might one take advantage of this? The higher population is going to put upward pressure on commodities, and the chaos is going to make their production much riskier in Africa.

In conclusion.....

Brexit itself is likely to be good for Britain. And it augurs some big changes in the world at large. Don’t forget that it will all be in the context of both the Greater Depression and the accelerating and world-changing technological revolution I described last month. Our objective here remains to not only keep you advised of what’s happening, but help you profit from opportunities while avoiding major dangers.

Editor's note: The biggest threat to your wealth right now isn’t an economic recession, a stock market crash, or even a global banking crisis. It’s something much bigger and far more dangerous. This short video explains more…

It explains how violent currency moves—like we’re seeing today—have preceded some of the worst financial disasters in history. By the end of the video, you’ll know why you can’t afford to ignore the warnings we’re seeing right now. You’ll learn how to protect yourself and profit from the coming crisis. Click here to watch this free video.

The article Weekend Edition: How to Profit From These Massive, Brexit-Induced Trends was originally published at caseyresearch.com.

Get our latest FREE eBook "The Rebel's Guide to Trading Options"....Just Click Here!

Wednesday, December 23, 2015

By Far the Biggest Threat to Your Wealth in 2016

By Justin Spittler

Today, we begin with a warning. We’re going to tell you about a dangerous event that is very likely to happen within the next year. You’ve probably never thought about this threat. Until now, Casey Research has never discussed it in public. This threat isn’t a stock market collapse…it’s not a failure of the Social Security system…it’s not even a national debt or currency crisis. It’s much more dangerous and much more likely to happen than any of those things.We’re talking about a major financial terrorist attack. A total wipeout of your financial data, assets, and records and those of many millions of other people. If you’re like most people, you think, “There’s no way that could happen here. Surely the financial system is completely safe.” But think about it….

If you have $100,000 in the bank, what do you really have?

These days, it’s not a claim to hard assets like gold or silver. And it’s certainly not real cash in a bank. Many local banks don’t even keep that much cash on hand! Just try asking your bank for $25,000 in cash. The teller will say, “We can’t give you that much money.” If you keep your life savings in a bank or brokerage account, what you have are electronic entries that hackers can easily and quickly delete. All the money you’ve earned...the hard work, the sweat, the sacrifice...the nest egg you’ve built to provide for your family, GONE. In an instant.

Cyberterrorists have already broken into the world’s most secure digital systems....

For example…..

➢ In May, hackers stole information on 300,000 private tax returns from the Internal Revenue Service (IRS). They used the information to claim tens of millions of dollars in fraudulent tax refunds.

➢ In April, hackers gained access to President Obama’s email. They gathered details on Obama’s personal schedule as well as private conversations with foreign officials.

➢ And earlier this year, we learned that a group of hackers infiltrated some of America’s largest and most sophisticated financial firms. The victims include JPMorgan Chase, E*Trade, and Scottrade. The hackers stole the personal data of more than 100 million customers. They even manipulated stock prices.

E.B. Tucker, editor of The Casey Report, explains: In today’s high tech world, the lifeblood of our economy is a complex system of digital payments, digital book entries, and digital money. Billions of dollars are electronically transferred every day. We bank online, shop on our computers, and pay for lunch with credit and debit cards. Even the stock exchanges are now 100% electronic. The money in your savings, brokerage, and credit card accounts are just bits and bytes. A skilled hacker could steal it or make it vanish completely.

Here’s E.B....The U.S. has enemies all over the world: Russia, China, Iran, Syria, Iraq, and Saudi Arabia come to mind. There are millions of people out there who want to see the West burn. And it’s only a matter of time before they strike us at one of our most vulnerable points: Our digital financial system. As cybersecurity expert, Mary Galligan, recently told Bloomberg News, state sponsored cyberterrorism is “the FBI’s worst nightmare.”

The fallout from a cyberattack could be catastrophic….

E.B. explains…Just imagine, what if all of the accounts at a major bank like Wells Fargo were suddenly erased? What if businesses couldn’t process digital payments? What if your brokerage told you its records had been destroyed and all evidence of your stock portfolio had disappeared? What if a cyberattack shut down our electrical grid? I’ll tell you what would happen: An explosion of chaos. Society would break down. When people are wiped out financially, they’re often wiped out mentally and morally, too…they’ll do anything to survive, including resort to violence.

The government and central banks cannot protect you from cyberterrorists….

They don’t want people talking about this massive threat. They want to keep it quiet. You see, the U.S. dollar isn’t backed by gold like it was in the past. Our monetary system is built on confidence, and confidence alone. If lots of people questioned the safety of the system and pulled their money out, it could trigger a nationwide run on the banks, a stock market collapse, and a currency crisis. It could literally lead to rioting in the streets.

If you keep most of your money in digital form….

You must take steps to protect yourself and your family before an attack happens. The first step is to store a sizable amount of cash in a safe place you can easily access. We recommend at least three months’ worth of living expenses. Six months’ worth is even better.

You can store the cash in a safe, in a public storage container, or bury it in a waterproof container in your backyard. This might sound extreme, but think about it…if the financial system is compromised and your debit and credit cards become useless, you’ll need enough cash on hand to pay for groceries, gasoline, and other daily necessities.

Otherwise, you’re in a vulnerable position. Having no cash on hand means you could struggle to feed your family in an emergency. Because we believe most Americans are overlooking this huge threat, we put together a new special report titled “How to Protect Yourself from a Financial Terrorist Attack.” We talked with top cybersecurity experts and put hundreds of hours of research into this report. It explains seven specific steps you can take now to protect your money from financial terrorism. Click here to learn more.

Switching gears, the Dow Jones U.S. Trucking Index is headed for its worst year ever….

Yesterday, it closed down 17% on the year. It’s dropped 7.1% in December alone. The Dow Trucking Index tracks the performance of major U.S. trucking stocks. It’s only had three down years since 2001. Over that period, it’s averaged annual returns of 12%. The chart below shows trucking stocks have been in a clear downtrend all year.

E.B. Tucker says investors should watch this trend even if they don’t own trucking stocks. Trucks carry inventory to stores. They carry parts to the assembly plant. Then they carry assembled products to buyers. When sales are rising, it tends to show up in trucking companies before retailers. Trucking companies also feel the pinch first when sales are falling. This is why trucking stocks often give clues about where the market’s going long before other industries.

E.B. also says the collapse in trucking stocks is an early warning sign for the rest of the market. Transport stocks have given investors early warning signs for the past 100 years. Right now, the Dow Trucking Index is telling us business is not great. The trucks aren’t full. This is a dire sign. It’s saying we’re in for some negative surprises in 2016.

From March 2009 through December 2014, the S&P 500 gained 204%. But the bull market has stalled this year. The S&P 500 is down 1% since January. If this trend continues, 2015 will the S&P’s first down year since 2008. On its own, this isn’t a huge concern. However, Dispatch readers know there are many other signs U.S. stocks have already topped out

For one, the current bull market in stocks is now 81 months old. It’s run 31 months longer than the average bull market since World War II. Of course, bull markets don’t die of old age. But they all die eventually. On top of that, U.S. stocks are expensive. The S&P 500 is now 57% more expensive than its historical average. Again, bull markets don’t end just because stocks are expensive. But expensive stocks can fall much harder during a big selloff.

We recommend investing with caution right now. You should own a significant amount of cash and physical gold...and you should sell any overpriced stocks that are vulnerable to an economic downturn.

Chart of the Day

Oil tanker rates are at their highest level in seven years. Today’s chart shows the daily shipping rates for very large crude carriers (VLCC), the second largest type of oil tanker. Each VLCC can carry 2 million barrels of oil. From 2011 through 2014, VLCC shipping rates averaged $20,000/day. This year, rates have soared 79%. Earlier this month, VLCC daily rates reached $112,775, their highest level since 2008.Meanwhile, the price of oil has plunged 32% this year. Earlier this month, oil fell to its lowest level since 2009. Oil tanker rates can go up when oil prices go down…because ship operators charge based on how much oil they move. Their rates are not directly tied to the price of oil.

Dispatch readers know the world has a huge surplus of oil right now. All this oil needs to go somewhere, and oil tankers get paid to move it. As you can see in the chart, it’s a great time to be an oil tanker company.

The article By Far the Biggest Threat to Your Wealth in 2016 was originally published at caseyresearch.com.

Get our latest FREE eBook "Understanding Options"....Just Click Here!

Wednesday, December 2, 2015

How Big the Gig Economy Really Is

By John Mauldin

There is growing awareness of what is being called the “gig economy.” It’s not just Uber driving or Airbnb. There are literally scores of websites and apps where you can advertise your services, get temporary or part time work, and do so from anywhere you happen to be.Some “gigs” actually pay pretty good money, but they are for people with specialized skills who prefer to live a somewhat different lifestyle than the typical 9 to 5’er does. My hedge fund friend Murat Köprülü has been busy researching and documenting this phenomenon and regularly regales me with what he finds.

He goes and spends evenings and weekends with young gig workers, trying to figure out what it is they really do and how they make ends meet in New York City. It turns out they need a lot less to support their lifestyle than you might imagine, and they prefer working intermittent gigs, being able to do what they want, and having no boss.

A close look at the data indicates that the gig economy is indeed big and growing. But there is a great deal of debate among economists about how big it really is.

It’s Much Bigger Than the Employment Data Suggests

Gig workers don’t seem to show up clearly in the BLS employment data. Typically, we would expect those working in the gig economy to appear in the self employed category, but that category is actually drifting downward in numbers—relatively speaking.But Harvard economist Larry Katz and Princeton’s Alan Krueger, who are working on research to document the rise of the gig economy in America, says that our current measures ignore the bulk of the gig economy.

From a story at fusion.net:

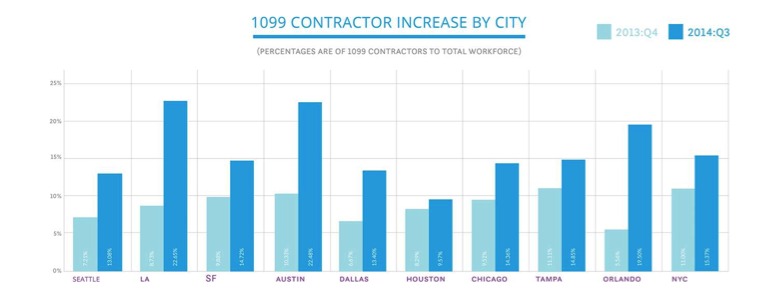

Katz said two pieces of evidence suggest current measures of self-employment and multiple-job holding are “missing a large part of the gig economy.” The first is that the share of the employed (and of the adult population) filing a 1099 form, the tax document “gig economy” workers must file, increased in the 2000s, even as standard measures of self-employment declined in the 2000s. Other groups have confirmed this: Zen Payroll, a site that tracks the sharing economy, found increases in the share of 1099 workers across many major U.S. metros.

Source: Zen Payroll via Small Business Labs

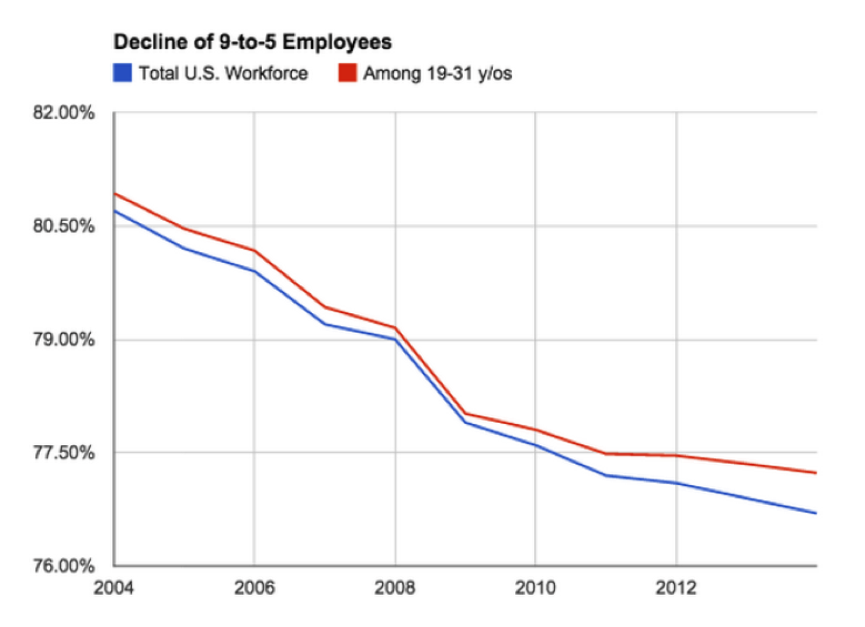

And data from research group EconomicModeling.com show the share of traditional, 9-to-5 workers in the labor force has declined…..

Source: Fusion, data via EconomicModeling.com

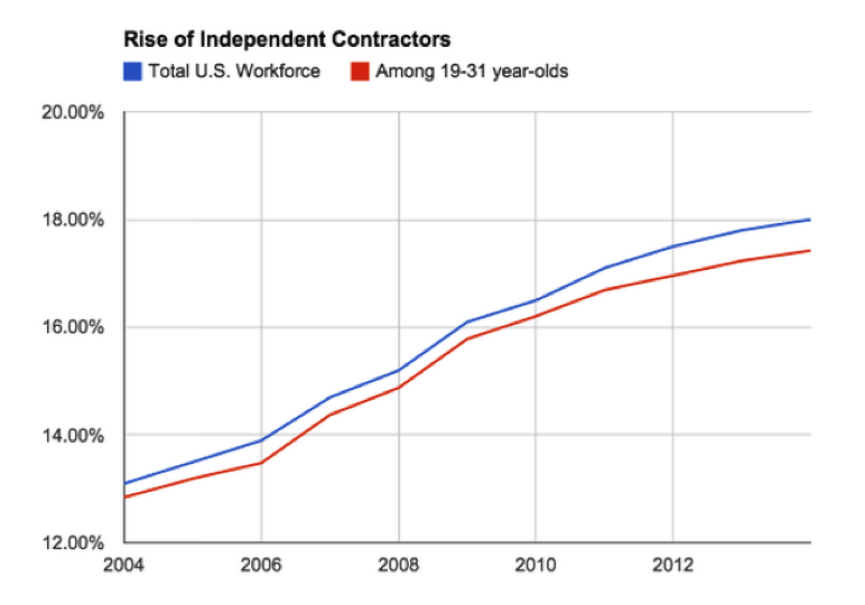

… while those who categorize themselves as “miscellaneous proprietors” is climbing.

Source: Fusion, data via EconomicModeling.com

A recent survey found 60 percent of such workers get at least 25 percent of their income from gig economy work.

And this report absolutely squares with what my friend Murat’s research is showing: that gig economy is not shrinking. On the contrary, it’s on the rise, and a quite rapid rise.

Subscribe to Thoughts from the Frontline

Follow Mauldin as he uncovers the truth behind, and beyond, the financial headlines in his free publication, Thoughts from the Frontline. The publication explores developments overlooked by mainstream news to help you understand what’s happening in the economy and navigate the markets with confidence.The article was excerpted from John F. Mauldin’s Thoughts from the Frontline. Follow John Mauldin on Twitter. The article How Big the Gig Economy Really Is was originally published at mauldineconomics.com.

Get our latest FREE eBook "Understanding Options"....Just Click Here!

Labels:

apps,

data,

employment,

financial,

Frontline,

John Mauldin,

markets,

Mauldin Economics,

money,

Uber

Thursday, October 29, 2015

The Financialization of the Economy

By John Mauldin

Roger Bootle once wrote:

The whole of economic life is a mixture of creative and distributive activities. Some of what we ‘‘earn’’ derives from what is created out of nothing and adds to the total available for all to enjoy. But some of it merely takes what would otherwise be available to others and therefore comes at their expense.

Successful societies maximise the creative and minimise the distributive. Societies where everyone can achieve gains only at the expense of others are by definition impoverished. They are also usually intensely violent. Much of what goes on in financial markets belongs at the distributive end. The gains to one party reflect the losses to another, and the fees and charges racked up are paid by Joe Public, since even if he is not directly involved in the deals, he is indirectly through costs and charges for goods and services.

The genius of the great speculative investors is to see what others do not, or to see it earlier. This is a skill. But so is the ability to stand on tip toe, balancing on one leg, while holding a pot of tea above your head, without spillage. But I am not convinced of the social worth of such a skill.

This distinction between creative and distributive goes some way to explain why the financial sector has become so big in relation to gross domestic product – and why those working in it get paid so much.

Roger Bootle has written several books, notably The Trouble with Markets: Saving Capitalism from Itself.

I came across this quote while reading today’s Outside the Box, which comes from my friend Joan McCullough. She didn’t actually cite it but mentioned Bootle in passing, and I googled him, which took me down an alley full of interesting ideas. I had heard of him, of course, but not really read him, which I think may be a mistake I should correct.

But today we are going to focus on Joan’s own missive from last week, which she has graciously allowed me to pass on to you. It’s a probing examination of how and why the financialization of the US and European (and other developed world) economies has become an anchor holding back our growth and future well being. Joan lays much of the blame at the feet of the Federal Reserve, for creating an environment in which financial engineering is more lucrative than actually creating new businesses and increasing production and sales.

There are no easy answers or solutions, but as with any destructive codependent relationship, the first step is to recognize the problem. And right now, I think few do. What you will read here is of course infused with Joan’s irascible personality and is therefore really quite the fun read (even as the message is sad).

Joan writes letters along this line twice a day, slicing and dicing data and news for her rather elite subscriber list. Elite in the sense that her service is rather expensive, so I thank her for letting me send this out. Drop me a note if you want us to put you in touch with her.

I am back in Dallas after a whirlwind trip to Washington DC. I attended Steve Moore’s wedding at the awe-inspiring Jefferson Memorial; and then we hopped a plane back to Dallas and Tulsa to see daughter Abbi, her husband Stephen, and my new granddaughter, Riley Jane, who was delivered six weeks premature while we were in the air.

The doctors decided to bring Riley into the world early as Abbi was beginning to experience seriously high blood pressure and other problematic side effects. Riley barely weighs in at 4 pounds and will spend the first three years of her life in the NICU (the neonatal intensive care unit). Having never been in one before, I was rather amazed by all the high tech gear surrounding Riley and all of the usual medical devices shrunk to the size where they can be useful with preemie babies.

The doctors and nurses assured me that the frail little bundle I was very hesitant to touch would be quite fine. And Abbi is much better and already up and about.

As I was flying back to Dallas later that afternoon, it struck me how, not all that long ago, in my parents’ generation, both mother and daughter would have been at severe risk. Interestingly, both Abbi and her twin sister were significantly premature as well, some 30 years ago in Korea. The progress of medicine and medical technology has allowed so many more people to live long and productive lives, and that process is only going to continue to improve with each and every passing year.

And now, I think it’s time to let you get on with Joan McCullough’s marvelous musings. Have a great week!

Your glad I’m living at this time in history analyst,

John Mauldin, Editor

Outside the Box

Outside the Box

Stay Ahead of the Latest Tech News and Investing Trends...

The Financialization of the Economy

Joan McCullough, Longford AssociatesOctober 21, 2015

Yesterday, we learned that lending standards had eased and that there was increased loan demand from institutions and households, per the ECB’s September report. (Which was attributed to the success of QE and which buoyed the Euro in the process.)

This has been bothering me. Because it is a great example of the debate over “financialization” of an economy, i.e., is it a good thing or a bad thing?

The need to further explore the topic was provoked by reading this morning that one of the larger shipping alliances, G6, has again announced sailing cancellations between Asia and North Europe and the Mediterranean. This round of cuts targets November and December. The Asia-Europe routes, please note, are where the lines utilize their biggest ships and have been running below breakeven. So it’s easy to understand why such outsized capacity is further dictating the need to cancel sailings outright. G6 members: American President, Hapag Lloyd, Hyundai Merchant Marine, Mitsui, Nippon and OOCL. So as you can see from that line-up, these are not amateurs.

We have already discussed in the past in this space, the topic of financialization. But seeing as how the stock market keeps rallying while the economic statistics have remained for the most part, punk, time to revisit the issue once again. Is it all simply FED or no FED? Or is the interest rate issue ground zero and/or purely symptomatic of the triumph of financialization over the real economy?

Further urged to revisit the topic by the seemingly contradictory developments of the ECB banks reportedly humming along nicely while trade between Asia and Europe remains obviously, significantly crimped. Let’s make this plain English because it takes too much energy to interpret most of what is written on the topic.

Snappy version:

Definition (one of quite a few, but the one I think is accurate for purposes of this screed):

Financialization is characterized by the accrual of profits primarily thru financial channels (allocating or exchanging capital in anticipation of interest, divvies or capital gains) as opposed to accrual of profits thru trade and the production of goods/services.

Economic activity can be “creative” or “distributive”. The former is self- explanatory, i.e., something is produced/created. The latter pretty much simply defines money changing hands. (So that when this process gets way overdone as it likely has become in our world, one of the byproducts is the widening gap called “income inequality”.)

You guessed correctly: financialization is viewed as largely distributive.

So now we roll around to the nitty-gritty of the issue. Which presents itself when business managers evolve to the point where they are pretty much under the control of the financial community. Which in our case is simply “Wall Street”.

This is something I saved from an article last summer which ragged mercilessly on IBM for having kissed Wall Street’s backside ... and in the process over the years, ruined the biz. “And of course, it’s not just IBM. ... A recent survey of chief financial officers showed that 78 percent would ‘give up economic value’ and 55 percent would cancel a project with a positive net present value—that is, willingly harm their companies—to meet Wall Street’s targets and fulfill its desire for ‘smooth’ earnings.... http://www.forbes.com/sites/stevedenning/2014/06/03/why-financialization-has-run-amok/

IBM is but one possible target in laying this type of blame where the decisions on corporate action are ceded to the financial community; the instances are innumerable.

You probably could cite the well-known example of a couple of years back when Goldman Sachs was exposed as the owner of warehouse facilities that held 70% of North American aluminum inventory. And how that drove up the price and cost end-users dearly. (Estimated as $ 5bil over 3 years’ time.)

First link: NY Times article from July of 2013, talking about the warehousing issue.

http://www.nytimes.com/2013/07/21/business/a-shuffle-of-aluminum-but-to-banks-pure-gold.html?pagewanted=all&_r=0

Second link: Senate testimony from Coors Beer, complaining about the same situation.

http://www.banking.senate.gov/public/index.cfm? FuseAction=Files.View&FileStore_id=9b58c670-f002-42a9-b673- 54e4e05e876e

Well, here’s another from the same article which makes the point quite clearly: Boeing’s launch of the 787 was marred by massive cost overruns and battery fires. Any product can have technical problems, but the striking thing about the 787’s is that they stemmed from exactly the sort of decisions that Wall Street tells executives to make.

Before its 1997 merger with McDonnell Douglas, Boeing had an engineering driven culture and a history of betting the company on daring investments in new aircraft. McDonnell Douglas, on the other hand, was risk-averse and focused on cost cutting and financial performance, and its culture came to dominate the merged company. So, over the objections of career long Boeing engineers, the 787 was developed with an unprecedented level of outsourcing, in part, the engineers believed, to maximize Boeing’s return on net assets (RONA). Outsourcing removed assets from Boeing’s balance sheet but also made the 787’s supply chain so complex that the company couldn’t maintain the high quality an airliner requires. Just as the engineers had predicted, the result was huge delays and runaway costs.

Boeing’s decision to minimize its assets was made with Wall Street in mind. RONA is used by financial analysts to judge managers and companies, and the fixation on this kind of metric has influenced the choices of many firms. In fact, research by the economists John Asker, Joan Farre-Mensa, and Alexander Ljungqvist shows that a desire to maximize short term share price leads publicly held companies to invest only about half as much in assets as their privately held counterparts do.”

That’s from an article in the June, 2014, Harvard Business Review by Gautam Mukunda, “The Price of Wall Street’s Power” also cited in the Forbes article. This is the link; it is worth the read though you may not agree with parts of the conclusion: https://hbr.org/2014/06/the-price-of-wall-streets-power

The upshot to this type of behavior is that the balance of power ... and ideas ... then migrates into domination by one group.

Smaller glimpse: Over financialization is what happens when a company generates cash then pays it to shareholders and senior management which m.o. also includes share buybacks and vicious cost cutting. This is one way, as you can see, in which the real economy is excluded from the party!

Part of the financialization process also includes ‘cognitive capture’ where the big swingin’ investment banking sticks have the ear of business managers.

And the business managers/special interest groups, in turn, have the ear of the federal government. See? The control by Wall Street is still there, but sometimes the route is a tad circuitous! The clandestine formulation of the TPP agreement is a perfect example of this type of dominance. (Congress shut out/ corporate lobbyists invited in.)

So the whole process goes to the extreme. Therein lies the rub: the extreme. So that business obediently complies with the wishes of these financial wizards. Taken altogether, over time, our entire society morphs to where it assumes a posture of servitude to the interests of Wall Street.

An example of that? John Q.’s sentiment meter (a/k/a consumer confidence) is clearly known to be tied most of the time to the direction of the S&P 500. Which of course, is aided and abetted by the foaming at the mouth Talking Heads who pretty much .... dictate to John Q. how he is supposed to be feeling.

Forty years on the Street, I am still agog at the increasing clout of the FOMC to the extent where we are now hostages to their infernal sound bites and communiqués. Another example of the process of creeping financialization? I’d surely say so!

This is not an effort to try and convict “financialization” as indeed it has its place. When it is used prudently. Such as to facilitate trade in the real economy! Sounds kind of Austrian, eh? You bet. The simplest example of this which is frequently cited is a home mortgage. The borrower exchanges future income for a roof via a bank note.

And so it goes. Financialization humming along nicely, facilitating trade in the real economy. Unfortunately, along the line somewhere, it got out of hand. Which is where the World Bank comes in.

http://data.worldbank.org/indicator/FS.AST.PRVT.GD.ZS

As they have the statistics on “domestic credit to private sector (% of GDP)”

Why do we wanna’ look at that? Well the answer is suggested by yet another institution who has studied the issue. Correct. The IMF. Which espouses the notion that “the marginal effect of financial depth on output growth becomes negative ... when credit to the private sector reaches 80-100% of GDP ...

https://www.imf.org/external/pubs/ft/wp/2012/wp12161.pdf

Does the above sound familiar? Right. Too much financialization crimps growth.

That’s when we turn to the above-referenced World Bank table. Which shows the latest available worldwide statistics (2014) on domestic credit to private sector % of GDP.

Okay. Maybe we oughta’ read this bit from the World Bank before we get to the US statistic:

... “Domestic credit to private sector refers to financial resources provided to the private sector by financial corporations, such as through loans, purchases of nonequity securities, and trade credits and other accounts receivable, that establish a claim for repayment. ...

The financial corporations include monetary authorities and deposit money banks, as well as other financial corporations ...

Examples of other financial corporations are finance and leasing companies, money lenders, insurance corporations, pension funds, and foreign exchange companies.” ....

Clear enough. Again, the IMF suggests that 80 to 100% of GDP is where it gets dicey in terms of impact on growth.....

In 2014, the US ratio stood at 194.8. In 1981 (as far back as the table goes), our ratio stood at 89.1.

For comparison, also in 2014, Germany stood at 80.0; France at 94.9. China at 141.8 and Japan at 187.6. Which is suggestive of what can be called “over-financialization”. So what’s the beef with that, you ask?

For all the reasons mentioned above which led to increasing dominance by the financial sector on corporate and household behavior, the emphasis leans heavily towards making money out of money. Which I’d like to do myself. You?

But when massaged into the extreme which is clearly, I believe, where we find ourselves now ... at the end of the day, we create nothing.

By creating nothing, the economy relies on the financialization process to create growth. But the evidence supports the notion that once overdone, financialization stymies growth.

“ ... The whole of economic life is a mixture of creative and distributive activities. Some of what we “earn” derives from what is created out of nothing and adds to the total available for all to enjoy. But some of it merely takes what would otherwise be available to others and therefore comes at their expense. Successful societies maximize the creative and minimize the distributive. Societies where everyone can achieve gains only at the expense of others are by definition impoverished. They are also usually intensely violent.” ... Roger Bootle quoted here: http://bilbo.economicoutlook.net/blog/?p=5537

In short, corporate behavior is dictated by Wall Street desire which in turn results in a flying S&P 500. Against a backdrop, say, of a record number of US workers no longer participating in the labor force.

So instead of cogitating the entire picture and all of its skanky details, we have so farbeen willing to accept a one-size fits all alibi for stock market action where financialization still dominates; the only choice is what financialization flavor will trump the other: “FED or no FED”.

I now wonder if when Bootle said a few years back ... “they are usually intensely violent”, if this wasn’t prescience. Which can be applied to the current political landscape in the US where the financialization of the economy has so excluded the average worker ... that he is willing to put Ho-Ho the Clown in the White House. Just to change the channel. And hope for relief.

As you can see, I am trying very hard to understand how as a society we got to this level.

Like Outside the Box? Sign up today and get each new issue delivered free to your inbox.

It's your opportunity to get the news John Mauldin thinks matters most to your finances.

The article Outside the Box: The Financialization of the Economy was originally published at mauldineconomics.com.

Get our latest FREE eBook "Understanding Options"....Just Click Here!

Monday, October 26, 2015

Someone Is Spending Your Pension Money

By John Mauldin

“Retirement is like a long vacation in Las Vegas. The goal is to enjoy it to the fullest, but not so fully that you run out of money.”– Jonathan Clements

“In retirement, only money and symptoms are consequential.”– Mason Cooley

Retirement is every worker’s dream, even if your dream would have you keep doing the work you love. You still want the financial freedom that lets you work for love instead of money. This is a relatively new dream. The notion of spending the last years of your life in relative relaxation came about only in the last century or two. Before then, the overwhelming number of people had little choice but to work as long as they physically could. Then they died, usually in short order. That’s still how it is in many places in the world.

Retirement is a new phenomenon because it is expensive. Our various labor-saving machines make it possible at least to aspire to having a long, happy retirement. Plenty of us still won’t reach the goal. The data on those who have actually saved enough to maintain their lifestyle without having to work is truly depressing reading. Living on Social Security and possibly income from a reverse mortgage is limited living at best.

In this issue, I’ll build on what we said in the last two weeks on affordable healthcare and potentially longer lifespans. Retirement is not nearly as attractive if all we can look forward to is years of sickness and penury. We are going to talk about the slow motion train wreck now taking shape in pension funds that is going to put pressure on many people who think they have retirement covered.

Please feel free to forward this to those who might be expecting their pension funds to cover them for the next 30 or 40 years. Cutting to the chase, US pension funds are seriously underfunded and may need an extra $10 trillion in 20 years. This is a somewhat controversial letter, but I like to think I’m being realistic. Or at least I’m trying.