Crude oil, like most commodities, is not priced as a single data point like a stock. Instead, commodities, like oil, trade via futures contracts. A futures contract is an agreement to buy or sell a particular commodity or security at a predetermined price at a specified time in the future. Futures contracts are standardized for quantity and quality specifications to facilitate trading on a futures exchange....Continue Reading Here.

Trade ideas, analysis and low risk set ups for commodities, Bitcoin, gold, silver, coffee, the indexes, options and your retirement. We'll help you keep your emotions out of your trading.

Showing posts with label Russia. Show all posts

Showing posts with label Russia. Show all posts

Saturday, May 14, 2022

Trading Crude Oil With USO

Thursday, March 10, 2022

How You Can Minimize Trading Risk & Grow Capital During A Global Crisis

To minimize trading risk and grow capital during a global crisis is somewhat hinged on the answers to speculative questions.

- How long will the Russia – Ukraine war last?

- How high is the price of oil and gas going to go?

- How quickly will central banks raise interest rates to counter high inflation?

- What assets should I put my money into?

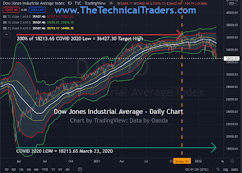

Knowing what the Best Asset Now (BAN) is, is critical for risk management and consistent growth no matter the market condition. Buy the Dip or Sell the Rally? Let's start here with the DJI weekly chart

Labels:

commodities,

currency,

investing,

money,

Oil Prices,

Russia,

stocks,

Ukraine

Thursday, April 23, 2020

Our MarketClub Members Bailed Before Crude Oil Went Negative

If the world wasn't strange enough right now, the crude oil market just took it up a notch. On Monday, April 20, 2020, the May contract for WTI Crude Oil fell to negative $37/barrel, bizarre territory after a record breaking price drop.

Futures traders are rightfully concerned about decreased demand, overproduction, and limited storage space. MarketClub members were thankfully sitting on the sidelines (or were riding the move down) after getting an exit signal for this liquid energy fund.

What’s the Next Move for USO?

MarketClub members have the Chart Analysis Score at their fingertips. If and when the USO trend reverses, members will see the score increase and will receive Trade Triangle signals as the ETF establishes new short term, intermediate, and long-term bullish trends.

Want the score and signals for USO or any other energy stock or ETF?

Join MarketClub now and get immediate access!

Futures traders are rightfully concerned about decreased demand, overproduction, and limited storage space. MarketClub members were thankfully sitting on the sidelines (or were riding the move down) after getting an exit signal for this liquid energy fund.

What’s the Next Move for USO?

MarketClub members have the Chart Analysis Score at their fingertips. If and when the USO trend reverses, members will see the score increase and will receive Trade Triangle signals as the ETF establishes new short term, intermediate, and long-term bullish trends.

Want the score and signals for USO or any other energy stock or ETF?

Join MarketClub now and get immediate access!

Labels:

commodities,

Crude Oil,

Drilling,

futures,

MarketClub,

Natural Gas,

oil storage,

Permian Basin,

Russia,

Saudi Arabia,

WTI

Tuesday, May 7, 2019

U.S. Stock Markets Could Rally Beyond Expectations

Late Sunday afternoon, President Trump surprised the global markets with the announcement of increased trade tariffs with China relating to the ongoing trade negotiations and delayed trade talks between the two global superpowers. The global markets reacted immediately upon the open Sunday night (Asian open). The VIX short position puts quite a bit of professional traders at risk of big losses today while those of us that were prepared for an increase in volatility and price rotation is poised for some incredible opportunities.

The U.S. stock market is set up for a price move that will likely make many people very wealthy while frustrating many others over the next few months. We’ve recently posted many articles regarding the 2020 U.S. Presidential election cycle and the fear cycle that comes from these major political events. In November 2016, we remember watching Gold rally $60 early in the election night, then fall $100 as news began reporting the surprise winner. There is so much capital, and future capital expectations that ride on these election cycles – it can actually drive the markets in one direction or another.

Get Our Free Market Research Right Here

Right now, we have two things we want to alert you to regarding our proprietary Fibonacci price modeling utility. First, the current trend is Bullish and the chance of a downside price move is still valid. Remember, one of the primary price rules within Fibonacci price theory is that price must ALWAYS attempt to seek out new highs and new lows – at all times. This means that once price establishes new price highs, any failure to continue establishing new price highs, through standard price rotation, will result in its price attempting to establish new price lows.

So, as we continue with our expectations, remember that any failure of price to continue the push higher means it WILL rotate lower and attempt to establish new price lows.

Taking a look at this IWM Monthly chart shows a very clear price rotation near the end of 2018 and that the current price has yet to rally above the October 2018 highs. In this instance, we have a FAILURE to establish new price highs within the current price move. We also have a new price low established in December 2018. This high and low sets up the range of $173.99 and $125.80. Fibonacci price theory tells us that PRICE WILL attempt to establish a new price high or new price low from within this range. Therefore, the price WILL either continue to rally higher and break the $173.99 level or price WILL reverse lower, without reaching the $173.99 level and target the $125.80 level.

Our modeling system is currently telling us that price and trend is bullish and that the current price level has clearly rallied above the Fibonacci price trigger levels near $143.50. Should price rotate lower and breach these Fibonacci price trigger levels, then we would expect the price to move much lower. Right now, we don’t expect that to happen based on a strong U.S. economy, employment and earnings.

This Monthly SPX chart shows a similar setup – yet the main difference is that the current HIGH PRICES are clearly above the October 2018 previous highs. Thus, in this instance the SPX has reached “new price highs” as a component of Fibonacci price theory and, because of this fact, must continue to strive for new price highs or risk failing and rotating lower to establish new price lows.

In fact, the past three trading sessions are proprietary SP500 index trading system issued two quick winning trades for members. The two trades pulled 2.5% and 2% out of the market in less than 24 hours from the entry prices. This momentum and trend trading system are going to be a new trading weapon for us to follow and trade the markets once we implement this into the member’s area for viewing the charts and signals at any time.

Take a look at the chart below then consider what that last statement really means. It suggests that we have already reached into new price high territory. Fibonacci theory suggests that “once new price highs are established, the trend MUST continue to attempt to establish new higher price highs – OR FAIL and attempt to establish a new price low. Well, a failure at this level could mean a price move all the way back towards recent lows near December 2018 – near $2346.58. Therefore, it is critical that we see other markets, like the IWM, continue to push higher in an attempt to support this broader upside price move for all the U.S. major stocks.

The most important factor going forward is to be prepared to think and react very quickly to price rotations, news, and the election cycle process. Take a look at how volatile the market has become over the past 12 months and consider the fact that we could continue to see this type of volatility in the markets for the next 15+ months – at least through the election cycle process.

Remember also that the US economy is operating on very strong fundamentals, employment, and outputs. Disruption of future expectations could lead to a massive displacement of capital in the global markets. Watch crude oil, gold, silver and other commodities for any signs of weakness. And pay attention to the levels we are suggesting in this research post. If the SPX falls below $2600 – be prepared. If the IWM falls below $142 – be prepared. Price is always seeking out new price highs and new price lows. If it can’t get one side, it will attempt to get the other.

The global market “Shake out” that we wrote about weeks ago is just starting. Our expectations are that an increase in price volatility, as well as a minor price rotation, will take place in the U.S. markets before a continued upside price bias will drive prices higher again. There are two main drivers that will become leaders of any bigger rotation in the global markets – Metals and Commodities. If we begin to see a collapse in commodity prices, pretty much across the board, while metals breakout into a rally, then we are setting up for a bigger downside price move. Until that happens, continue to expect an upside price bias to continue in the U.S. stock market.

Secondly, should a massive currency revaluation event take place, where global currencies weaken as the U.S. Dollar stays strong, then we could be setting up for a “slow unraveling” of foreign debt markets and foreign equity markets. This would be almost like a “slow bleed out” as a currency devaluation event prompt incredible pricing pressures on local foreign governments to support their economies. These devaluation events, if they happen, could prompt a hyper inflation type of event that could disrupt weaker nations to such a degree that they could weaken world leading economies that have exposure to these foreign nations – Think China/Russia.

Our advice continues to be to look for opportunities as the volatility increases and continue to expect an upside price bias in the U.S. stock market – at least until we have any strong evidence that price trend has changed. Don’t buy into the doom-sayers just yet. In our opinion, this U.S. upside price move is not over yet.

If you want to become a technical trader and pull money from the markets during times when most others cannot be sure to join the Wealth Trading Newsletter today. Plus, for a few days only I’m giving away and shipping Free Silver Rounds to subscribers who join our select membership levels.

Chris Vermeulen @ The Technical Traders

The U.S. stock market is set up for a price move that will likely make many people very wealthy while frustrating many others over the next few months. We’ve recently posted many articles regarding the 2020 U.S. Presidential election cycle and the fear cycle that comes from these major political events. In November 2016, we remember watching Gold rally $60 early in the election night, then fall $100 as news began reporting the surprise winner. There is so much capital, and future capital expectations that ride on these election cycles – it can actually drive the markets in one direction or another.

Get Our Free Market Research Right Here

Right now, we have two things we want to alert you to regarding our proprietary Fibonacci price modeling utility. First, the current trend is Bullish and the chance of a downside price move is still valid. Remember, one of the primary price rules within Fibonacci price theory is that price must ALWAYS attempt to seek out new highs and new lows – at all times. This means that once price establishes new price highs, any failure to continue establishing new price highs, through standard price rotation, will result in its price attempting to establish new price lows.

So, as we continue with our expectations, remember that any failure of price to continue the push higher means it WILL rotate lower and attempt to establish new price lows.

Taking a look at this IWM Monthly chart shows a very clear price rotation near the end of 2018 and that the current price has yet to rally above the October 2018 highs. In this instance, we have a FAILURE to establish new price highs within the current price move. We also have a new price low established in December 2018. This high and low sets up the range of $173.99 and $125.80. Fibonacci price theory tells us that PRICE WILL attempt to establish a new price high or new price low from within this range. Therefore, the price WILL either continue to rally higher and break the $173.99 level or price WILL reverse lower, without reaching the $173.99 level and target the $125.80 level.

Our modeling system is currently telling us that price and trend is bullish and that the current price level has clearly rallied above the Fibonacci price trigger levels near $143.50. Should price rotate lower and breach these Fibonacci price trigger levels, then we would expect the price to move much lower. Right now, we don’t expect that to happen based on a strong U.S. economy, employment and earnings.

This Monthly SPX chart shows a similar setup – yet the main difference is that the current HIGH PRICES are clearly above the October 2018 previous highs. Thus, in this instance the SPX has reached “new price highs” as a component of Fibonacci price theory and, because of this fact, must continue to strive for new price highs or risk failing and rotating lower to establish new price lows.

In fact, the past three trading sessions are proprietary SP500 index trading system issued two quick winning trades for members. The two trades pulled 2.5% and 2% out of the market in less than 24 hours from the entry prices. This momentum and trend trading system are going to be a new trading weapon for us to follow and trade the markets once we implement this into the member’s area for viewing the charts and signals at any time.

Take a look at last weeks trade and today’s trade which both hit T1 (Target 1).

Take a look at the chart below then consider what that last statement really means. It suggests that we have already reached into new price high territory. Fibonacci theory suggests that “once new price highs are established, the trend MUST continue to attempt to establish new higher price highs – OR FAIL and attempt to establish a new price low. Well, a failure at this level could mean a price move all the way back towards recent lows near December 2018 – near $2346.58. Therefore, it is critical that we see other markets, like the IWM, continue to push higher in an attempt to support this broader upside price move for all the U.S. major stocks.

The most important factor going forward is to be prepared to think and react very quickly to price rotations, news, and the election cycle process. Take a look at how volatile the market has become over the past 12 months and consider the fact that we could continue to see this type of volatility in the markets for the next 15+ months – at least through the election cycle process.

Remember also that the US economy is operating on very strong fundamentals, employment, and outputs. Disruption of future expectations could lead to a massive displacement of capital in the global markets. Watch crude oil, gold, silver and other commodities for any signs of weakness. And pay attention to the levels we are suggesting in this research post. If the SPX falls below $2600 – be prepared. If the IWM falls below $142 – be prepared. Price is always seeking out new price highs and new price lows. If it can’t get one side, it will attempt to get the other.

The global market “Shake out” that we wrote about weeks ago is just starting. Our expectations are that an increase in price volatility, as well as a minor price rotation, will take place in the U.S. markets before a continued upside price bias will drive prices higher again. There are two main drivers that will become leaders of any bigger rotation in the global markets – Metals and Commodities. If we begin to see a collapse in commodity prices, pretty much across the board, while metals breakout into a rally, then we are setting up for a bigger downside price move. Until that happens, continue to expect an upside price bias to continue in the U.S. stock market.

Secondly, should a massive currency revaluation event take place, where global currencies weaken as the U.S. Dollar stays strong, then we could be setting up for a “slow unraveling” of foreign debt markets and foreign equity markets. This would be almost like a “slow bleed out” as a currency devaluation event prompt incredible pricing pressures on local foreign governments to support their economies. These devaluation events, if they happen, could prompt a hyper inflation type of event that could disrupt weaker nations to such a degree that they could weaken world leading economies that have exposure to these foreign nations – Think China/Russia.

Our advice continues to be to look for opportunities as the volatility increases and continue to expect an upside price bias in the U.S. stock market – at least until we have any strong evidence that price trend has changed. Don’t buy into the doom-sayers just yet. In our opinion, this U.S. upside price move is not over yet.

If you want to become a technical trader and pull money from the markets during times when most others cannot be sure to join the Wealth Trading Newsletter today. Plus, for a few days only I’m giving away and shipping Free Silver Rounds to subscribers who join our select membership levels.

Chris Vermeulen @ The Technical Traders

Labels:

China,

Chris Vermeulen,

commodities,

cycle,

fibonacci,

investing,

markets,

Russia,

The Technical Traders,

volatility

Friday, April 7, 2017

Surviving and Thriving During an Economic Collapse

By Nick Giambruno

In just over a century, the international monetary system has collapsed three times: in 1914, in 1939, and in 1971, when Nixon severed the dollar’s last ties to gold. We are due for another major breakdown soon.

This time, the US dollar will lose its status as the world’s premier reserve currency. And the ramifications of that happening are hard to overstate. It will likely be the tipping point at which the US government becomes desperate enough to officially restrict the movement of people and their money… desperate enough to nationalize retirement savings… and desperate enough to make other forms of overt wealth confiscation routine.

For decades, countries around the world have conducted most of their international trade in US dollars. If they want to play in the international sandbox, most have to buy US dollars on the currency market first. This creates a (frequently artificial) demand for dollars, which makes those dollars more valuable.

Imagine the overall boost this arrangement gives to the dollar’s value. It’s enormous.

This system allows the US government and US citizens to live way beyond their means. It also gives the US government immense geopolitical leverage. It can pick and choose which countries can participate in the US-dollar-based financial system—and, by extension, the vast majority of international trade.

All of these unique benefits will disappear when the dollar loses its premier status. No one knows exactly when that will happen, but we’re quickly moving in that direction. Russia, China, Brazil, and India are all making serious moves to dump the dollar and trade in their own currencies. The momentum is quickly gaining critical mass.

I believe it won’t be long before the US government will be desperate enough to enact the restrictive measures we all fear. It’s important to prepare for the economic and financial consequences now. However, you also need to prepare for the sociopolitical consequences of the next economic collapse. It’s probably not going to happen tomorrow, but the direction the bankrupt US government is headed is clear.

Once the dollar loses its status as the world’s premier currency, your options for protecting your savings will have likely narrowed significantly, if not disappeared altogether. It’s important to act before that happens.

P.S. New York Times best-selling author Doug Casey and I think that a crisis for the record books is coming soon. We think your savings are highly vulnerable. There’s a good chance you could be wiped out.

That’s why we released an urgent new video on surviving and thriving during the next financial crisis.

Click here to watch it now.

In just over a century, the international monetary system has collapsed three times: in 1914, in 1939, and in 1971, when Nixon severed the dollar’s last ties to gold. We are due for another major breakdown soon.

This time, the US dollar will lose its status as the world’s premier reserve currency. And the ramifications of that happening are hard to overstate. It will likely be the tipping point at which the US government becomes desperate enough to officially restrict the movement of people and their money… desperate enough to nationalize retirement savings… and desperate enough to make other forms of overt wealth confiscation routine.

For decades, countries around the world have conducted most of their international trade in US dollars. If they want to play in the international sandbox, most have to buy US dollars on the currency market first. This creates a (frequently artificial) demand for dollars, which makes those dollars more valuable.

Imagine the overall boost this arrangement gives to the dollar’s value. It’s enormous.

This system allows the US government and US citizens to live way beyond their means. It also gives the US government immense geopolitical leverage. It can pick and choose which countries can participate in the US-dollar-based financial system—and, by extension, the vast majority of international trade.

All of these unique benefits will disappear when the dollar loses its premier status. No one knows exactly when that will happen, but we’re quickly moving in that direction. Russia, China, Brazil, and India are all making serious moves to dump the dollar and trade in their own currencies. The momentum is quickly gaining critical mass.

I believe it won’t be long before the US government will be desperate enough to enact the restrictive measures we all fear. It’s important to prepare for the economic and financial consequences now. However, you also need to prepare for the sociopolitical consequences of the next economic collapse. It’s probably not going to happen tomorrow, but the direction the bankrupt US government is headed is clear.

Once the dollar loses its status as the world’s premier currency, your options for protecting your savings will have likely narrowed significantly, if not disappeared altogether. It’s important to act before that happens.

P.S. New York Times best-selling author Doug Casey and I think that a crisis for the record books is coming soon. We think your savings are highly vulnerable. There’s a good chance you could be wiped out.

That’s why we released an urgent new video on surviving and thriving during the next financial crisis.

Click here to watch it now.

The article Surviving and Thriving During an Economic Collapse was originally published at caseyresearch.com.

Labels:

China,

currency,

Dollar,

gold,

investment,

Nick Giambruno,

Nixon,

Russia,

stocks,

US

Sunday, November 20, 2016

Two Days with Real and Wannabee Elite

By Doug Casey

Recently I made a few comments about the world’s self-identified “elite”, and also about the migrants that are plaguing Europe. Happily, I was able to do some one stop shopping on both of these topics when I was in New York to attend a very elitist and Globalist conference. I’m not going to name it because its organizers/sponsors are business partners of mine.And since they spent multi millions putting it together, and I pretty much despised their invitees, I’m not about to identify it exactly. Just let me say that the conclave has aspirations to become another Council on Foreign Relations, Bilderberg, Bohemian Grove, Atlantic Council, or Davos. Same kind of people, same ideas. Uniformly bad ideas. But ideas that the public has been brainwashed into thinking are good.

A lot of people are afraid these groups control the world, or at least governments. They don’t. They’re social gatherings for high level government employees and NGO types who like to network, and feel relevant. And lots of their minions, who enjoy the rich food, pretending they’re big shots too, while listening to pontifications by actual big shots. They hope they can cozy up to them, close enough to ride a richer gravy train.

The avowed purpose of this conclave was to “build the public private partnership”—the exact definition of fascism. So there were also lots of big league corporate types who want to “make a difference”, and rich guys who want to be known for something besides having money.

Warren Buffett

The program opened with Warren Buffett’s talk about how he didn’t need $50 billion, didn’t believe anybody else did either, and why he was a “philanthropist” who would give it all away. The avuncular Buffett is an investment genius; I enjoyed and agreed with everything he said on investing. But, like his friend Bill Gates, he’s also an autistic idiot savant. That’s someone who is a genius at one thing, and a fool at most everything else.Most people assume that if you know about investing, you must also know about economics, which is a related discipline. But that’s completely untrue. It’s analogous to thinking that someone who knows how to drive a car also knows how one works. Economics is the study of how men go about producing and consuming; investing is the practice of allocating capital for maximum returns. Buffett’s grasp of economics is shallow, conventional, and unrelated to his success as an investor.

Furthermore, if Buffett was really a philanthropist he wouldn’t dissipate his $50 billion on poor people in Third World countries (which is where I suspect most of what’s left after administrative expenses will go). That will assuage some liberal guilt, but will vanish without a trace like water poured into the Sahara.

And actually just make the root problem worse in many ways. If he really wants to help his fellow man, he would continue compounding capital at 20%, forever. Capital makes the world wealthy; consuming or frittering away capital makes the world poor. But enough on Buffett. He only exasperated me for about 40 minutes out of two full days.

George Soros

Much worse was George Soros. He spent his time not just passively endorsing (like Buffett), but actively promoting disastrous policies. In essence, these were his major points.1) Brexit should be overturned, regardless of the vote.

2) The EU should spend at least $200 billion a year (in addition to what individual countries spend) both to make migrants welcome, and to install a Marshall Plan for Africa.

3) All of Europe should import migrants at least proportionally to the 1mm entering Germany. He recognized that the migrants represent an “existential crisis” for Europe, but believes the solution is to accommodate them.

4) The EU should actively arm against Russia.

5) The EU in Brussels should be granted the right to tax.

As I listened to him I felt I’d been transported to Bizzarro World, or perhaps some magic land from Gulliver’s Travels, where everything is upside down, wrong is right, and black is white. Just as much of Soros’ presentation was on migration, so was much of the rest of the conference. It’s very much on the minds of the “elite”.

His new Marshall Plan would consist of Europe and the US sending trillions to African governments to develop the Continent. Strange, really. Africa has received about a trillion of foreign aid over the last 50 years; that capital has either been wasted on uneconomic boondoggles, or shipped off to the bank accounts of the ruling class. Soros is far from naïve; he’s got to know this.

I wonder what he actually hopes to accomplish, and why? After all, he’s 84 years old, and doesn’t need any more money. Well, it’s hard to be sure how some people’s minds are wired. And, as The Phantom once asked, “Who knows what evil lurks in the hearts of men?”

Incidentally—completely contrary to conventional wisdom—I consider the much lauded Marshall Plan to have been an unnecessary and destructive boondoggle. But this isn’t the moment to explain why that’s true.

As I said above, the Summit was centered on migration. I’ve recently commented on the subject, and will reiterate a few points below before returning to the views of the Globalists and self-identified Elite.

A Word on Migration

Let me start by saying I’m all for immigration and completely open borders to enable opportunity seekers from anyplace to move anyplace else. With two big, critically important, caveats.....1) there can be no welfare or free government services, so everyone has to pay his own way, and no freeloaders are attracted

2) all property is privately owned, to minimize the possibility of squatter camps full of beggars.

In the absence of welfare benefits, immigrants are usually the best of people because you get mobile, aggressive, and opportunity seeking people that want to leave stagnant and repressive cultures for vibrant and liberal ones. That was the case with the millions of immigrants who came to the US in the late 19th and early 20th centuries. And they had zero in the way of state support.

But what is going on in Europe today is entirely different. The migrants coming to Europe aren’t being attracted by opportunity in the new land so much as the welfare benefits and the soft life. Western Europe is a massive welfare state that providing free food, housing, medical care, schooling, and living expenses to all comers. Benefits like these will naturally draw in poor people from poor countries. For the most part they’ll be unskilled, poorly educated, and many will have a bad attitude. The question arises why—since they’re almost all Muslims—they aren’t being welcomed by Saudi Arabia, the UAE, Qatar, or Brunei, which are wealthy Muslim countries.

What we’re talking about here is the migration of millions of people of different language, different race, different religion, different culture, and different mode of living. If you’re an alien and you’re 1 out of 10,000, or 1000, or even 100, you’re a curiosity, an interesting outsider. And you’d have to integrate in the new society. But an influx of millions of migrants can only destroy the old culture. And guarantee antagonism—especially when the locals are forced to pay for it. In many ways, what’s happening now isn’t just comparable to what happened 2,000 years ago with the migration of the Germanic barbarians into the Roman Empire. It’s potentially much more serious.

Although most of the migration will be out of Africa, it’s supposed to be official Chinese policy to migrate about 300 million Chinese into Africa in the years to come. They’re employed in building roads, mines, railroads and other infrastructure. The Africans like the goodies, but don’t like the Chinese. It has the makings of a race war a generation or so in the future.

The problem won’t only be tens or hundreds of millions of Africans migrating to Europe, but tens or hundreds of millions of Chinese migrating to Africa. The EU is a huge aggravating factor with the migrant situation. Brussels is full of globalists and doctrinaire socialists who not only promote bad policies, but make the whole continent pay for the mistakes of its most misguided members.

The migrants, who are manifestly unwelcome in Hungary, Poland, and other Eastern European countries, will prove another big impetus for the breakup of the EU. Millions of Africans will want to emigrate, especially to the homelands of their ex-colonial masters in Europe. The colonizers are now themselves being colonized. Fair enough, I suppose; a case of the sins of the father truly devolving upon the sons.

If I was an African from south of the Sahara, I’d absolutely try to get to Italy or Greece or France or Spain or on my way to Northern Europe to cash in on the largesse of these stupid Europeans. I’m a fan of what’s left of Western Civilization. I hate to see it washed away. But that’s what will happen if the floodgate is opened.

Unless the Europeans get in front of this situation, it’s not just some refugees from the Near East they’ll have to deal with. Especially with the economic chaos of The Greater Depression, it’s going to be many millions from Africa, and then perhaps millions more from Central Asia, and even India and Bangladesh. The world is becoming a very small place. What happens when scores of thousands of migrants set up a squatter camp someplace—with no food, shelter, or sanitary facilities? What will happen when there are scores or hundreds of squatter camps? Unlike the Goths and the Vandals, who became the new aristocracy, the chances of the Africans integrating is essentially zero.

The situation is likely to be most stressful…..

Some will say “But you have to be charitable, you can’t just let them starve because they’ve had some bad luck”. To that I’d say an individual, or a family, can have some bad luck. But the places these people come from have had “bad luck” for centuries. Their bad luck is the consequence of their political, economic, and social systems. Their cultures—let me note the elephant in the room—are backward, degraded, and unproductive. It makes no sense, it’s idiotic, to import—at huge expense—masses of people that have a culture of “bad luck”.

On just one day recently, the Italian Coast Guard rescued 10,000 Africans off the Libyan coast—almost all men from Guinea, Gambia, Nigeria, and neighboring countries—and transported them to Italy. It’s hard to see them ever going back home. But it’s certain they’ll encourage they’re friends and families to join them.

The situation can only get worse. Why? In 1950, the 250 million Africans were only 9% of the world’s population; it’s 27% now, but there will be 4 billion, for 40%, in 2100.

Making that observation is highly politically incorrect, and presumably racist. I’ll have more to say on racism in the future. But the fact is that Africa has always been an economic basket case; if Vasco Da Gama had thrown out a wheel when he was rounding the Cape, he would also have had to throw out an instruction book on how to use it. But nobody could have read it.

Be that as it may. But Europeans made things worse when they conquered the continent and divided it up into political entities that made zero sense from a cultural, linguistic, religious or tribal viewpoint. That guaranteed chaos for the indefinite future. That’s why it’s always a mad scramble to get control of the government in these countries, in order to loot the treasury, entrench ones cronies, and punish ones enemies. Until there’s a bloody revolution, and the shoe goes on another foot.

Here’s the takeaway. The population of Africa is going up by several billion people in the years to come. The net wealth of the continent is going nowhere. The locals will want to move wholesale to Europe, where the living is easy. And where the politically correct Cultural Marxists are anxious to destroy their own civilization.

Meanwhile, there are hundreds of think tanks in the U.S. alone, most located within the Washington Beltway who believe that these people should be encouraged to migrate, or imported en masse. They’re populated by partisan academics, ex-politicos, retired generals and others circulating through the revolving doors of the military/industrial/political/academic complex.

They’re really just propaganda outlets, funded by foundations, and donors who want to give an intellectual patina to their views and, to use a popular phrase, “make a difference”.

Think tanks, and their cousins, the lobbyists and the NGOs, are mostly what I like to call Running Dogs, who act as a support system for the Top Dogs in the Deep State. Their product is “policy recommendations,” which influence how much tax you have to pay and how many new regulations you have to obey. Think tanks are populated almost exclusively by people who are, simultaneously, both “useful idiots” and “useless mouths.” They’re no friends of the common man.

The migration policies they’re promoting are creating minor chaos now. With world-class chaos in the wings.

Let me repeat, and re-emphasize, what I said earlier. The free-market solution to the migrant situation is quite simple. If all the property of a country is privately owned, anyone can come and stay as long as he can pay for his accommodations. When even the streets and parks are privately owned, trespassers, beggars, squatters, migrants, vagrants and the like have a problem. A country with 100% private property, and zero welfare, would only attract people who like those conditions. And they’d undoubtedly be welcome as individuals. But “migration” would be impossible.

This is how the migration problem could be solved. You don’t need the government. You don’t need the army. You don’t need visas or quotas. You don’t need laws. You don’t need treaties to solve the migration problem. All you need is privately owned property and the lack of welfare benefits. Instead, think tanks will come up with some cockamamie political solution. But the good news is that it will speed up the disintegration of the EU.

My prediction that the Continent will one day just be a giant petting zoo for the Chinese is intact—assuming the current wave of migrants approve. There will also be an exodus of capital and people from Europe to parts of Latin America, plus to the U.S., Canada, Australia, and New Zealand. This is, obviously, bad for Europe and good for the recipient countries, since these emigrants will be educated and affluent.

But, having said that, let me take you back to the conference where migration was a major topic of discussion by the elite.

Back to the Conference

Those are my thoughts on the topic of migration. Here’s what other attendees thought....I spent a couple of hours listening to a panel entitled “Corruption in Latin America”. A bunch of ex-Presidents commiserated on how awful corruption is, and how new laws ought to be passed to stamp it out once and for all. They were all skilled, even enthusiastic, bullshit artists, who knew how to blather meaninglessly, saying nothing. They all agreed that illegal drugs were a major cause for corruption, but nobody thought to mention that maybe the problem wasn’t the drugs, but the fact they were illegal.

None of these people understood the actual causes and the nature of corruption. Which is ironic, since most of them were quite wealthy—something that’s hard to do on a Third World politician’s salary.

One especially naive panelist, representing the US State Department, said “many see the private sector as part of the problem”. What, one might ask, actually causes the problem?

The short answer was supplied by Tacitus 1900 years ago. He said “The more numerous the laws, the more corrupt the State”. That’s because the laws invariably have economic consequences, benefiting one group at the expense of another. The most practical way to obviate them is by paying off an official.

Naturally, nobody even broached the subject that laws themselves cause corruption. And corruption is actually not only necessary, but is encouraged, whenever economic laws are passed. Plan your life around corruption remaining endemic, no matter how much self-righteous apparatchiks blather on about it at conferences.

General David Petraeus

I listened to David Petraeus offer solutions to the world’s problems. They were what you might expect from an ex-general and CIA director. To David it’s all about using force and money “intelligently”. It never seemed to cross his mind that adventures like those in Iraq and Afghanistan ($6 trillion and counting, to accomplish absolutely nothing) might actually bankrupt the US. Or that he was intimately involved in the ongoing disaster.My takeaway is that, after David collects say $20 million in the “private sector”, we’ll see him resurface as a candidate for the US Presidency. He’s smooth, polished, and confident. I was somewhat surprised that some general wasn’t tapped this election for a VP slot, since the military is the US Government’s most trusted branch by far. Rest assured there will be a general running in 2020.

Donald Rumsfeld also held the stage for 40 minutes. He was affable, likable, and entertaining, as are many sociopaths. Not even the faintest acknowledgement passed his lips about how the current migrant disaster was rooted in his unprovoked attacks on backward countries on the other side of the world. But why should he care? He’s already collected his $20 million in the “private sector” after many years of “service”.

The Migration Round Table

Another highlight was listening to a Round table on “The Public/ Private Partnership on Migration”. It might as well have been a meeting of the Soviet politburo, where everyone implicitly accepted the same totally flawed principles, speaking seriously and sincerely to each other about how they plan to change the world. These people were mainly interested in reinforcing each others views, like a conversation on NPR.How to solve the refugee/migrant situation? No solutions were proposed by any of the 40 high government officials and think tank big shots. Everybody’s attention focused on two things: how awful the situation is, and how they can feed, clothe, and house the masses. I was amused at the sight of parasites talking to parasites about parasites.

References were made to “broader economic integration”, a nebulous phrase that can mean almost anything, and no references at all to freer markets. There were continual references to a “partnership” between the public and private sectors. It made me feel I was among aliens. How can there be a partnership between producers, and those who not only steal 50% of the production, but then want to direct where the remainder goes. These people all seemed to believe that if you earned money, you didn’t deserve to keep it. But if you needed money, you were entitled to it.

There was a discussion about how the crisis that started in 2007 has set back the progress of Africa. But zero discussion of what caused the crisis. Or what would happen when it stated up again (which is happening right now). The only discussion of how to create prosperity was about Special Economic Zones—areas insulated from the taxes and regulations affecting the rest of the country. Needless to say no one thought to ask why an entire country couldn’t become an SEZ.

A question occurred to me about the several hundred thousand refugees/migrants that still might be imported to the US—although it's much less likely with Trump as the President: Exactly who will pay for them, and how much will the pleasure of their company cost? These people have nothing but the rags on their backs.

Will they be ferried to the US on commercial airliners? When they land, how will they be clothed? They’ll need to be fed for an indefinite period. And housed. And entertained. Mosques must be found, or founded, so they can worship. Very few have any marketable skills, and very few even speak English. Most of them could just stay on welfare for the rest of their lives.

It seems completely insane. But it’s clearly the “Globalist agenda”, endorsed by all these people. Of course there’s some perverse justice at work if the US winds up having to import a few million Muslim refuges. The Muslim world was, at least, stable before Bush and Obama went on a wild “regime change” adventure. Now chaos reigns in Iraq, Afghanistan, Syria, and Libya.

One justification put forward for migration to Europe was that its population was dropping, and it would need people, if only to take care of the oldsters. For what it’s worth, we’ll have robots doing that within a decade.

Conclusion?

You’re perhaps wondering how any sensible person could sit there and listen to such blather and nonsense for two days without reacting. Of course I wanted to debunk about 95% of what I heard. But the Summit was structured so that Guests didn’t have a forum from which to challenge the Nomenklatura and their Apparatchiks. So I sat there, observing an alien species in a sort of formalized mating ritual. No opportunity presented itself to shock these copulating dogs with a bucket of cold water. Certainly not from a seat in the Peanut Gallery.Are conferences like this one, and its lookalikes, a waste of time? Completely. And keep that in mind before you make a contribution to a charity or an NGO. Could it have been worthwhile? Yes. If it had addressed the questions I posed above. But, even then, the answers would have been worthless, given the attendees.

I think migration is going to be one of the biggest problems in the next generation. It’s a sure thing that not just millions, but tens of millions of “feet people” and “boat people” are going to try to overrun Europe. If they’re accepted and resettled it will destroy what’s left of Western Civilization. If they’re repelled, it could result in millions of deaths, and be quite a scandal. I don’t know how this will sort out. But it’s going to be a big deal. And ugly.

What should you do? Own plenty of gold and silver, and make sure that you have one or more residences that are out of harm’s way.

Editor’s Note: If you haven't seen it yet, Doug Casey has just released his latest and most controversial prediction yet. It involves a shocking currency ban (not gold) that may soon take effect under the Trump presidency.

Already, Fed members have met in private to discuss this matter. And the savings of millions could be devalued if this goes into effect.

To watch the video and discover the 4 steps Doug is taking to prepare, click here.

The article Doug Casey’s Two Days with the Real and Wannabee Elite was originally published at caseyresearch.com.

Labels:

capital,

crisis,

Doug Casey,

economics,

EU,

Europe,

General Patraeus,

George Soros,

Germany,

medical care,

money,

NGO,

Russia,

Warren Buffett,

welfare

Monday, October 10, 2016

One Giant Powder Keg… and the Fuse is Already Lit

By Nick Giambruno

Their mission was to capture, or more likely, kill. Dozens of renegade commandos in three Blackhawk helicopters swooped in on the holiday residence of the president. Immediately, they engaged in a fierce gun battle with the president’s bodyguards and killed a number of them. Tourists in a nearby five-star resort fled for their lives. Their idyllic vacations had turned into a war zone in the blink of an eye.The president, however, was nowhere to be found. He had been tipped off about the plot and made it to the safety of his private jet. He had cheated death by mere minutes. The renegade soldiers got wind of the escape. They commandeered a couple of F16 fighter jets and sent them to the skies to shoot down the presidential jet. Aware the rebel F16s were hunting them, the president’s pilots were able to obfuscate the identity of their aircraft by altering the jet’s transponder signal.

The transponder is an electronic signal that shows an aircraft’s identity. It’s used by air traffic controllers to keep track of planes in the air. Somehow, the pilots of the presidential jet were able to set their transponder signal to make it appear as if they were instead a civilian passenger jet. The confused rebel fighter jets ran out of fuel and had to return to base before they figured out what happened.

The president had cheated death for the second time that day. This story sounds like something out of a Tom Clancy novel or a Hollywood blockbuster. But it’s not. It happened in real life earlier this summer. In Turkey.

The country is one giant powder keg and the fuse is already lit. When the next global crisis explodes, there’s a good chance Turkey will be involved somehow.

Turkey was founded from the ashes of the Ottoman Empire. It’s where Europe meets Asia. Today, it’s at the epicenter of many crises that are destabilizing the world the migrant disaster in Europe, the ongoing carnage in Iraq and Syria, the battle with ISIS, a conflict with the Kurds, and the new Cold War with Russia. It could soon also play a big role in the collapse of the world’s largest economy, the European Union (EU).

It’s hard to think of another place that has more tripwires for a global meltdown. In light of all these potential triggers as well as the recent failed military coup d’état that killed over 290 people, I thought it was time to take a closer look at Turkey. Doug Casey and I just returned from the crisis stricken country, the latest destination we visited with (literal) blood in the streets.

We put our boots on the ground in the same area where that hit squad of rebel soldiers nearly assassinated Recep Tayyip Erdogan, the Turkish president. (In addition to all of the crises listed above, the Turkish military had invaded northern Syria just before our arrival.)

Perhaps most importantly, Turkey is at the heart of the migrant crisis that is tearing Europe apart. The migrant crisis will be one of the main issues on the minds of Italians as they vote in the upcoming referendum, which could very well decide the fate of the EU and the euro currency. That’s why I’ve spent weeks on the ground in Italy, watching these events unfold.

The Financial Times commented on what would happen if the Italian referendum fails:

It would probably lead to the most violent economic shock in history, dwarfing the Lehman Brothers bankruptcy in 2008 and the 1929 Wall Street crash.

Like with the Brexit vote, the migrant issue and by extension Turkey may determine the outcome of the Italian referendum on December 4, 2016.Turkey Holds the Keys to the EU’s Future

Parroting U.S. concerns about democracy and human rights, the EU has also harshly criticized Turkey’s response to the failed coup. This hasn’t endeared them to the Turkish government. It’s actually incredibly stupid for the Europeans. And by stupid I mean exactly that an unwitting tendency toward self destruction. The Europeans fail to see the indirect and delayed consequences of their decision to antagonize the Turkish government.That’s because the Turkish government holds the trump card on what is perhaps the most explosive political issue on the continent right now: the migrant crisis. Concerns about the unprecedented flow of migrants into Europe over the past couple of years played a key role in the Brexit vote. It’s also acting as a political accelerant to the rise of anti-EU parties all over Europe. It’s a simple relationship. The more migrants come to Europe, the more popular anti-EU political parties become, and the weaker the EU itself becomes.

This is where Turkey holds the keys to the future political landscape of Europe. Turkey is a major transit point migrants use on their way to Europe. The Turkish government doesn’t want the migrants to stay in Turkey, so they haven’t really had much of a reason to stop them from leaving for Europe. They even enjoyed the situation because it gave them negotiating leverage with Brussels. The Turks essentially said “give us what we want or we’ll open the floodgates.”

What the Turks want is lots of money and to join the Schengen visa free zone, which allows unfettered access to most of Europe. Brussels partially gave in to the blackmail. They started giving the Turks money to the tune of $6 billion and agreed to hold talks about getting visa-free access to the continent. In return, the Turks would cut off the flow of migrants.

For a while this arrangement worked. But after the attempted coup and then the purge of suspected putschists, the EU cried foul. They deemed the purges to be an erosion of democracy and the rule of law.

They basically told the Erdogan government it can forget about joining the Schengen zone.

Unsurprisingly, the Turkish government not so subtly warned that if the EU walks away from its part of the deal, so will it. Specifically, the Turkish government has threatened to open the migrant floodgates just in time for the Italian referendum and other key European elections. The Italian referendum could very well lead to the end of the euro and the EU itself, while triggering a global financial meltdown of historical proportions.

Turkey sending a new wave of migrants into Europe just before this key vote will help seal its fate.

There are potentially severe consequences in the currency and stock markets. That’s exactly why I recently spent weeks on the ground in Italy getting the scoop on this explosive story that almost nobody else is talking about.

New York Times best selling author Doug Casey and I just released an urgent video with all the details.

Our video reveals how a financial shock far greater than 2008 could strike America on December 4th, 2016. And how it could either wipe out a big part of your savings or be the fortune building opportunity of a lifetime.

The video describes specific ways to profit as well as which stocks to avoid like radioactive waste. You can get a first look at this video by clicking here.

The article One Giant Powder Keg… and the Fuse is Already Lit was originally published at caseyresearch.com.

Get our latest FREE eBook "Understanding Options"....Just Click Here!

Monday, January 4, 2016

How Saudi Arabia and OPEC are Manipulating Oil Prices

About eighteen months ago the international price of WTI Crude Oil, at the close of June 2014, was $105.93 per barrel. Flash forward to today; the price of WTI Crude Oil was just holding above $38.00 per barrel, a drastic fall of more than 65% since June 2014. I will point out several reasons behind this sharp, sudden, and what now seems to be prolonged slump.

The Big Push

Despite a combination of factors triggering the fall in prices, the biggest push came from the U.S. Shale producers. From 2010 to 2014, oil production in the U.S. increased from 5,482,000 bpd to 8,663,000 (a 58% increase), making the U.S. the third largest oil-producing country in the world. The next big push came from Iraq whose production increased from 2,358,000 bpd in 2010 to 3,111,000 bpd in 2014 (a 32% increase), mostly resulting from the revival of its post war oil industry.

The country-wide financial crunch, and the need for the government to increasingly export more to pay foreign companies for their production contracts and continue the fight against militants in the country took production levels to the full of its current capacity. In addition; global demand remained flat, growing at just 1.1% and even declining for some regions during 2014. Demand for oil in the U.S. grew just 0.6% against production growth of 16% during 2014.

Europe registered extremely slow growth in demand, and Asia was plagued by a slowdown in China which registered the lowest growth in its demand for oil in the last five years. Consequently, a global surplus was created courtesy of excess supply and lack of demand, with the U.S. and Iraq contributing to it the most.

The Response

In response to the falling prices, OPEC members met in the November of 2014, in Vienna, to discuss the strategy forward. Advocated by Saudi Arabia, the most influential member of the cartel, along with support from other GCC countries in the OPEC, the cartel reluctantly agreed to maintain its current production levels. This sent WTI Crude Oil and Brent Oil prices below $70, much to the annoyance of Russia (non-OPEC), Nigeria and Venezuela, who desperately needed oil close to $90 to meet their then economic goals.

For Saudi Arabia, the strategy was to leverage their low cost of production advantage in the market and send prices falling beyond such levels so that high cost competitors (U.S. Shale producers are the highest cost producers in the market) are driven out and the market defines a higher equilibrium price from the resulting correction. The GCC region, with a combined $2.5 trillion in exchange reserves, braced itself for lower prices, even to the levels of $20per barrel.

The Knockout Punch

By the end of September 2014, according to data from Baker Hughes, U.S. Shale rigs registered their highest number in as many years at 1,931. However, they also registered their very first decline to 1,917 at the end of November 2014, following OPEC’s first meeting after price falls and its decision to maintain production levels. By June 2015, in time for the next OPEC meeting, U.S. Shale rigs had already declined to just 875 by the end of May; a 54% decline.

The Saudi Arabia strategy was spot on; a classic real-life example of predatory price tactics being used by a market leader, showing its dominant power in the form of deep foreign-exchange pockets and the low costs of production. Furthermore, on the week ending on the date of the most recent OPEC meeting held on December 4th, 2015, the U.S. rig count was down even more to only 737; a 62% decline. Despite increased pressure from the likes of Venezuela, the GCC lobby was able to ensure that production levels were maintained for the foreseeable future.

Now What?

Moving forward; the U.S. production will decline by 600,000 bpd, according to a forecast by the International Energy Agency. Furthermore, news from Iraq is that its production will also decline in 2016 as the battle with militants gets more expensive and foreign companies like British Petroleum have already cut operational budgets for next year, hinting production slowdowns. A few companies in the Kurdish region have even shut down all production, owing to outstanding dues on their contracts with the government.

Hence, for the coming year, global oil supply is very much likely to be curtailed. However, Iran’s recent disclosure of ambitions to double its output once sanctions are lifted next year, and call for $30 billion in investment in its oil and gas industry, is very much likely to spoil any case for a significant price rebound.

The same also led Saudi Arabia and its GCC partners to turn down any requests from other less-economically strong members of OPEC to cut production, in their December 2015, meeting. Under the current scenarios members like Venezuela, Algeria and Nigeria, given their dependence on oil revenues to run their economies, cannot afford to cut their own production but, as members of the cartel, can plea to cut its production share to make room for price improvements, which they can benefit from i.e. forego its market share.

It’s Not Over Until I’ve Won

With news coming from Iran, and the successful delivery of a knockout punch to a six-year shale boom in the U.S., Saudi Arabia feared it would lose share to Iran if it cut its own production. Oil prices will be influenced increasingly by the political scuffles between Saudi Arabia and its allies and Iran. The deadlock and increased uncertainty over Saudi Arabia and Iran’s ties have sent prices plunging further. The Global Hedge Fund industry is increasing its short position for the short-term, which stood at 154 million barrels on November 17th, 2015, when prices hit $40 per barrel; all of this indicating a prolonged bear market for oil.

One important factor that needs to be discussed is the $1+ trillions of junk bonds holding up the shale and other marginal producers. As you know, that has been teetering and looked like a crash not long ago. The pressure is still there. As the shale becomes more impaired, the probability of a high yield market crash looks very high. If that market crashes, what happens to oil? Wouldn’t there be feedback effects between the oil and the crashing junk market, with a final sudden shutdown of marginal production? Could this be the catalyst for a quick reversal of oil price?

The strategic interests, primarily of the U.S. and Saudi Arabia; the Saudis have strategically decided to go all in to maintain their market share by maximizing oil production, even though the effect on prices is to drive them down even further. In the near term, they have substantial reserves to cover any budget shortfalls due to low prices. More importantly, in the intermediate term, they want to force marginal producers out of business and damage Iran’s hopes of reaping a windfall due to the lifting of sanctions. This is something they have in common with the strategic interests of the U.S. which also include damaging the capabilities of Russia and ISIS. It’s certainly complicated sorting out the projected knock-on effects, but no doubt they are there and very important.

I’ll Show You How Great I Am

Moreover, despite a more than 50% decline in its oil revenues, the International Monetary Fund has maintained Saudi Arabia’s economy to grow at 3.5% for 2015, buoyed by increasing government spending and oil production. According to data by Deutsche Bank and IMF; in order to balance its fiscal books, Saudi Arabia needs an oil price of$105. But the petroleum sector only accounts for 45% of its GDP, and as of June 2015, according to the Saudi Arabian Monetary Agency, the country had combined foreign reserves of $650 billion. The only challenge for Saudi Arabia is to introduce slight taxes to balance its fiscal books. As for the balance of payments deficit; the country has asserted its will to depend on its reserves for the foreseeable future.

Conclusion

The above are some of the advantages which only Saudi Arabia and a couple of other GCC members in the OPEC enjoy, which will help them sustain their strategy even beyond 2016 if required. But I believe it won’t take that long. International pressure from other OPEC members, and even the global oil corporations’ lobby will push leaders on both sides to negotiate a deal to streamline prices.

With the U.S. players more or less out by the end of 2016, the OPEC will be in more control of price fluctuations and, therefore, in light of any deal between Iran and Saudi Arabia (both OPEC members) and even Russia (non-OPEC), will alter global supply for prices to rebound, thus controlling prices again.

What we see now in oil price manipulation is just the mid-way point. Lots of opportunity in oil and oil related companies will slowly start to present themselves over the next year which I will share my trades and long term investment pays with subscribers of my newsletter at The Gold & Oil Guy.com

Chris Vermeulen

Labels:

Gas,

GCC,

gold and oil guy,

hedge fund,

investment,

ISIS,

Oil,

OPEC,

Petroleum,

production,

Russia,

sanctions,

Saudi Arabia,

shale,

surplus,

WTI,

yield

Wednesday, December 23, 2015

By Far the Biggest Threat to Your Wealth in 2016

By Justin Spittler

Today, we begin with a warning. We’re going to tell you about a dangerous event that is very likely to happen within the next year. You’ve probably never thought about this threat. Until now, Casey Research has never discussed it in public. This threat isn’t a stock market collapse…it’s not a failure of the Social Security system…it’s not even a national debt or currency crisis. It’s much more dangerous and much more likely to happen than any of those things.We’re talking about a major financial terrorist attack. A total wipeout of your financial data, assets, and records and those of many millions of other people. If you’re like most people, you think, “There’s no way that could happen here. Surely the financial system is completely safe.” But think about it….

If you have $100,000 in the bank, what do you really have?

These days, it’s not a claim to hard assets like gold or silver. And it’s certainly not real cash in a bank. Many local banks don’t even keep that much cash on hand! Just try asking your bank for $25,000 in cash. The teller will say, “We can’t give you that much money.” If you keep your life savings in a bank or brokerage account, what you have are electronic entries that hackers can easily and quickly delete. All the money you’ve earned...the hard work, the sweat, the sacrifice...the nest egg you’ve built to provide for your family, GONE. In an instant.

Cyberterrorists have already broken into the world’s most secure digital systems....

For example…..

➢ In May, hackers stole information on 300,000 private tax returns from the Internal Revenue Service (IRS). They used the information to claim tens of millions of dollars in fraudulent tax refunds.

➢ In April, hackers gained access to President Obama’s email. They gathered details on Obama’s personal schedule as well as private conversations with foreign officials.

➢ And earlier this year, we learned that a group of hackers infiltrated some of America’s largest and most sophisticated financial firms. The victims include JPMorgan Chase, E*Trade, and Scottrade. The hackers stole the personal data of more than 100 million customers. They even manipulated stock prices.

E.B. Tucker, editor of The Casey Report, explains: In today’s high tech world, the lifeblood of our economy is a complex system of digital payments, digital book entries, and digital money. Billions of dollars are electronically transferred every day. We bank online, shop on our computers, and pay for lunch with credit and debit cards. Even the stock exchanges are now 100% electronic. The money in your savings, brokerage, and credit card accounts are just bits and bytes. A skilled hacker could steal it or make it vanish completely.

Here’s E.B....The U.S. has enemies all over the world: Russia, China, Iran, Syria, Iraq, and Saudi Arabia come to mind. There are millions of people out there who want to see the West burn. And it’s only a matter of time before they strike us at one of our most vulnerable points: Our digital financial system. As cybersecurity expert, Mary Galligan, recently told Bloomberg News, state sponsored cyberterrorism is “the FBI’s worst nightmare.”

The fallout from a cyberattack could be catastrophic….

E.B. explains…Just imagine, what if all of the accounts at a major bank like Wells Fargo were suddenly erased? What if businesses couldn’t process digital payments? What if your brokerage told you its records had been destroyed and all evidence of your stock portfolio had disappeared? What if a cyberattack shut down our electrical grid? I’ll tell you what would happen: An explosion of chaos. Society would break down. When people are wiped out financially, they’re often wiped out mentally and morally, too…they’ll do anything to survive, including resort to violence.

The government and central banks cannot protect you from cyberterrorists….

They don’t want people talking about this massive threat. They want to keep it quiet. You see, the U.S. dollar isn’t backed by gold like it was in the past. Our monetary system is built on confidence, and confidence alone. If lots of people questioned the safety of the system and pulled their money out, it could trigger a nationwide run on the banks, a stock market collapse, and a currency crisis. It could literally lead to rioting in the streets.

If you keep most of your money in digital form….

You must take steps to protect yourself and your family before an attack happens. The first step is to store a sizable amount of cash in a safe place you can easily access. We recommend at least three months’ worth of living expenses. Six months’ worth is even better.

You can store the cash in a safe, in a public storage container, or bury it in a waterproof container in your backyard. This might sound extreme, but think about it…if the financial system is compromised and your debit and credit cards become useless, you’ll need enough cash on hand to pay for groceries, gasoline, and other daily necessities.

Otherwise, you’re in a vulnerable position. Having no cash on hand means you could struggle to feed your family in an emergency. Because we believe most Americans are overlooking this huge threat, we put together a new special report titled “How to Protect Yourself from a Financial Terrorist Attack.” We talked with top cybersecurity experts and put hundreds of hours of research into this report. It explains seven specific steps you can take now to protect your money from financial terrorism. Click here to learn more.

Switching gears, the Dow Jones U.S. Trucking Index is headed for its worst year ever….

Yesterday, it closed down 17% on the year. It’s dropped 7.1% in December alone. The Dow Trucking Index tracks the performance of major U.S. trucking stocks. It’s only had three down years since 2001. Over that period, it’s averaged annual returns of 12%. The chart below shows trucking stocks have been in a clear downtrend all year.

E.B. Tucker says investors should watch this trend even if they don’t own trucking stocks. Trucks carry inventory to stores. They carry parts to the assembly plant. Then they carry assembled products to buyers. When sales are rising, it tends to show up in trucking companies before retailers. Trucking companies also feel the pinch first when sales are falling. This is why trucking stocks often give clues about where the market’s going long before other industries.

E.B. also says the collapse in trucking stocks is an early warning sign for the rest of the market. Transport stocks have given investors early warning signs for the past 100 years. Right now, the Dow Trucking Index is telling us business is not great. The trucks aren’t full. This is a dire sign. It’s saying we’re in for some negative surprises in 2016.

From March 2009 through December 2014, the S&P 500 gained 204%. But the bull market has stalled this year. The S&P 500 is down 1% since January. If this trend continues, 2015 will the S&P’s first down year since 2008. On its own, this isn’t a huge concern. However, Dispatch readers know there are many other signs U.S. stocks have already topped out

For one, the current bull market in stocks is now 81 months old. It’s run 31 months longer than the average bull market since World War II. Of course, bull markets don’t die of old age. But they all die eventually. On top of that, U.S. stocks are expensive. The S&P 500 is now 57% more expensive than its historical average. Again, bull markets don’t end just because stocks are expensive. But expensive stocks can fall much harder during a big selloff.

We recommend investing with caution right now. You should own a significant amount of cash and physical gold...and you should sell any overpriced stocks that are vulnerable to an economic downturn.

Chart of the Day

Oil tanker rates are at their highest level in seven years. Today’s chart shows the daily shipping rates for very large crude carriers (VLCC), the second largest type of oil tanker. Each VLCC can carry 2 million barrels of oil. From 2011 through 2014, VLCC shipping rates averaged $20,000/day. This year, rates have soared 79%. Earlier this month, VLCC daily rates reached $112,775, their highest level since 2008.Meanwhile, the price of oil has plunged 32% this year. Earlier this month, oil fell to its lowest level since 2009. Oil tanker rates can go up when oil prices go down…because ship operators charge based on how much oil they move. Their rates are not directly tied to the price of oil.

Dispatch readers know the world has a huge surplus of oil right now. All this oil needs to go somewhere, and oil tankers get paid to move it. As you can see in the chart, it’s a great time to be an oil tanker company.

The article By Far the Biggest Threat to Your Wealth in 2016 was originally published at caseyresearch.com.

Get our latest FREE eBook "Understanding Options"....Just Click Here!

Subscribe to:

Comments (Atom)