Commodities such as energy, grains, and precious metals have all experienced nice rallies. Price action also confirms money flow coming out of transports and into utilities....Continue Reading Here.

Trade ideas, analysis and low risk set ups for commodities, Bitcoin, gold, silver, coffee, the indexes, options and your retirement. We'll help you keep your emotions out of your trading.

Tuesday, April 12, 2022

Utilities Rising & Transporters Sinking - Sector Rotation Is Providing Clues

Historically, investors gravitate toward more defensive and commodity focused sectors, such as precious metals, energy, commodities, and utilities, in late cycle bull markets. Recently, the stock market is beginning to show us signs that the bull market may be coming to an end.

Labels:

commodities,

Crude Oil,

energy,

grains,

investing,

Natural Gas,

precious metals,

stocks,

utilities

Tuesday, April 5, 2022

Waiting For GLD To Make New Highs - Gold Rally Is Still Intact

The calm of the last 3 weeks has resulted in a risk on environment. This, in turn, has led to a nice recovery rally in stocks. For the time being, volatility has subsided. However, we believe there are many underlying market risks that can still resurface without any warning.

From late 2015 to August 2020, the price of gold doubled, going from approximately $1040 to $2080. Gold then experienced a profit taking $400 pullback. Gold’s rally over the past 12 months failed to break through its $2080 price level. After retreating back to $200, gold seems to have found support at the $1900 level.

In reviewing the following spot gold chart, it appears we have broken out of an accumulation phase and seem to be preparing to move above the $2080 high.....Continue Reading Here.

From late 2015 to August 2020, the price of gold doubled, going from approximately $1040 to $2080. Gold then experienced a profit taking $400 pullback. Gold’s rally over the past 12 months failed to break through its $2080 price level. After retreating back to $200, gold seems to have found support at the $1900 level.

In reviewing the following spot gold chart, it appears we have broken out of an accumulation phase and seem to be preparing to move above the $2080 high.....Continue Reading Here.

Thursday, March 10, 2022

How You Can Minimize Trading Risk & Grow Capital During A Global Crisis

To minimize trading risk and grow capital during a global crisis is somewhat hinged on the answers to speculative questions.

- How long will the Russia – Ukraine war last?

- How high is the price of oil and gas going to go?

- How quickly will central banks raise interest rates to counter high inflation?

- What assets should I put my money into?

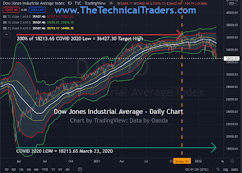

Knowing what the Best Asset Now (BAN) is, is critical for risk management and consistent growth no matter the market condition. Buy the Dip or Sell the Rally? Let's start here with the DJI weekly chart

Labels:

commodities,

currency,

investing,

money,

Oil Prices,

Russia,

stocks,

Ukraine

Tuesday, February 15, 2022

Stocks Fall as Gold and Oil Jumps Amid Tension Over Ukraine - FED

The FED has made it very clear that it will raise its benchmark interest rate, the federal funds rate. This could have severe consequences and even lead to a financial crisis. They are too far behind the curve and will be labeled a major policy error in the future, most likely. They have put themselves in a situation where they are now their own hostage. They need more leadership to describe what a soft landing is going to look like. They have been too slow to act, and now they are going too fast. The “Powell Put” has now been put out to pasture.

We believe that the FED will make more rate hikes than they have announced. Goldman Sachs thinks there will be four 25-basis-point increases in the federal funds rate in 2022. Jamie Dimon, CEO of JPMorgan Chase, said, “he wouldn’t be surprised if there were even more interest rate hikes than that in 2022. There’s a pretty good chance there will be more than four. There could be six or seven. I grew up in a world where Paul Volcker raised his rates 200 basis points on a Saturday night.”

Mr. James Bullard of the St. Louis FED spoke out in an arrogant tone that aggressive action is now required. The markets translated this to mean that the FED was going to call an emergency meeting as soon as this coming week to hike interest rates by no less than 50 basis points. This sent interest rates soaring and stock prices plummeting.....Read More Here.

We believe that the FED will make more rate hikes than they have announced. Goldman Sachs thinks there will be four 25-basis-point increases in the federal funds rate in 2022. Jamie Dimon, CEO of JPMorgan Chase, said, “he wouldn’t be surprised if there were even more interest rate hikes than that in 2022. There’s a pretty good chance there will be more than four. There could be six or seven. I grew up in a world where Paul Volcker raised his rates 200 basis points on a Saturday night.”

Mr. James Bullard of the St. Louis FED spoke out in an arrogant tone that aggressive action is now required. The markets translated this to mean that the FED was going to call an emergency meeting as soon as this coming week to hike interest rates by no less than 50 basis points. This sent interest rates soaring and stock prices plummeting.....Read More Here.

Labels:

Crude Oil,

Fed,

Federal Reserve,

gold,

Goldman Sachs,

investing,

JP Mprgan,

stocks

Saturday, January 29, 2022

Fed Comments Help To Settle Global Market Expectations

The recent Fed comments should have helped settle the global market expectations related to if and when the Fed will start raising rates and/or taking further steps to curb inflation trends.

Additionally, the Fed has been telegraphing its intentions very clearly over the past few months, providing ample time for traders and investors to alter their approach to pending monetary tightening actions. Read the full Fed Statement here.

In my opinion, foreign markets are more likely to see increased risks and declining price trends for two reasons.

In my opinion, foreign markets are more likely to see increased risks and declining price trends for two reasons.

First, at risk nations/borrowers struggle to reduce debt levels.

Second, foreign market traders/investors struggle to adapt to the transition away from speculative “growth” trends.

I think the U.S. Dollar may continue to show strength over the next 4+ months as the foreign traders pile into U.S. economic strength while the Fed initiates their tightening actions.

So it makes sense to me that global markets would recoil from Fed tightening while debt-heavy corporations/nations seek relief from rising debt obligations....Continue Reading Here.

So it makes sense to me that global markets would recoil from Fed tightening while debt-heavy corporations/nations seek relief from rising debt obligations....Continue Reading Here.

Labels:

banks,

Dollar,

Fed,

Federal Reserve,

inflation,

interest rates,

investing,

stocks

Monday, January 17, 2022

Death, Taxes, and Time Decay

Few things are certain in life. But as the old saying goes, there is nothing quite so certain as “death and taxes”. As an Options Trader, I would enthusiastically add option time decay to that list.

Options offer traders and investors more leverage and risk mitigation than just purchasing shares outright. For example, if I were to purchase 100 shares of a stock at $100 per share, my total capital outlay would be $10,000. Options give us the right to buy or sell at a certain price for a pre-determined length of time.

I could control that same 100 shares by purchasing an "At the Money" call with a $100 strike price with 90 days to expiration for perhaps $6 per share, or $600 total capital outlay.

That’s powerful leverage. My downside risk is also limited to....Continue Reading Here.

Thursday, December 16, 2021

Earn Monthly Dividends By Solar Powering Schools, Businesses and Communities

Like the big oil companies we are diversified across all of the energy sectors. Here is our new favorite, shore up your retirement with this great program.

Sourcing our Solar Projects

Sun Exchange identifies schools, businesses and organisations that want to go solar. Our solar engineers work with local solar construction partners to carefully evaluate proposed solar projects and ensure they meet our core criteria:

* Economic and technical viability

* Social and environmental responsibility

Tip: Sign Up and get notified about new solar project crowd sales coming soon.

View Upcoming Solar Projects Here

Buying Solar Cells

Once solar projects have been accepted as viable and responsible, we run a crowd sale for the solar cells that will power the project. Any individual or organisation, anywhere in the world, can sign up to be a Sun Exchange member and buy solar cells, even starting with a single solar cell.

Your solar cells will:

* Generate clean energy

* Make a positive social and environmental impact

* Earn income as you lease them to schools, businesses and other organisations

* Reduce your carbon footprint for years to come

Buying Solar Cells

Once solar projects have been accepted as viable and responsible, we run a crowd sale for the solar cells that will power the project. Any individual or organisation, anywhere in the world, can sign up to be a Sun Exchange member and buy solar cells, even starting with a single solar cell.

Your solar cells will:

* Generate clean energy

* Make a positive social and environmental impact

* Earn income as you lease them to schools, businesses and other organisations

* Reduce your carbon footprint for years to come

Tip: Buy solar cells in the local currency of the project using credit card, bank transfer, Sun Exchange

wallet or Bitcoin (BTC).

Installing Solar Cells

Once a solar cell crowd sale sells out (they go quickly!), installation of the solar project begins. The appointed local construction partners install your solar cells, which typically takes four to six weeks, but can be longer for larger projects.

Tip: Track the status of your solar cells through your Sun Exchange dashboard.

Effortless Solar Income

Generate and sell clean energy. Schools, businesses and organisations pay you to use the clean electricity your solar cells produce. Your lease starts when your solar cells start generating electricity.

You’ll receive your monthly solar income, net of insurance and servicing fees, into your Sun Exchange wallet in your choice of the local currency of the project or Bitcoin (BTC).

Your Sun Exchange dashboard keeps you up to date on:

* Solar project status updates

* Our solar cell earnings (BTC and ZAR)

* The clean energy your solar cells generate (kWh)

* The amount of carbon your solar cells offset (kg CO2)

* Your Sun Exchange wallet balance, payments and withdrawals

Installing Solar Cells

Once a solar cell crowd sale sells out (they go quickly!), installation of the solar project begins. The appointed local construction partners install your solar cells, which typically takes four to six weeks, but can be longer for larger projects.

Tip: Track the status of your solar cells through your Sun Exchange dashboard.

Effortless Solar Income

Generate and sell clean energy. Schools, businesses and organisations pay you to use the clean electricity your solar cells produce. Your lease starts when your solar cells start generating electricity.

You’ll receive your monthly solar income, net of insurance and servicing fees, into your Sun Exchange wallet in your choice of the local currency of the project or Bitcoin (BTC).

Your Sun Exchange dashboard keeps you up to date on:

* Solar project status updates

* Our solar cell earnings (BTC and ZAR)

* The clean energy your solar cells generate (kWh)

* The amount of carbon your solar cells offset (kg CO2)

* Your Sun Exchange wallet balance, payments and withdrawals

Tip: The monthly income you accumulate in your Sun Exchange wallet can be used to buy more solar cells

in other solar projects.

Start earning monetized sunshine and offset your carbon footprint, while powering schools, businesses and communities through Sun Exchange.

Labels:

alternative energy,

Big Oil,

Bitcoin,

crypto,

cryptocurrency,

dividend,

energy,

green living,

investing,

solar

Thursday, November 18, 2021

Screening Key Technicals To Select Option Trade Types

Controlling portfolio beta, which measures overall systemic risk of a portfolio compared to the market, on the whole, is essential as these markets continue to break record high after record high with violent pullbacks.

The month of September was a prime example as the markets pushed to new all time highs early in the month then suffered a deep sell off to only bounce back to new record highs in October.

Controlling beta while generating in line or superior returns relative to the market is the goal with an options based portfolio. A beta controlled portfolio can be achieved via a blended options based approach where ~50% cash is held in conjunction with long index based equities and an options component.

Options alone cannot be the sole driver of portfolio appreciation; however, options can play a critical component in the overall portfolio construction to control beta....Read More Here.

Sunday, October 10, 2021

Where The SP500 Is Headed Next Week

Everyone wishes they knew where the stock market was going to go next. What sector is going to rally? When is the subsequent market sell off? When and where to put your money to work are the questions strive to figure out. Nothing is perfect. You cannot predict the future, but if you follow something close enough, you can get a good feeling of where it’s headed next, based on what it has recently been doing.

There are two moving averages here, the 50 day and the 20 day moving average. When the price is above these moving averages in general, and they’re sloping upwards, this means the market is most likely going to continue to trend higher.

When the price is sloping down, the price is below the moving average, and the 20 day moving average is below the 50 day, just what the market is doing this week; this tells us that there’s actually a mixed market signal. The market is struggling and in a new. As the saying goes, “the trend is your friend,” so it’s always best to trade with the market trend for the chart time frame you are following....Continue Reading Here

There are two moving averages here, the 50 day and the 20 day moving average. When the price is above these moving averages in general, and they’re sloping upwards, this means the market is most likely going to continue to trend higher.

When the price is sloping down, the price is below the moving average, and the 20 day moving average is below the 50 day, just what the market is doing this week; this tells us that there’s actually a mixed market signal. The market is struggling and in a new. As the saying goes, “the trend is your friend,” so it’s always best to trade with the market trend for the chart time frame you are following....Continue Reading Here

Labels:

Chris Vermeulen,

moving average,

SDS,

SP500,

SPY,

SSO,

stocks,

The Technical Traders

Friday, August 20, 2021

How To Trade When There Is Panic Selling In The Market

Straight from me to you – what you should do when panic selling hits the market. Should you follow the pack or hold firm?

As technical traders when all indicators are saying to get out of the market, then this is exactly what should be done. We do not fight a downward trend that is more likely to continue in that direction than it is to reverse. Do I like selling at a loss, of course not. But holding positions when all indicators are saying to sell is not a smart move – it’s an emotional one.

When fear hits the market and panic selling commences, yet all indicators show that the overall market remains in an uptrend, it’s best to hold on through the wave. The market will shake out those who caved to emotion and gave the sell orders to their brokers. To learn more about what to look for and how to trade when there is panic and fear....Listen to the Report Here.

As technical traders when all indicators are saying to get out of the market, then this is exactly what should be done. We do not fight a downward trend that is more likely to continue in that direction than it is to reverse. Do I like selling at a loss, of course not. But holding positions when all indicators are saying to sell is not a smart move – it’s an emotional one.

When fear hits the market and panic selling commences, yet all indicators show that the overall market remains in an uptrend, it’s best to hold on through the wave. The market will shake out those who caved to emotion and gave the sell orders to their brokers. To learn more about what to look for and how to trade when there is panic and fear....Listen to the Report Here.

Labels:

Chris Vermeulen,

gld,

gold,

SILJ,

Silver,

slv,

stocks,

The Technical Traders

Subscribe to:

Comments (Atom)