The recent downward Crude Oil trend may have caught many traders by surprise. Just before the US Fed raised interest rates on June 15, 2022, Crude oil was trading above $120ppb. Less than 5 days later, it collapsed -12% and has continued to trend lower. Currently, Crude Oil is near -17% lower than recent highs.

It appears Crude Oil has confirmed resistance near $120 and is devaluing as consumers pull away from traditional driving/spending habits while the Fed aggressively attempts to burst the inflation bubble. This type of contraction in Crude Oil is very similar to what happened in 2008-09 when the Global Financial Crisis (GFC) hit – Crude Oil collapsed more than -70% after IYC started trending lower in 2007....Continue Reading Here

Trade ideas, analysis and low risk set ups for commodities, Bitcoin, gold, silver, coffee, the indexes, options and your retirement. We'll help you keep your emotions out of your trading.

Showing posts with label Bitcoin. Show all posts

Showing posts with label Bitcoin. Show all posts

Thursday, June 23, 2022

Crude Oil Breaks Downward – Rejecting The $120 Price Level

Thursday, December 16, 2021

Earn Monthly Dividends By Solar Powering Schools, Businesses and Communities

Like the big oil companies we are diversified across all of the energy sectors. Here is our new favorite, shore up your retirement with this great program.

Sourcing our Solar Projects

Sun Exchange identifies schools, businesses and organisations that want to go solar. Our solar engineers work with local solar construction partners to carefully evaluate proposed solar projects and ensure they meet our core criteria:

* Economic and technical viability

* Social and environmental responsibility

Tip: Sign Up and get notified about new solar project crowd sales coming soon.

View Upcoming Solar Projects Here

Buying Solar Cells

Once solar projects have been accepted as viable and responsible, we run a crowd sale for the solar cells that will power the project. Any individual or organisation, anywhere in the world, can sign up to be a Sun Exchange member and buy solar cells, even starting with a single solar cell.

Your solar cells will:

* Generate clean energy

* Make a positive social and environmental impact

* Earn income as you lease them to schools, businesses and other organisations

* Reduce your carbon footprint for years to come

Buying Solar Cells

Once solar projects have been accepted as viable and responsible, we run a crowd sale for the solar cells that will power the project. Any individual or organisation, anywhere in the world, can sign up to be a Sun Exchange member and buy solar cells, even starting with a single solar cell.

Your solar cells will:

* Generate clean energy

* Make a positive social and environmental impact

* Earn income as you lease them to schools, businesses and other organisations

* Reduce your carbon footprint for years to come

Tip: Buy solar cells in the local currency of the project using credit card, bank transfer, Sun Exchange

wallet or Bitcoin (BTC).

Installing Solar Cells

Once a solar cell crowd sale sells out (they go quickly!), installation of the solar project begins. The appointed local construction partners install your solar cells, which typically takes four to six weeks, but can be longer for larger projects.

Tip: Track the status of your solar cells through your Sun Exchange dashboard.

Effortless Solar Income

Generate and sell clean energy. Schools, businesses and organisations pay you to use the clean electricity your solar cells produce. Your lease starts when your solar cells start generating electricity.

You’ll receive your monthly solar income, net of insurance and servicing fees, into your Sun Exchange wallet in your choice of the local currency of the project or Bitcoin (BTC).

Your Sun Exchange dashboard keeps you up to date on:

* Solar project status updates

* Our solar cell earnings (BTC and ZAR)

* The clean energy your solar cells generate (kWh)

* The amount of carbon your solar cells offset (kg CO2)

* Your Sun Exchange wallet balance, payments and withdrawals

Installing Solar Cells

Once a solar cell crowd sale sells out (they go quickly!), installation of the solar project begins. The appointed local construction partners install your solar cells, which typically takes four to six weeks, but can be longer for larger projects.

Tip: Track the status of your solar cells through your Sun Exchange dashboard.

Effortless Solar Income

Generate and sell clean energy. Schools, businesses and organisations pay you to use the clean electricity your solar cells produce. Your lease starts when your solar cells start generating electricity.

You’ll receive your monthly solar income, net of insurance and servicing fees, into your Sun Exchange wallet in your choice of the local currency of the project or Bitcoin (BTC).

Your Sun Exchange dashboard keeps you up to date on:

* Solar project status updates

* Our solar cell earnings (BTC and ZAR)

* The clean energy your solar cells generate (kWh)

* The amount of carbon your solar cells offset (kg CO2)

* Your Sun Exchange wallet balance, payments and withdrawals

Tip: The monthly income you accumulate in your Sun Exchange wallet can be used to buy more solar cells

in other solar projects.

Start earning monetized sunshine and offset your carbon footprint, while powering schools, businesses and communities through Sun Exchange.

Labels:

alternative energy,

Big Oil,

Bitcoin,

crypto,

cryptocurrency,

dividend,

energy,

green living,

investing,

solar

Monday, November 26, 2018

Crude Oil and Bitcoin Hit New Yearly Lows

For the first time in a year WTI crude oil is traded below $54 a barrel hitting a low of $53.63. Oil fell as much as 6% as fears are surfacing that OPEC's planned production cuts will do little to stave off a surge in global stockpiles.

Bitcoin finally made a significant move to break out of the tight trading range that it had been trapped in. Unfortunately for Bitcoin bulls, it was not the move that they were looking for as it dropped almost 13% on Monday and continued lower Tuesday shedding another 4.8% to trade at the new yearly low of $4,547.00. The cryptocurrency is now down more than 60% year to date and more than 70% since its all time high. Where will it stop? $3000, $2000 or $1000?

Not to be outdone by oil and Bitcoin, stocks are all continuing the sell off that started Monday with the S&P 500 dropping 1.6%, the DOW is once again below 25k, shedding 2% and the NASDAQ is trading back below 7,000 losing 1.6%. The recent sell off has once again pushed the stock market back below the yearly open, shedding all of the gains that came with record highs earlier in the year which has driven all three indexes into correction/bear market territory. It's looking more and more like we have a good to chance to end the year lower unless we get the Santa Clause rally.

Jeremy Lutz

INO/MarketClub

Bitcoin finally made a significant move to break out of the tight trading range that it had been trapped in. Unfortunately for Bitcoin bulls, it was not the move that they were looking for as it dropped almost 13% on Monday and continued lower Tuesday shedding another 4.8% to trade at the new yearly low of $4,547.00. The cryptocurrency is now down more than 60% year to date and more than 70% since its all time high. Where will it stop? $3000, $2000 or $1000?

Not to be outdone by oil and Bitcoin, stocks are all continuing the sell off that started Monday with the S&P 500 dropping 1.6%, the DOW is once again below 25k, shedding 2% and the NASDAQ is trading back below 7,000 losing 1.6%. The recent sell off has once again pushed the stock market back below the yearly open, shedding all of the gains that came with record highs earlier in the year which has driven all three indexes into correction/bear market territory. It's looking more and more like we have a good to chance to end the year lower unless we get the Santa Clause rally.

Jeremy Lutz

INO/MarketClub

Friday, November 23, 2018

Crude Oil and Bitcoin Hit New Yearly Lows

For the first time in a year WTI crude oil is traded below $54 a barrel hitting a low of $53.63. Oil fell as much as 6% as fears are surfacing that OPEC's planned production cuts will do little to stave off a surge in global stockpiles.

Bitcoin finally made a significant move to break out of the tight trading range that it had been trapped in. Unfortunately for Bitcoin bulls, it was not the move that they were looking for as it dropped almost 13% on Monday and continued lower Tuesday shedding another 4.8% to trade at the new yearly low of $4,547.00. The cryptocurrency is now down more than 60% year to date and more than 70% since its all time high. Where will it stop? $3000, $2000 or $1000?

Not to be outdone by oil and Bitcoin, stocks are all continuing the sell off that started Monday with the S&P 500 dropping 1.6%, the DOW is once again below 25k, shedding 2% and the NASDAQ is trading back below 7,000 losing 1.6%. The recent sell off has once again pushed the stock market back below the yearly open, shedding all of the gains that came with record highs earlier in the year which has driven all three indexes into correction/bear market territory. It's looking more and more like we have a good to chance to end the year lower unless we get the Santa Clause rally.

Jeremy Lutz

INO/MarketClub

Bitcoin finally made a significant move to break out of the tight trading range that it had been trapped in. Unfortunately for Bitcoin bulls, it was not the move that they were looking for as it dropped almost 13% on Monday and continued lower Tuesday shedding another 4.8% to trade at the new yearly low of $4,547.00. The cryptocurrency is now down more than 60% year to date and more than 70% since its all time high. Where will it stop? $3000, $2000 or $1000?

Not to be outdone by oil and Bitcoin, stocks are all continuing the sell off that started Monday with the S&P 500 dropping 1.6%, the DOW is once again below 25k, shedding 2% and the NASDAQ is trading back below 7,000 losing 1.6%. The recent sell off has once again pushed the stock market back below the yearly open, shedding all of the gains that came with record highs earlier in the year which has driven all three indexes into correction/bear market territory. It's looking more and more like we have a good to chance to end the year lower unless we get the Santa Clause rally.

Jeremy Lutz

INO/MarketClub

Saturday, October 13, 2018

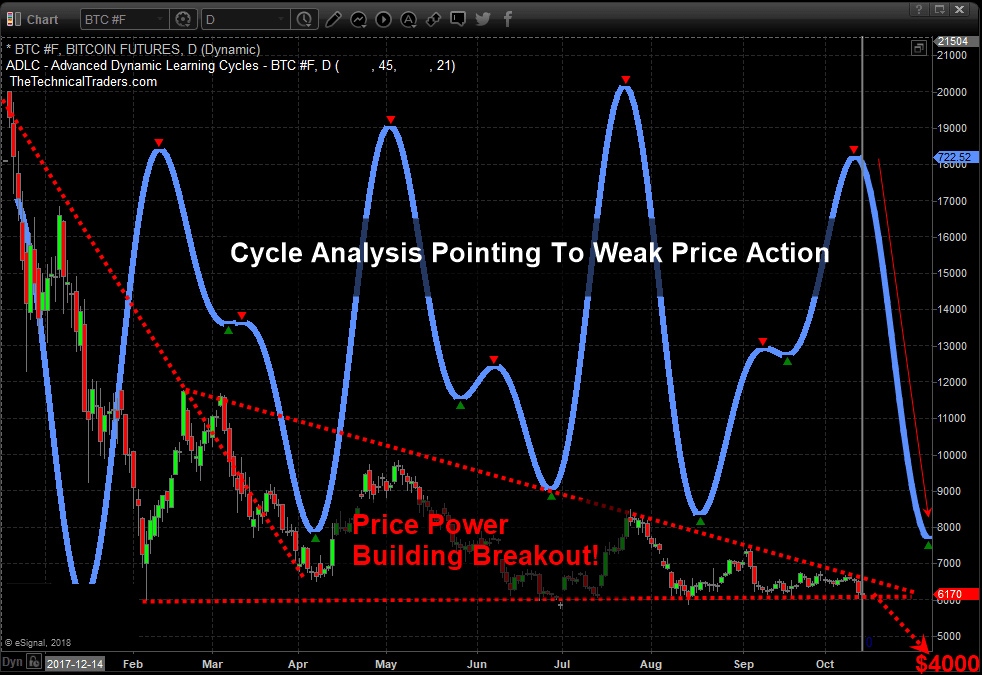

Why the Bitcoin Breakdown May Push Prices Below $5000

Recent market turmoil across the global stock markets has refocused investors on the concerns of global economics, trade, and geopolitical issues – away from cryptocurrencies. The biggest, Bitcoin, has been under extended pricing pressure recently and our research team believes Bitcoin will breach the $6000 level to the downside fairly quickly as extended global market downtrends continue.

The premise of our analysis is simple, the factors weighing on foreign investors and Bitcoin investors are that currencies are fluctuating wildly, local stock markets are declining and local economies may be contracting. All of this operates as a means for investors to turn to a “protectionism” stance where they attempt to protect capital/cash and attempt to limit downside risks.

The fact that Bitcoin has yet to break higher and has continued to fall under further pricing and adoption pressure means those investors that were hungry for the next great rally may be getting tired of waiting for this next move – if it ever happens. Our belief is that any downside pressure in Bitcoin below $5800 will likely push many crypto enthusiasts over the end and prompt them to sell out before prices attempt to move down further.

Our research team believes a deeper downside price rotation is setting up in Bitcoin that will push prices below the $5000 level before the end of this year. The uncertainty of the global equities markets are creating an environment where cryptos have simply lost their appeal. There has been no real substantial upside price move over the past 6+ months and the FLAG formation setting up is a very real warning sign that the eventual breakout move could be very dangerous.

Additionally, when we add our proprietary Advanced Learning Cycle system to the research, which points to much lower price rotation over the next 30+ days, we begin to see the very real possibility that Bitcoin could fall below $5000 very quickly and potentially target $4000 as an ultimate low.

As much as we would like to inform our followers that we believe Bitcoin will rally back to $18k fairly quickly, that is simply not the case. All of our indicators are suggesting that Bitcoin will fall to below $5000, and possibly towards $4000, before any real support is found. If you are a bitcoin believer, be aware that you may have a substantial opportunity to use your skills at this price swing plays out. Looking to buy back in near $4000 is much better than trying to hold for an additional $2000 loss.

Visit The Technical Traders to learn more about our research team and resources to help you become a better trader. Be prepared and build your skills to target greater success with our dedicated team. Read some of our other research to see for yourself how well we’ve been calling these recent market moves. Isn’t it time you invested in your future success?

Chris Vermeulen

The premise of our analysis is simple, the factors weighing on foreign investors and Bitcoin investors are that currencies are fluctuating wildly, local stock markets are declining and local economies may be contracting. All of this operates as a means for investors to turn to a “protectionism” stance where they attempt to protect capital/cash and attempt to limit downside risks.

The fact that Bitcoin has yet to break higher and has continued to fall under further pricing and adoption pressure means those investors that were hungry for the next great rally may be getting tired of waiting for this next move – if it ever happens. Our belief is that any downside pressure in Bitcoin below $5800 will likely push many crypto enthusiasts over the end and prompt them to sell out before prices attempt to move down further.

Our research team believes a deeper downside price rotation is setting up in Bitcoin that will push prices below the $5000 level before the end of this year. The uncertainty of the global equities markets are creating an environment where cryptos have simply lost their appeal. There has been no real substantial upside price move over the past 6+ months and the FLAG formation setting up is a very real warning sign that the eventual breakout move could be very dangerous.

Additionally, when we add our proprietary Advanced Learning Cycle system to the research, which points to much lower price rotation over the next 30+ days, we begin to see the very real possibility that Bitcoin could fall below $5000 very quickly and potentially target $4000 as an ultimate low.

As much as we would like to inform our followers that we believe Bitcoin will rally back to $18k fairly quickly, that is simply not the case. All of our indicators are suggesting that Bitcoin will fall to below $5000, and possibly towards $4000, before any real support is found. If you are a bitcoin believer, be aware that you may have a substantial opportunity to use your skills at this price swing plays out. Looking to buy back in near $4000 is much better than trying to hold for an additional $2000 loss.

Visit The Technical Traders to learn more about our research team and resources to help you become a better trader. Be prepared and build your skills to target greater success with our dedicated team. Read some of our other research to see for yourself how well we’ve been calling these recent market moves. Isn’t it time you invested in your future success?

Chris Vermeulen

Labels:

Bitcoin,

BTC,

Chris Vermeulen,

cryptocurrency,

Ethereum,

Litecoin,

LTC. ETH,

Technical Traders

Thursday, September 13, 2018

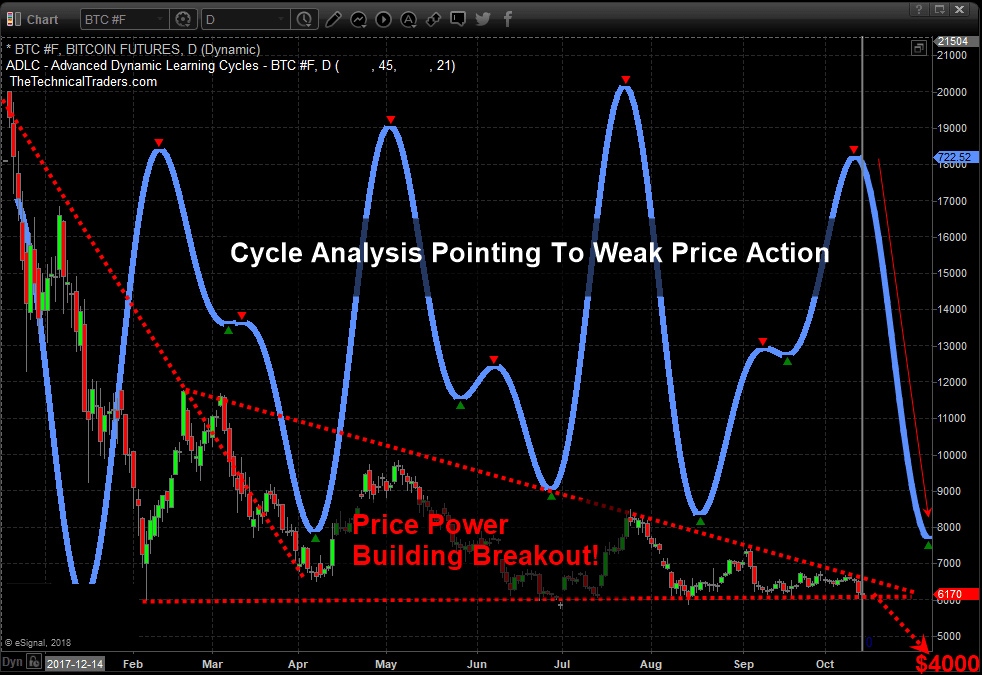

How Bitcoin Will Make You Big Money Again

If you are a Bitcoin fan or looking for the next opportunity for a Bitcoin rally, you may not have long to wait before a price breakout takes place. Our research team at The Technical Traders believes a price breakout may occur before the end of 2018 – the only question is will it be a breakout rally or a breakdown crash before the next mega rally?

Cryptos and, in particular, Bitcoin has increased in popularity and adoption over the past 24 months across the globe. Recently, Citigroup has announced new technology making Crypto transactions more secure and reducing the risk of such transactions. Additionally, Circle recently announced a US Dollar based Crypto currency that is backed by Goldman-Sachs. News from Europe is that the EU has been urged to adopt common Crypto Currency rules that will fuel more attention and enterprise on developing suitable Crypto solutions for the European markets.

All of this plays into our research that a breakout/breakdown is inevitable and it is just a matter of time before this coiling price consolidation “apexes” and expands.

This chart shows massive breakdown washout below $6000 taking it back to prices before crypto became popular in early 2017.

This next chart below shows our cycle analysis and how much bitcoin moved from our cycle bottoms to tops. We are now at NEARING a critical juncture of a $6000 breakdown which is clearly a support level, and a potential major cycle bottom or continuation down cycle. Huge money can be made from this extreme volatility that is about to unfold and savvy technical traders can see the profit potential unfolding.

We urge all traders to keep Cryptos in focus over the next few weeks and months. Our research team shares our proprietary analysis and research with our paid members regarding the Crypto currency trends and trades.

If you want to learn what we believe will be the next big move in the Crypto markets, then visit The Technical Traders to learn more. Our proprietary modeling systems are clearly showing us what we should expect over the next few weeks and months. As a member, you will have access to this research and benefit from our Daily Research Videos.

Chris Vermeulen

Cryptos and, in particular, Bitcoin has increased in popularity and adoption over the past 24 months across the globe. Recently, Citigroup has announced new technology making Crypto transactions more secure and reducing the risk of such transactions. Additionally, Circle recently announced a US Dollar based Crypto currency that is backed by Goldman-Sachs. News from Europe is that the EU has been urged to adopt common Crypto Currency rules that will fuel more attention and enterprise on developing suitable Crypto solutions for the European markets.

All of this plays into our research that a breakout/breakdown is inevitable and it is just a matter of time before this coiling price consolidation “apexes” and expands.

This chart shows massive breakdown washout below $6000 taking it back to prices before crypto became popular in early 2017.

This next chart below shows our cycle analysis and how much bitcoin moved from our cycle bottoms to tops. We are now at NEARING a critical juncture of a $6000 breakdown which is clearly a support level, and a potential major cycle bottom or continuation down cycle. Huge money can be made from this extreme volatility that is about to unfold and savvy technical traders can see the profit potential unfolding.

We urge all traders to keep Cryptos in focus over the next few weeks and months. Our research team shares our proprietary analysis and research with our paid members regarding the Crypto currency trends and trades.

If you want to learn what we believe will be the next big move in the Crypto markets, then visit The Technical Traders to learn more. Our proprietary modeling systems are clearly showing us what we should expect over the next few weeks and months. As a member, you will have access to this research and benefit from our Daily Research Videos.

Chris Vermeulen

Labels:

analysis,

Bitcoin,

Chris Vermeulen,

crypto,

cryptocurrency,

cycle,

rally,

Technical Traders,

volatility

Friday, July 20, 2018

Bitcoin Rallies to Upper Channel - What Next?

Even we were concerned with Bitcoin briefly traded below $6k in late June. Yet, the recent upside price move was incredibly quick and the price of Bitcoin ran right up to our upper price channel. We believe this will become a new price peak over the next few days/weeks where the price of Bitcoin should continue to drop from these levels near $7500. We know there are many Bitcoin investors that want to hear us state that it should continue to push higher, but there are other factors at play here that may limit this movement.

The price channels that are currently constraining the price of Bitcoin originate back in February and March of 2018. The low and high price rotation within these months start the points of interest for our research team. From these points, we have continued to identify key price levels that appear to contain breakouts.

You can see from the chart below, the upper BLUE channel line is our downward sloping price channel that is acting like an upper ceiling for the price. Additionally, you can see our “drawn Red and Green arrows” showing what we believed Bitcoin would potentially do over the next few months. We believed that Bitcoin, as it traded lower, towards $6k, may find support and rally (based on our time/price cycles) towards a peak near July 16 (showing as the end of the Green Arrow). From this point, we believe the price of Bitcoin will trail off, heading lower, with the intent to retest channel support near $5700 if the price cannot break through and hold above the blue upper channel.

This longer term daily Bitcoin chart shows a larger picture of our analysis work. You can clearly see the channels that are constraining price at the moment – the BLUE support channel and the RED resistance channel. The most recent lows established a new lower price point for the Blue channel – which indicated a downward sloping pennant formation is in place.

There are two things we want to caution Bitcoin investors and traders about. First, the rotation that we are expecting to complete this pennant formation could happen very quickly within a fairly tight range ($7400 to $5700). For traders, this is an excellent range for some quick profits. For investors, this could create some stress as price rotates.

Second, by our estimates, at least one more low price rotation is required before any real breakout will be attempted. If our analysis is correct, this current price peak will end with prices falling back below $6k, forming another “lower bottom” and rallying again to near the upper price channel (near $6700 or so) before trailing off for the last time – nearing the apex of the pennant formation. We believe the current outcome of this price setup will be a low price breakout, forming a potential wave 5 that should end near or below $5500. After that bottom is reached, we should be looking for a new bottom formation setting up a new advancement leg higher.

Could our analysis change, of course, it could depending on what price action shows us. Right now, this pennant formation and the wave counts are driving our analysis. The Time/price cycle analysis helps us to determine when and where price target/peaks/troughs may happen, but they are not set in stone. If you are a trader and are long Bitcoin, this may be the highest price you will see over the next few months.

If you are an investor and think this is the start of a bigger move higher – we don’t agree with you. We believe we are very close to the final leg lower that should form the new price bottom – at least for a while. Once this bottom forms, we’ll be able to provide a better understanding of what we believe will happen in the future. For right now, our target low for the bottom is $4400 on or near August 20, 2018. We’ll see how it plays out.

We keep a close eye using our proprietary ADL Fibonacci and ADL Cycle forecasting systems using the Bitcoin investment trust which trades like a stock/ETF, the symbol is: GBTC.

If you want to learn how we can help you stay ahead of these global market moves and help you plan for and execute greater trades, please visit The Technical Traders site to learn how we assist you. We offer comprehensive research, analysis, daily video, trading signals and much more to our valued subscribers. We also offer access to our specialized proprietary price modeling systems that have proven to be timely and accurate.

The price channels that are currently constraining the price of Bitcoin originate back in February and March of 2018. The low and high price rotation within these months start the points of interest for our research team. From these points, we have continued to identify key price levels that appear to contain breakouts.

You can see from the chart below, the upper BLUE channel line is our downward sloping price channel that is acting like an upper ceiling for the price. Additionally, you can see our “drawn Red and Green arrows” showing what we believed Bitcoin would potentially do over the next few months. We believed that Bitcoin, as it traded lower, towards $6k, may find support and rally (based on our time/price cycles) towards a peak near July 16 (showing as the end of the Green Arrow). From this point, we believe the price of Bitcoin will trail off, heading lower, with the intent to retest channel support near $5700 if the price cannot break through and hold above the blue upper channel.

This longer term daily Bitcoin chart shows a larger picture of our analysis work. You can clearly see the channels that are constraining price at the moment – the BLUE support channel and the RED resistance channel. The most recent lows established a new lower price point for the Blue channel – which indicated a downward sloping pennant formation is in place.

There are two things we want to caution Bitcoin investors and traders about. First, the rotation that we are expecting to complete this pennant formation could happen very quickly within a fairly tight range ($7400 to $5700). For traders, this is an excellent range for some quick profits. For investors, this could create some stress as price rotates.

Second, by our estimates, at least one more low price rotation is required before any real breakout will be attempted. If our analysis is correct, this current price peak will end with prices falling back below $6k, forming another “lower bottom” and rallying again to near the upper price channel (near $6700 or so) before trailing off for the last time – nearing the apex of the pennant formation. We believe the current outcome of this price setup will be a low price breakout, forming a potential wave 5 that should end near or below $5500. After that bottom is reached, we should be looking for a new bottom formation setting up a new advancement leg higher.

Could our analysis change, of course, it could depending on what price action shows us. Right now, this pennant formation and the wave counts are driving our analysis. The Time/price cycle analysis helps us to determine when and where price target/peaks/troughs may happen, but they are not set in stone. If you are a trader and are long Bitcoin, this may be the highest price you will see over the next few months.

If you are an investor and think this is the start of a bigger move higher – we don’t agree with you. We believe we are very close to the final leg lower that should form the new price bottom – at least for a while. Once this bottom forms, we’ll be able to provide a better understanding of what we believe will happen in the future. For right now, our target low for the bottom is $4400 on or near August 20, 2018. We’ll see how it plays out.

We keep a close eye using our proprietary ADL Fibonacci and ADL Cycle forecasting systems using the Bitcoin investment trust which trades like a stock/ETF, the symbol is: GBTC.

If you want to learn how we can help you stay ahead of these global market moves and help you plan for and execute greater trades, please visit The Technical Traders site to learn how we assist you. We offer comprehensive research, analysis, daily video, trading signals and much more to our valued subscribers. We also offer access to our specialized proprietary price modeling systems that have proven to be timely and accurate.

Labels:

Bitcoin,

cryptocurrency,

Ethereum,

Litecoin

Sunday, January 7, 2018

Preparing for the Cryptocurrency Swan Event

Our trading partner Chris Vermeulen sent over this great article he put together covering how the current crypto markets volatility might affect the rest of the markets.

Many people have speculated that Cryptocurrencies can go to $10k or higher. Recently, the Chinese government has stepped up policy to regulate and eliminate Crypto ICOs as a means of increased speculation and gray market capital. Additionally, Jamie Dimon, of JP Morgan, stated that Bitcoin is a fraud and that it would “blow up” (MSN > Bitcoin is a Fraud That Will Blow Up Says JP Morgan Boss). What is the truth and what should investors expect in the future? Well, here is my opinion on this topic.

Bitcoin is based on the Blockchain technology architecture. I believe this architecture will continue to be explored under the basis of an open, distributed ledger method of developing opportunities. This technology improvement will likely drive advancement in other sectors of the global market as security and accountability continue to increase. Yet, the growing pains of this technology will likely continue to drive some wild moves over the next few years.

It has been reported that Cryptocurrencies fell $23 Billion in value since the peak. This would put the total valuation of the Crypto market at about $117 Billion near the same peak. Consider for a moment that the Bernie Madoff scandal was near $65 Billion total. Could a Cryptocurrency based “Swan Event” create chaos in the global markets?

In comparison to more traditional investment instruments, the risk exposure of Cryptocurrencies seems somewhat limited. Yet consider this… Many global firms jumped onto the Blockchain bandwagon within the last 12~24 months. This is not just individual investors any longer, this is most of the global financial market.

DATE TIMELINE OF FIRST INVESTMENT INTO CRYPTOCURRENCIES

So, now our “Swan Event” has a bit of depth in terms of risk exposure and breadth in terms of global market reach. What would an extended decline in Cryptocurrency valuations do to these firms and to the confidence in the Cryptocurrency market?

Could a collapse “Swan Event” drive prices back to below $1000 (USD) or further? What would the outcome of such an event be like for the global markets? Would this type of move reflect into the global market as an advance or decline overall? And what would this mean to the bottom line of these financial firms that have invested capital, resources and client’s capital into these markets?

It is our believe that the global markets are, without a Cryptocurrency event, setting up for a potentially massive corrective move. The chart, below, clearly shows what we believe to be a Head-n-Shoulders pattern forming that will likely prompt a breakdown move near October 2017 or shortly thereafter.

We believe this global market correction will prompt selling in weaker instruments and drive a massive “rip your face off” rally in the metals. We believe this move has already started with the formation of the Head-n-Shoulders pattern in the US markets as well as the recent upside move in the metals. The Cryptocurrency “Swan Event” may be the catalyst event that is needed to put pressure on other market instruments (US and Global equities, RealEstate, Consumer confidence/spending and Metals).

U.S. CUSTOM INDEX....HEAD-N-SHOULDER FORMATION

METALS : START OF RIP YOUR FACE OFF RALLY

REAL ESTATE CORRECTION

Are you prepared for this move? Do you want to know what to expect and do you need help understanding these market dynamics? The markets are setting up for what could be one of the most explosive cycle event moves in nearly a decade and you need to be prepared. We offer our research to our clients at The Market Trend Forecast for far less than you would imagine. For less than $1 per day, you can have access to our advanced research and analytics, market trend forecasts and more. We keep you informed with our timely updates and research to help you understand how these markets are moving, where to find opportunities and how to protect your investments.

Our research team has over 30 years experience in the markets and have been trained by some of the best technicians that ever lived. Isn’t it time you invested in a team of dedicated market analysts that can help you protect your assets and find opportunities for an unbelievable subscription rate?

When you join, we’ll send your our Guide to understanding trading PDF booklet to help you understand our advanced analysis techniques and adaptive learning strategies. These are all part of our commitment to providing you the best analysis, research and understanding of the market’s dynamics as well as making sure you understand what we are delivering to you each week.

Don’t miss this next big move, the “Swan Event”....Timing is everything.

Visit The Technical Traders Right Here to see what we are offering you.

Chris Vermeulen

Just Getting Started Trading Cryptocurrency? Get $10.00 Worth of FREE Bitcoin Right Here

Many people have speculated that Cryptocurrencies can go to $10k or higher. Recently, the Chinese government has stepped up policy to regulate and eliminate Crypto ICOs as a means of increased speculation and gray market capital. Additionally, Jamie Dimon, of JP Morgan, stated that Bitcoin is a fraud and that it would “blow up” (MSN > Bitcoin is a Fraud That Will Blow Up Says JP Morgan Boss). What is the truth and what should investors expect in the future? Well, here is my opinion on this topic.

Bitcoin is based on the Blockchain technology architecture. I believe this architecture will continue to be explored under the basis of an open, distributed ledger method of developing opportunities. This technology improvement will likely drive advancement in other sectors of the global market as security and accountability continue to increase. Yet, the growing pains of this technology will likely continue to drive some wild moves over the next few years.

It has been reported that Cryptocurrencies fell $23 Billion in value since the peak. This would put the total valuation of the Crypto market at about $117 Billion near the same peak. Consider for a moment that the Bernie Madoff scandal was near $65 Billion total. Could a Cryptocurrency based “Swan Event” create chaos in the global markets?

In comparison to more traditional investment instruments, the risk exposure of Cryptocurrencies seems somewhat limited. Yet consider this… Many global firms jumped onto the Blockchain bandwagon within the last 12~24 months. This is not just individual investors any longer, this is most of the global financial market.

DATE TIMELINE OF FIRST INVESTMENT INTO CRYPTOCURRENCIES

So, now our “Swan Event” has a bit of depth in terms of risk exposure and breadth in terms of global market reach. What would an extended decline in Cryptocurrency valuations do to these firms and to the confidence in the Cryptocurrency market?

Could a collapse “Swan Event” drive prices back to below $1000 (USD) or further? What would the outcome of such an event be like for the global markets? Would this type of move reflect into the global market as an advance or decline overall? And what would this mean to the bottom line of these financial firms that have invested capital, resources and client’s capital into these markets?

It is our believe that the global markets are, without a Cryptocurrency event, setting up for a potentially massive corrective move. The chart, below, clearly shows what we believe to be a Head-n-Shoulders pattern forming that will likely prompt a breakdown move near October 2017 or shortly thereafter.

We believe this global market correction will prompt selling in weaker instruments and drive a massive “rip your face off” rally in the metals. We believe this move has already started with the formation of the Head-n-Shoulders pattern in the US markets as well as the recent upside move in the metals. The Cryptocurrency “Swan Event” may be the catalyst event that is needed to put pressure on other market instruments (US and Global equities, RealEstate, Consumer confidence/spending and Metals).

U.S. CUSTOM INDEX....HEAD-N-SHOULDER FORMATION

METALS : START OF RIP YOUR FACE OFF RALLY

REAL ESTATE CORRECTION

Are you prepared for this move? Do you want to know what to expect and do you need help understanding these market dynamics? The markets are setting up for what could be one of the most explosive cycle event moves in nearly a decade and you need to be prepared. We offer our research to our clients at The Market Trend Forecast for far less than you would imagine. For less than $1 per day, you can have access to our advanced research and analytics, market trend forecasts and more. We keep you informed with our timely updates and research to help you understand how these markets are moving, where to find opportunities and how to protect your investments.

Our research team has over 30 years experience in the markets and have been trained by some of the best technicians that ever lived. Isn’t it time you invested in a team of dedicated market analysts that can help you protect your assets and find opportunities for an unbelievable subscription rate?

When you join, we’ll send your our Guide to understanding trading PDF booklet to help you understand our advanced analysis techniques and adaptive learning strategies. These are all part of our commitment to providing you the best analysis, research and understanding of the market’s dynamics as well as making sure you understand what we are delivering to you each week.

Don’t miss this next big move, the “Swan Event”....Timing is everything.

Visit The Technical Traders Right Here to see what we are offering you.

Chris Vermeulen

Just Getting Started Trading Cryptocurrency? Get $10.00 Worth of FREE Bitcoin Right Here

Labels:

Bitcoin,

Chris Vermeulen,

cryptocurrency,

Ethereum,

Gas,

gold,

ICO,

Litecoin,

Oil

Friday, December 29, 2017

2018 First Quarter Technical Analysis Price Forecast

As 2017 draws to a close, our analysis shows the first Quarter of 2018 should start off with a solid rally. Our researchers use our proprietary modeling and technical analysis systems to assist our members with detailed market analysis and timing triggers from expected intraday price action to a multi-month outlook.

These tools help us to keep our members informed of market trends, reversals, and big moves. Today, we are going to share some of our predictive modelings with you to show you why we believe the first three months of 2018 should continue higher.

One of our most impressive and predictive modeling systems is the Adaptive Dynamic Learning system. This system allows us to ask the market what will be the highest possible outcome of recent trading activity projected into the future. It accomplishes this by identifying Genetic Price/Pattern markers in the past and recording them into a Genome Map of price activity and probable outcomes.

This way, when we ask it to show us what it thinks will be the highest probable outcome for the future, it looks into this Genome Map, finds the closest relative Genetic Price/Pattern marker and then shows us what this Genome marker predicts as the more likely outcome.

This current Weekly chart of the SPY is showing us that the next few Weeks and Months of price activity should produce a minimum of a $5 – $7 rally. This means that we could see a continued 2~5% rally in US Equities early in 2018.

Additionally, the ES (S&P E-mini futures) is confirming this move in early 2018 with its own predictive analysis. The ADL modeling system is showing us that the ES is likely to move +100 pts from current levels before the end of the first Quarter 2018 equating to a +3.5% move (or higher). We can see from this analysis that a period of congestion or consolidation is expected near the end of January or early February 2018 – which would be a great entry opportunity.

The trends for both of these charts is strongly Bullish and the current ADL price predictions allow investors to understand the opportunities and expectations for the first three months of 2018. Imagine being able to know or understand that a predictive modeling system can assist you in making decisions regarding the next two to three months as well as assist you in planning and protecting your investments? How powerful would that technology be to you?

Our job at Technical Traders Ltd. is to assist our members in finding and executing profitable trades and to assist them in understanding market trends, reversals, and key movers. We offer a variety of analysis types within our service to support any level of a trader from novice to expert, and short term to long term investors.

Our specialized modeling systems allow us to provide one of a kind research and details that are not available anywhere else. Our team of researchers and traders are dedicated to helping us all find great success with our trading.

So, now that you know what to expect from the SPY and ES for the next few months, do you want to know what is going to happen in Gold, Silver, Bonds, FANGs, the US Dollar, Bitcoin, and more?

Join The Technical Traders Right Here to gain this insight and knowledge today.

Chris Vermeulen

These tools help us to keep our members informed of market trends, reversals, and big moves. Today, we are going to share some of our predictive modelings with you to show you why we believe the first three months of 2018 should continue higher.

One of our most impressive and predictive modeling systems is the Adaptive Dynamic Learning system. This system allows us to ask the market what will be the highest possible outcome of recent trading activity projected into the future. It accomplishes this by identifying Genetic Price/Pattern markers in the past and recording them into a Genome Map of price activity and probable outcomes.

This way, when we ask it to show us what it thinks will be the highest probable outcome for the future, it looks into this Genome Map, finds the closest relative Genetic Price/Pattern marker and then shows us what this Genome marker predicts as the more likely outcome.

This current Weekly chart of the SPY is showing us that the next few Weeks and Months of price activity should produce a minimum of a $5 – $7 rally. This means that we could see a continued 2~5% rally in US Equities early in 2018.

Additionally, the ES (S&P E-mini futures) is confirming this move in early 2018 with its own predictive analysis. The ADL modeling system is showing us that the ES is likely to move +100 pts from current levels before the end of the first Quarter 2018 equating to a +3.5% move (or higher). We can see from this analysis that a period of congestion or consolidation is expected near the end of January or early February 2018 – which would be a great entry opportunity.

The trends for both of these charts is strongly Bullish and the current ADL price predictions allow investors to understand the opportunities and expectations for the first three months of 2018. Imagine being able to know or understand that a predictive modeling system can assist you in making decisions regarding the next two to three months as well as assist you in planning and protecting your investments? How powerful would that technology be to you?

Our job at Technical Traders Ltd. is to assist our members in finding and executing profitable trades and to assist them in understanding market trends, reversals, and key movers. We offer a variety of analysis types within our service to support any level of a trader from novice to expert, and short term to long term investors.

Our specialized modeling systems allow us to provide one of a kind research and details that are not available anywhere else. Our team of researchers and traders are dedicated to helping us all find great success with our trading.

So, now that you know what to expect from the SPY and ES for the next few months, do you want to know what is going to happen in Gold, Silver, Bonds, FANGs, the US Dollar, Bitcoin, and more?

Join The Technical Traders Right Here to gain this insight and knowledge today.

Chris Vermeulen

Monday, December 18, 2017

Should You Consider Investing/Buying Gold or Bitcoin?

Our trading partner Chris Vermeulen of The Technical Traders just put together this great article comparing Bitcoin against traditional commodities for investing and storing wealth....

Recently, we have been asked by a number of clients about the precious metals and what our advice would be with regards to buying, selling or holding physical or trading positions in the metals. There are really only a few short and simple answers to this question and they are revolve around the concept of providing a hedge against risk, capital preservation and opportunity for returns. Let’s explore the details a bit further.

Recently, we have been asked by a number of clients about the precious metals and what our advice would be with regards to buying, selling or holding physical or trading positions in the metals. There are really only a few short and simple answers to this question and they are revolve around the concept of providing a hedge against risk, capital preservation and opportunity for returns. Let’s explore the details a bit further.

First, Gold, historically, has been and will continue to be the basis of physical wealth for the foreseeable future. Currently, Gold and Silver are relatively low cost compared to other assets offering similar protection. As of right now, Gold and Silver are nearing the lowest price ratio levels, historically, that have existed since 1990. This means, the relationship of the price ratio for Gold and Silver are comparatively low in relationship to how Gold and Silver are priced in peak levels. So, right now is the time to be acquiring Gold and Silver as a low price hedge against another global crisis event or market meltdown.

People are starting to park their money in digital currencies, like Bitcoin and Ethereum, rather than parking them in fiat currencies – I buy and hold my currencies in this crypto wallet CoinBase. This is primarily due to the Negative Interest Rate Policy as well as Zero Interest Rate Policy of the Central Banks, which explains the sharp rise in the price of Bitcoin, this year.

Taking a look at this chart of the DOW Index shown in relative Gold Ounce price levels, we can see that every peak in this ratio above 15 or so has resulted in a dramatic ratio level reversion (decline). This reversion means that asset prices (the DOW price level) declined while the price of Gold rose or stayed relatively stable. The current level is well above 17 and any peak in this level should start the next rally in precious metals while global equities contract.

Second, the fact that the Gold and Silver price ratio is historically very low (meaning they provide a very good hedging opportunity at historically very low price ratio levels) also means that cash can be traded for physical gold with very limited risk and provide an excellent hedge for inflation, global market crisis events and as long term investments. Taking advantage of the current market conditions, one has to be aware that crisis events do exist and present a clear risk to future equity investments.

One could decide to risk further capital hedging with options or short positions as risk becomes more evident, but these are inherently more risky than a physical Gold or Silver investment. Physical Gold or Silver, especially rare coins which include greater intrinsic value, can provide real capital, real gains, real hedging of risk and real return – whereas the short positions or options are only valuable if the trade is executed to profit.

One could decide to risk further capital hedging with options or short positions as risk becomes more evident, but these are inherently more risky than a physical Gold or Silver investment. Physical Gold or Silver, especially rare coins which include greater intrinsic value, can provide real capital, real gains, real hedging of risk and real return – whereas the short positions or options are only valuable if the trade is executed to profit.

The relationship of the US Dollar to Gold is key to understanding precious metals valuations. As the US Dollar increases in value, this puts pressure on the price of Gold because most of the world operates in US Dollars and Gold is typically a hedge against risk and inflation. Therefore, as the US Dollar increases in value, there is a perceived view that risks and inflation are less of a threat to the global economy.

As this chart, below, shows, the US Dollar is currently settling within a FLAG formation that could result in downside price action – below recent support. When we consider the first chart, showing the price of Gold being historically very cheap and the ratio being above 17, we must assume that any downside price activity in Gold is a blessing right now because these levels have not been seen since 1999, 1965 or 1929. In other words, this is potentially a once-in-a-lifetime opportunity for investors.

Lastly, Gold and Silver are very limited in supply on this planet and, unless society decides that Gold or Silver is absolutely worthless as a substance, will likely continue to increase in value. News that China and Russia are acquiring hundreds of tons of gold each year in preparation for a gold based currency is another set of reasons that you should consider starting your own physical hoard of precious metals.

The most important thing for you to understand about owning physical Gold and Silver is that it is a protective investment that can be liquidated or resold at almost any time in the future. It can be traded, held, secured and transported easily. You can physically take possession of your Gold and Silver and be assured that through any banking crisis, global market crisis or major global event, you have enough physical precious metal to operate in a crisis mode and likely attain great wealth/gains in the process.

The most important thing for you to understand about owning physical Gold and Silver is that it is a protective investment that can be liquidated or resold at almost any time in the future. It can be traded, held, secured and transported easily. You can physically take possession of your Gold and Silver and be assured that through any banking crisis, global market crisis or major global event, you have enough physical precious metal to operate in a crisis mode and likely attain great wealth/gains in the process.

Think of physical Gold and Silver like an “emergency kit”. You hope you never need it, but when you do need it, you had better be prepared and have set aside some physical holdings before the crisis event happened. Out here in California, we keep “Earthquake Kits” with emergency supplies, water, lanterns, food and other essentials. Well, guess what is included in my Earthquake Kit? Yup – Gold and Silver in proper quantities that I could barter and trade for items that are essential.

This final chart is the Gold to Silver ratio and is used to identify when price disparity between the two most common precious metals is opportunistic for one metal over the other. When the price of Gold is high compared to the price of Silver, this ratio will climb. When the price of Silver increases, because of perceived market risks, this ratio will decline. Currently, one can see that we are nearing a peak in this ratio chart – meaning that Silver is much cheaper, in relative terms, than gold. Because of this, investors should consider Silver and Gold as viable wealth protection.

Should another market crisis event unfold, both Silver and Gold will likely rally. This chart is telling us that Silver will likely rally by a larger percentage value than Gold to result in a decline in this ratio and resulting in closer “parity” between the valuations of these two precious metals. Again, currently, this is very close to a once-in-a-lifetime opportunity for investors.

Now is the time to consider building your “emergency kit” and to prepare for the next market crisis event. Our research team is ready to assist you and to keep you updated with Daily and Weekly update for all the major markets.

Visit The Technical Traders Here to learn more about our services and newsletters today.

Monday, November 20, 2017

Could a Bitcoin Blowout coincide with a Major Market Blowout?

Our team of researchers continues to attempt to identify market strengths and weakness in the US major markets by identifying key, underlying factors of the markets and how they relate to one another.

Recently, we’ve been warning of a potentially explosive bullish move in Metals and our last article highlighted the weakness in the Transportation Index as it relates to the US major markets.

On November 2, 2017, we warned that the NQ volatility would be excessive and that any move near or below 6200 would likely prompt support to drive prices higher as our Adaptive Dynamic Learning model was showing wide volatility and the potential for rotation moves.

Recently, we’ve been warning of a potentially explosive bullish move in Metals and our last article highlighted the weakness in the Transportation Index as it relates to the US major markets.

On November 2, 2017, we warned that the NQ volatility would be excessive and that any move near or below 6200 would likely prompt support to drive prices higher as our Adaptive Dynamic Learning model was showing wide volatility and the potential for rotation moves.

This week, we are attempting to highlight a potential move in Bitcoin that could disrupt the global economy and more traditional investment vehicles. For the past few years, Bitcoin has been on a terror to the upside. Recently, a 30% downside price rotation caused a bit of panic in the Crypto world. This -30% decline was fast and left some people wondering what could happen if something deeper were to happen – where would Crypto’s find a bottom. From that -30% low, Bitcoin has recovered to previous highs (near $8000) and have stalled – interesting.

While discussing Bitcoin with some associates a while back, I heard rumor that a move to Bitcoin CASH was underway and that Bitcoin would collapse as some point in the near future. The people I was meeting with were very well connected in this field and were warning me to alert me in case I had any Bitcoin holdings (which I do). I found it interesting that these people were moving into the Bitcoin CASH market as fast as they could. What did they know that I didn’t know and how could any potential Bitcoin blowout drive the global markets?

Panic breeds fear and fear drives the markets (fear or greed). If Bitcoin were to increase volatility beyond the most recent move (-30% in 4 days) – what could happen to the Crypto markets if a bubble collapse or fundamental collapse happened?

How would the major markets react to a Crypto market collapse that destroyed billions in capital? For this, we try to rely on our modeling systems and our understanding of the major markets. Let’s get started by looking at the NASDAQ with two modeling systems (the Fibonacci Price Modeling System and the Adaptive Dynamic Learning system).

This first chart is a Daily Adaptive Dynamic Learning (ADL) model representation of what this modeling system believes will be the highest probability outcome of price going forward 20 days. Notice that we are asking it to show use what it believes will happen from last week’s trading activity (ignoring anything prior). This provides us the most recent and relevant data to review.

We can see from the “range lines” (the red and green price range levels shown on the chart), that upside price range is rather limited to recent highs whereas downside prices swing lower (to near 6200 and below) rather quickly. Additionally, the highest probability price moves indicate that we could see some downside price rotation over the Thanksgiving week followed by a retest of recent high price levels throughout the end of November.

This NQ Weekly chart, below, is showing our Fibonacci price modeling system and the fact that we are currently in an extended bullish run that, so far, shows no signs of stalling. The Fibonacci Price Breach Level (the red line near the right side of the chart) is showing us that we should be paying attention to the 6075 level for any confirmation of a bearish trend reversal. Notice how that aligns with the blue projected downside support level (projected into future price levels). Overall, for the NQ or the US majors to show any signs of major weakness, these Fibonacci levels would have to be tested and breached. Until that happens, expect continued overall moderate bullish price activity. When it happens, look out below.

This NQ Weekly chart, below, is showing our Fibonacci price modeling system and the fact that we are currently in an extended bullish run that, so far, shows no signs of stalling. The Fibonacci Price Breach Level (the red line near the right side of the chart) is showing us that we should be paying attention to the 6075 level for any confirmation of a bearish trend reversal. Notice how that aligns with the blue projected downside support level (projected into future price levels). Overall, for the NQ or the US majors to show any signs of major weakness, these Fibonacci levels would have to be tested and breached. Until that happens, expect continued overall moderate bullish price activity. When it happens, look out below.

The next charts we are going to review are the Metals markets (Gold and Silver). Currently, an interesting setup is happening with Silver. It appears to show that volatility in the Silver market will be potentially much greater than the volatility in the Gold market. This would indicate that Silver would be the metal to watch going into and through the end of this year. This first chart is showing the ADL modeling system and highlighting the volatility and price predictions that are present in the Silver market. Pay attention to the facts that ranges and price projections are rather stable till about 15 days out – that’s when we are seeing a massive upside potential in Silver.

This next chart is the Fibonacci Price Modeling system on a Weekly Silver chart. What is important here is the recent price rotation that has setup the Fibonacci Price Breach trigger to the upside (currently). This move is telling us that as long as price stays above $16.89 on a Weekly closing price basis, then Silver should attempt to push higher and higher over time. The projected target levels are $19.50, $20.25 and $21.45. Notice any similarity in price levels between the Fibonacci analysis and the ADL analysis? Yes, that $16.89 level is clearly identified as price range support by the ADL modeling system (the red price range expectation lines).

How will this playout in our opinion with Bitcoin potentially rotating lower off this double top while the metals appear to be basing and potentially reacting to fear in the market? Allow us to explain what we believe will be the most likely pathway forward…

How will this playout in our opinion with Bitcoin potentially rotating lower off this double top while the metals appear to be basing and potentially reacting to fear in the market? Allow us to explain what we believe will be the most likely pathway forward…

At first, this holiday week in the US, the markets will be quiet and not show many signs of anything. Just another holiday week in the US with the markets mostly moderately bullish – almost on auto-pilot for the holidays. Then closing in on the end of November, we could start to see some increased volatility and price rotation in the metals and the US majors. If Bitcoin has moved by this time, we would expect that it would be setting up a rotational low above the -30% lows recently set. In other words, Bitcoin would likely fall 8~15% on rotation, then stall before attempting any further downside moves.

By the end of November, we expect the US markets to have begun a price pattern formation that indicates sideways/stalling price activity moving into the end of this year. This ADL Daily ES Chart clearly shows what is predicted going forward 20 days with price rotating near current highs for a few days before settling lower (near 2540~2550 through early Christmas 2017). The ADL projected highs are not much higher than recent high price levels, therefore we do not expect the ES to attempt to push much higher than 2595 in the immediate future. It might try to test this level or rotate a bit higher as a washout high, but our analysis shows that prices should be settling into complacency for the next week or two while settling near the lower range of recent price activity.

What you should take away from this analysis is the following : don’t expect any massive upside moves between now and the end of the year that last longer than a few days. Don’t expect the markets to rocket higher unless there is some unexpected positive news from somewhere that changes the current expectations. Expect Silver to begin to move higher in early December as well as expect Gold to follow Silver. We believe Silver is the metal to watch as it will likely be the most volatile and drive the metals move. Expect the major markets to be quiet through the Thanksgiving week with a potential for moderate bullish price activity before settling into a complacent retracement mode through the end of November and early December.

What you should take away from this analysis is the following : don’t expect any massive upside moves between now and the end of the year that last longer than a few days. Don’t expect the markets to rocket higher unless there is some unexpected positive news from somewhere that changes the current expectations. Expect Silver to begin to move higher in early December as well as expect Gold to follow Silver. We believe Silver is the metal to watch as it will likely be the most volatile and drive the metals move. Expect the major markets to be quiet through the Thanksgiving week with a potential for moderate bullish price activity before settling into a complacent retracement mode through the end of November and early December.

If Bitcoin does what we expect by creating a rotational lower price breakout setup from recent highs, we’ll know within a week or two. If this $8000 level holds as resistance, then we will clearly see Bitcoin rotate into a defensive market pattern (a flag formation or some other harmonic pattern above support). The US majors will likely follow this move as a broader fear could begin gripping the markets.

Lastly, as we mentioned last week, pay very close attention to the Transportation Index and it’s ability to find/hold support. Unless the Transportation index finds some level of support and begins a new bullish trend, we could be in for a more dramatic move early next year. Our last article clearly laid out our concerns regarding the Transportation Index and the broader market cycles. All of our analysis should be taken as segments of a much larger market picture. We are setting up for an interesting holiday season where the market could turn in an instant on fear or news of some global event (like a Bitcoin collapse). The volatility we are seeing our modeling systems predict is increasing (especially in the Silver market over the next few weeks). We could be headed for a bumpy ride with a classic top formation setting up.

Overall, protect your investments and your long positions. Many people will be away from their PCs and away from the markets over the holidays. It is important that you understand the risks that continue to play out in the markets. Pay attention to market sectors that are at risk of showing us greater fear or weakness in the major markets. Pay attention to these increases in volatility and price rotation. Most of all, pay attention to the market’s failure to move higher over this holiday season because we should be traditionally expecting the Christmas Rally to push equities moderately higher at this time.

Overall, protect your investments and your long positions. Many people will be away from their PCs and away from the markets over the holidays. It is important that you understand the risks that continue to play out in the markets. Pay attention to market sectors that are at risk of showing us greater fear or weakness in the major markets. Pay attention to these increases in volatility and price rotation. Most of all, pay attention to the market’s failure to move higher over this holiday season because we should be traditionally expecting the Christmas Rally to push equities moderately higher at this time.

Should we see any more clear signs of weakness or market rotation, you will know about it with our regular updates to the public. If you want to know how Acitve Trading Partners can assist you in staying up to day with the market cycles and analysis, then visit the Active Trading Partners and learn how we can assist you with detailed market research, daily updates, trading signals and more.

We are dedicated to helping you achieve success in the markets and do our best to make sure you are prepared for any future market moves. See how we can assist you now and in 2018 to achieve greater success.

Labels:

Bitcoin,

Bitcoin Cash,

cash,

Chris Vermeulen,

cryptos,

Drilling,

Gas,

gld,

global,

investment,

markets,

money,

Oil,

Silver,

slv

Tuesday, August 1, 2017

Could There Be a Reversal Coming to the Major U.S. Markets?

Technically speaking, this week could be very important for the major U.S. equity markets. There is an appearance of a “TOPPING PATTERN” forming. I am now awaiting confirmation by the actions of the equity markets, this week. Expect downward pressure beginning this month of August of 2017.

There is currently limited upside potential in the SPX relative to potential downside for the months of August, September and the early part of October 2017.

There are signs for the short, intermediate and longer term trends returning for the best six months of trading officially inaugurated in November of 2017! This is the timing framework when ‘The Next Runaway Leg Up In The Stock Market Will Resume.’

In last weeks’ market action as the profit taking rotation out of the high-tech sector rotated into the Dow Industrials, it reflected

a more defensive approach while being invested in “Blue Chips” during which time it achieved a new high. Sector rotation increased especially noticeable in the transports and technology sectors that were leading the markets higher. If they continue lower, more sectors will join the decline. I am expecting a coming pop in the VIX on Aug 4, Aug 23, Sept 11 or 12 and finally Sept 28 or 29. 2017. There was a flight to safety in the Yen as well as a strengthening of the price of Gold, Silver, Bitcoin and WTI Crude Oil.

An Unusual Anomaly

Over the past couple of weeks, there was this unusual Anomaly which occurred, as you can see in the chart below. It now makes me more cautious about our long understanding of “risk interconnectivity”.

How can the equity, gold, silver, crude oil and bitcoin markets ALL go HIGHER together?

Tune in every morning for my video analysis and market forecasts at The Gold & Oil Guy to know where the main ‘asset classes’ are headed tomorrow, this week, and next month.

In short, the major equities trend remains to the upside but its likely to take shape in a slow grinding process with downward pressure starting in August fora couple months.

Be sure to follow my daily pre-market video forecasts and ETF trades by visiting here at The Gold and Oil Guy

Chris Vermeulen

The Only Chart You Need To See!

There is currently limited upside potential in the SPX relative to potential downside for the months of August, September and the early part of October 2017.

There are signs for the short, intermediate and longer term trends returning for the best six months of trading officially inaugurated in November of 2017! This is the timing framework when ‘The Next Runaway Leg Up In The Stock Market Will Resume.’

In last weeks’ market action as the profit taking rotation out of the high-tech sector rotated into the Dow Industrials, it reflected

a more defensive approach while being invested in “Blue Chips” during which time it achieved a new high. Sector rotation increased especially noticeable in the transports and technology sectors that were leading the markets higher. If they continue lower, more sectors will join the decline. I am expecting a coming pop in the VIX on Aug 4, Aug 23, Sept 11 or 12 and finally Sept 28 or 29. 2017. There was a flight to safety in the Yen as well as a strengthening of the price of Gold, Silver, Bitcoin and WTI Crude Oil.

An Unusual Anomaly

Over the past couple of weeks, there was this unusual Anomaly which occurred, as you can see in the chart below. It now makes me more cautious about our long understanding of “risk interconnectivity”.

How can the equity, gold, silver, crude oil and bitcoin markets ALL go HIGHER together?

Tune in every morning for my video analysis and market forecasts at The Gold & Oil Guy to know where the main ‘asset classes’ are headed tomorrow, this week, and next month.

In short, the major equities trend remains to the upside but its likely to take shape in a slow grinding process with downward pressure starting in August fora couple months.

Be sure to follow my daily pre-market video forecasts and ETF trades by visiting here at The Gold and Oil Guy

Chris Vermeulen

Tuesday, June 27, 2017

The Best Way to Protect Yourself From Out of Control Governments

By Nick Giambruno, editor, Crisis Investing

You probably know it’s a bad idea to put all of your asset eggs in one investment basket. The same goes for holding all of your assets in one country. But how much thought have you put into political diversification? With proper planning, you can greatly reduce the risk your home government presents to your financial and personal well being.

International diversification frees you from absolute dependence on any one country. Achieve that freedom, and it becomes very difficult for any group of bureaucrats to control you. The results can be life changing. Everyone in the world should aim for political diversification. Though it’s especially critical for those who live under a government sinking hopelessly deeper into financial trouble.

That means most Western governments. The US in particular. To get started, there are four core areas to consider: your savings, your citizenship, your income, and your digital presence.

You can diversify your savings in several ways:

Unlike digital financial assets, it's probably impossible for your home country to seize your foreign real estate. Owning foreign real estate is one of the very few ways you can legally maintain some privacy for your wealth. In that sense, foreign real estate is the new Swiss bank account.

Foreign real estate often opens up other diversification options. In many cases, owning property in a foreign country makes it easier to open a bank account in that country.

It can also put you on the road to obtaining residency in a foreign country. It can even put you on a shortened path to citizenship in some cases. Lastly, owning foreign real estate gives you a second home, vacation hideaway, or place to retire. It’s an emergency “bolt hole” should you need to escape trouble back home.

There’s another important reason to get a second passport. No matter where you live, your home government can revoke your passport at any moment under any pretext it finds convenient. Your passport doesn’t actually belong to you. It belongs to the government. Having a second passport means that you can always escape your home country without having to live like a refugee.

Still, it’s essential to take the necessary steps before the government slams your window of opportunity shut. If history is any guide, it won’t be open forever. It's much better to have developed and implemented your game plan a year early than a minute late.

International diversification is a time tested strategy to protect you from desperate and out of control governments. Wealthy people around the world have used it for centuries to effectively protect their money and their families. Now, thanks to modern technology, anyone can implement similar strategies.

Regards,

Nick Giambruno

Editor, Crisis Investing

P.S. Taking the simple steps above is now more important than ever. As you'll see, widespread economic chaos is coming… America is about to enter a crisis far more severe than what we saw in 2008–2009.

Most investors aren’t prepared for what's coming. But Doug Casey and I know how to turn these types of situations into huge profits. And in this video, we share need to know information about the coming global economic meltdown.

Click Here to Watch it Now.

You probably know it’s a bad idea to put all of your asset eggs in one investment basket. The same goes for holding all of your assets in one country. But how much thought have you put into political diversification? With proper planning, you can greatly reduce the risk your home government presents to your financial and personal well being.

International diversification frees you from absolute dependence on any one country. Achieve that freedom, and it becomes very difficult for any group of bureaucrats to control you. The results can be life changing. Everyone in the world should aim for political diversification. Though it’s especially critical for those who live under a government sinking hopelessly deeper into financial trouble.

That means most Western governments. The US in particular. To get started, there are four core areas to consider: your savings, your citizenship, your income, and your digital presence.

Diversify Your Savings

It’s crucial to place some of your assets beyond the easy reach of your home government. It keeps that government from trapping your money if and when it implements capital controls or outright asset seizures. Any government can do either without warning.You can diversify your savings in several ways:

-

Foreign bank accounts

-

Precious metals held abroad

-

Foreign real estate

Unlike digital financial assets, it's probably impossible for your home country to seize your foreign real estate. Owning foreign real estate is one of the very few ways you can legally maintain some privacy for your wealth. In that sense, foreign real estate is the new Swiss bank account.

Foreign real estate often opens up other diversification options. In many cases, owning property in a foreign country makes it easier to open a bank account in that country.

It can also put you on the road to obtaining residency in a foreign country. It can even put you on a shortened path to citizenship in some cases. Lastly, owning foreign real estate gives you a second home, vacation hideaway, or place to retire. It’s an emergency “bolt hole” should you need to escape trouble back home.

Diversify Your Citizenship

One way to diversify your citizenship is with a second passport. Unfortunately, there is no route to a second passport that is simultaneously easy, fast, cheap, and legitimate. But that does not decrease the benefits of having one. Among other things, having a second passport allows you to invest, bank, travel, live, and do business in places you wouldn’t otherwise be able to.There’s another important reason to get a second passport. No matter where you live, your home government can revoke your passport at any moment under any pretext it finds convenient. Your passport doesn’t actually belong to you. It belongs to the government. Having a second passport means that you can always escape your home country without having to live like a refugee.

Diversify Your Income

Income diversification means structuring your cash flows so you’re less dependent on any one country for your income. The goal is to create multiple sources of revenue from international investment opportunities and trends. Bonus diversification points if you do all this through your own offshore company domiciled in a favorable jurisdiction.

Diversify Your Digital Presence

Moving your digital presence to ideal foreign jurisdictions also adds significant political diversification benefits. This commonly includes your IP address (which often pinpoints you to a precise physical address), email account, online file storage, and the components of personal and business websites.

Plan for Bigger Government

Somehow, someway, your home government will keep squeezing your pocketbook harder and keep subjecting you to escalating, arbitrary, and burdensome regulations and restrictions. Expect more government and less freedom all around. The window to protect yourself closes a bit more with each passing week. The good news is you can start to diversify internationally without leaving your home country, or even your living room.Still, it’s essential to take the necessary steps before the government slams your window of opportunity shut. If history is any guide, it won’t be open forever. It's much better to have developed and implemented your game plan a year early than a minute late.