The calm of the last 3 weeks has resulted in a risk on environment. This, in turn, has led to a nice recovery rally in stocks. For the time being, volatility has subsided. However, we believe there are many underlying market risks that can still resurface without any warning.

From late 2015 to August 2020, the price of gold doubled, going from approximately $1040 to $2080. Gold then experienced a profit taking $400 pullback. Gold’s rally over the past 12 months failed to break through its $2080 price level. After retreating back to $200, gold seems to have found support at the $1900 level.

In reviewing the following spot gold chart, it appears we have broken out of an accumulation phase and seem to be preparing to move above the $2080 high.....Continue Reading Here.

Trade ideas, analysis and low risk set ups for commodities, Bitcoin, gold, silver, coffee, the indexes, options and your retirement. We'll help you keep your emotions out of your trading.

Showing posts with label money. Show all posts

Showing posts with label money. Show all posts

Tuesday, April 5, 2022

Waiting For GLD To Make New Highs - Gold Rally Is Still Intact

Thursday, March 10, 2022

How You Can Minimize Trading Risk & Grow Capital During A Global Crisis

To minimize trading risk and grow capital during a global crisis is somewhat hinged on the answers to speculative questions.

- How long will the Russia – Ukraine war last?

- How high is the price of oil and gas going to go?

- How quickly will central banks raise interest rates to counter high inflation?

- What assets should I put my money into?

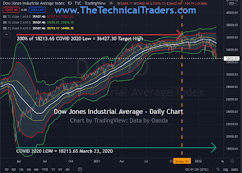

Knowing what the Best Asset Now (BAN) is, is critical for risk management and consistent growth no matter the market condition. Buy the Dip or Sell the Rally? Let's start here with the DJI weekly chart

Labels:

commodities,

currency,

investing,

money,

Oil Prices,

Russia,

stocks,

Ukraine

Friday, June 4, 2021

Learn How to Take Advantage of Volatility And Profit From It

Volatility is the most common way to measure risk in the financial markets. While there are a plethora of methods, calculations, and derivatives to calculate volatility, they are all trying to accomplish the same goal: what is the price of a security going to do in the future? Without a crystal ball, there’s no perfect answer, but let’s go through a few common ways that we can estimate future volatility.

Let’s Talk Volatility

Generally speaking, there are two types of volatility that traders and investors use in an effort to understand risk – historical volatility and implied volatility....Continue Reading Here.

Let’s Talk Volatility

Generally speaking, there are two types of volatility that traders and investors use in an effort to understand risk – historical volatility and implied volatility....Continue Reading Here.

Labels:

Chris Vermeulen,

investing,

money,

stocks,

The Technical Traders,

VIX,

volatility,

VVIX

Sunday, May 2, 2021

Utilities Continues To Rally – Is It Sending A Warning Signal Yet?

We have experienced an incredible rally in many sectors over the past 5+ months. My research team has been pouring over the charts trying to identify how the next few weeks and months may play out in terms of continued trending or risks of some price volatility setting up. We believe the Utilities Sector may hold the key to understanding how and when the US markets will reach some level of stronger resistance as many sector ETFs are trading in new all time high price ranges.

Utilities Sector Resistance at $71.10 Should Not Be Ignored

The Utilities Sector has continued to rally since setting up a unique bottom in late February 2021. A recent double top setup, near $68, suggests resistance exists just above current trading levels. Any continuation of this uptrend over the next few weeks, targeting the $70 Fibonacci 100% Measured Move, would place the XLU price just below the previous pre COVID19 highs near $71.10 (the MAGENTA Line).

My research suggests the momentum up this recent uptrend may continue to push prices higher into early May, quite possibly setting up the Utilities ETF for a rally above $70. Yet, we believe the resistance near $71.10 will likely act as a strong barrier for price and may prompt a downward price correction after the completion of the Fibonacci 100% Measured Price Move. In other words, the recent rally across many sectors will likely continue for a bit longer before key resistance levels begin to push many sectors into some sideways trading ranges....Continue Reading Here.

Utilities Sector Resistance at $71.10 Should Not Be Ignored

The Utilities Sector has continued to rally since setting up a unique bottom in late February 2021. A recent double top setup, near $68, suggests resistance exists just above current trading levels. Any continuation of this uptrend over the next few weeks, targeting the $70 Fibonacci 100% Measured Move, would place the XLU price just below the previous pre COVID19 highs near $71.10 (the MAGENTA Line).

My research suggests the momentum up this recent uptrend may continue to push prices higher into early May, quite possibly setting up the Utilities ETF for a rally above $70. Yet, we believe the resistance near $71.10 will likely act as a strong barrier for price and may prompt a downward price correction after the completion of the Fibonacci 100% Measured Price Move. In other words, the recent rally across many sectors will likely continue for a bit longer before key resistance levels begin to push many sectors into some sideways trading ranges....Continue Reading Here.

Labels:

Chris Vermeulen,

energy,

ETFs,

GUT,

investing,

money,

The Technical Traders,

utilities,

VIX,

volatility,

XLU

Monday, April 12, 2021

Latest Price Targets for Gold, Silver and Platinum

Join Chris Vermeulen as he provides an overview, chart patterns, and projected trends for the gold, silver, and platinum markets for the upcoming quarter.

Patterns always repeat. Sometimes they take months or years but they always repeat. Gold’s 8 months consolidation is nothing new when we look at 2008 where we lost 34% before bouncing off the .382 and .5 Fibonacci retracement area between $741-$650.

Patterns always repeat. Sometimes they take months or years but they always repeat. Gold’s 8 months consolidation is nothing new when we look at 2008 where we lost 34% before bouncing off the .382 and .5 Fibonacci retracement area between $741-$650.

We then found its next resistance at the .618 ext around $1153 before it began to scream higher to the 1 ext at over $1900 an ounce. As Rick Rule President and CEO of Sprott says, “if past is prologue” and we pull back to the same fib level as 2008, we are there right now or could go as low as $1560. But how high will it go?

Silver blasted out of its multi-year basing formation last year to around $30 an ounce before falling to a low around $22, between the .382 and .5 Fibonacci extensions. We have strong support between $20 and $21, but it is still in a strong bull flag pattern. Where will this bull flag pattern take us?

Not as many people are interested in Platinum as it has been pretty dormant after crashing in 2008, when it was at a premium to gold. The chart looks very different from Gold with more of a “random” feel. Platinum just tested its recent high in 2016 around $1200 an ounce which is bullish, however it still has a long way to go before it tests support like gold around the .382/.5 Fibonacci retracement levels.

Overall, we never know if gold, silver, platinum, or palladium will go ballistic first so it can be a good strategy to own a basket of all of them in a balanced, diversified portfolio....Read More Here.

Silver blasted out of its multi-year basing formation last year to around $30 an ounce before falling to a low around $22, between the .382 and .5 Fibonacci extensions. We have strong support between $20 and $21, but it is still in a strong bull flag pattern. Where will this bull flag pattern take us?

Not as many people are interested in Platinum as it has been pretty dormant after crashing in 2008, when it was at a premium to gold. The chart looks very different from Gold with more of a “random” feel. Platinum just tested its recent high in 2016 around $1200 an ounce which is bullish, however it still has a long way to go before it tests support like gold around the .382/.5 Fibonacci retracement levels.

Overall, we never know if gold, silver, platinum, or palladium will go ballistic first so it can be a good strategy to own a basket of all of them in a balanced, diversified portfolio....Read More Here.

Labels:

Chris Vermeulen,

commodities,

fibonacci,

gold,

investing,

money,

platinum,

Silver,

The Technical Traders

Monday, March 15, 2021

Are The U.S. Markets Sending a Warning Sign?

After an incredible rally phase that initiated just one day before the US elections in November 2020, we’ve seen certain sectors rally extensively. Are the markets starting to warn us that this rally phase may be stalling? We noticed very early that some of the strongest sectors appear to be moderately weaker on the first day of trading this week. Is it because of Triple-Witching this week (Friday, March 19, 2021)? Or is it because the Treasury Yields continue to move slowly higher? What’s really happening right now and should traders/investors be cautious?

The following XLF Weekly chart shows how the Financial sector rallied above the upper YELLOW price channel, which was set from the 2018 and pre COVID-19 2020 highs. Early 2021 was very good for the financial sector overall, we saw a 40%+ rally in this over just 6 months on expectations that the US economy would transition into a growth phase as the new COVID vaccines are introduced.

We are also concerned about an early TWEEZERS TOP pattern that has set up early this week. If price continues to move lower as we progress through futures contract expiration week, FOMC, and other data this week, then we may see some strong resistance setting up near $35.25. Have the markets gotten ahead of themselves recently? Could we be setting up for a moderately deeper pullback in price soon?....Read More Here.

The following XLF Weekly chart shows how the Financial sector rallied above the upper YELLOW price channel, which was set from the 2018 and pre COVID-19 2020 highs. Early 2021 was very good for the financial sector overall, we saw a 40%+ rally in this over just 6 months on expectations that the US economy would transition into a growth phase as the new COVID vaccines are introduced.

We are also concerned about an early TWEEZERS TOP pattern that has set up early this week. If price continues to move lower as we progress through futures contract expiration week, FOMC, and other data this week, then we may see some strong resistance setting up near $35.25. Have the markets gotten ahead of themselves recently? Could we be setting up for a moderately deeper pullback in price soon?....Read More Here.

Labels:

Chris Vermeulen,

investing,

money,

SP500,

SSO,

stocks,

The Technical Traders,

XLF

Wednesday, February 24, 2021

Bonds And Stimulus Are Driving Big Sector Trends And Shifting Capital

Falling Bonds and rising yields are creating a condition in the global markets where capital is shifting away from Technology, Communication Services and Discretionary stocks have suddenly fallen out of favor, and Financials, Energy, Real Estate, and Metals/Miners are gaining strength. The rise in yields presents an opportunity for Banks and Lenders to profit from increased yield rates. In addition, historically low interest rates have pushed the Real Estate sector, including commodities towards new highs.

We also note Miners and Metals have shown strong support recently as the US Dollar and Bonds continue to collapse. The way the markets are shifting right now is suggesting that we may be close to a technology peak, similar to the DOT COM peak, where capital rushes away from recently high flying technology firms into other sectors (such as Banks, Financials, Real Estate, and Energy).

The deep dive in Bonds and the US Dollar aligns with the research we conducted near the end of 2020, which suggested a market peak may set up in late February. We also suggested the markets may continue to trade in a sideways (rounded top) type of structure until late March or early April 2021. Our tools and research help us to make these predictions nearly 4 to 5+ months before the markets attempt to make these moves....You Can Read This Research Here.

We also note Miners and Metals have shown strong support recently as the US Dollar and Bonds continue to collapse. The way the markets are shifting right now is suggesting that we may be close to a technology peak, similar to the DOT COM peak, where capital rushes away from recently high flying technology firms into other sectors (such as Banks, Financials, Real Estate, and Energy).

The deep dive in Bonds and the US Dollar aligns with the research we conducted near the end of 2020, which suggested a market peak may set up in late February. We also suggested the markets may continue to trade in a sideways (rounded top) type of structure until late March or early April 2021. Our tools and research help us to make these predictions nearly 4 to 5+ months before the markets attempt to make these moves....You Can Read This Research Here.

Friday, February 12, 2021

Platinum Begins Big Breakout Rally....What Does That Mean for Investors & Traders?

If you were not paying attention, Platinum began to rally much higher over the past 3+ days – initiating a new breakout rally and pushing well above the $1250 level. What you may not have noticed with this breakout move is that commodities are hot – and inflation is starting to heat up. What does that mean for investors/traders?

Daily Platinum Chart Shows Clear Breakout Trend

First, Platinum is used in various forms for industrial and manufacturing, as well as jewelry and numismatic functions (minting/collecting). This move in Platinum is more likely related to the increasing inflationary pressures we’ve seen in the Commodity sector coupled with the increasing demand from the surging global economy (nearing a post-COVID-19 recovery). The most important aspect of this move is the upward pricing pressure that will translate into Gold, Silver, and Palladium.

We’ve long suggested that Platinum would likely lead a rally in precious metals and that a breakout move in platinum could prompt a broader uptrend in other precious metals. Now, the combination of this type of rally in Platinum combined with the Commodity rally and the inflationary pressures suggests the global markets could be in for a wild ride over the next 12 to 24+ months....Read More Here.

Labels:

Chris Vermeulen,

gold,

investing,

money,

platinum,

precious metals,

Silver,

stocks,

The Technical Traders

Wednesday, January 27, 2021

VIX and Defensive Sectors React To Perceived Trend Weakness

Since early November 2020, the VIX has continued to decline and consolidate near the 22 level. Late in December 2020 and beyond, the VIX started setting up series high price spikes – which indicates a flagging downside pattern is setting up. You can see this setup across the recent VIX highs.

Additionally, the VIX has “stepped” higher, moving from lows near 19.50 to higher lows near 21.00. This upward stepping base is indicative of a shift in volatility. My research team and I interpret this data as a sign that trend weakness is starting to build after the strong rally that initiated in early November 2020.

Although we have not seen any clear sign that the markets are about to reverse or decline, this move in the VIX is suggesting that volatility is increasing. The high price “breakout”, yesterday, in the VIX suggests a flag setup is nearing an Apex/breakout point....Read More Here.

Additionally, the VIX has “stepped” higher, moving from lows near 19.50 to higher lows near 21.00. This upward stepping base is indicative of a shift in volatility. My research team and I interpret this data as a sign that trend weakness is starting to build after the strong rally that initiated in early November 2020.

Although we have not seen any clear sign that the markets are about to reverse or decline, this move in the VIX is suggesting that volatility is increasing. The high price “breakout”, yesterday, in the VIX suggests a flag setup is nearing an Apex/breakout point....Read More Here.

Labels:

Chris Vermeulen,

daytrading,

energy,

investing,

money,

stocks,

The Technical Traders,

VIX

Friday, January 15, 2021

Our Custom Valuations Index Suggests Precious Metals Will Decline Before Their Next Attempt to Rally

My team prepares Custom Valuations Index charts to understand how capital is being deployed in the global markets alongside U.S. Dollar and Treasury Yields. The purpose of the Custom Index charts in this article is to provide better insight into and understanding of underlying capital movements in various market conditions.

Recently, we discovered the Custom Index chart shares a keen alignment with Gold (and likely the general precious metals sector). Let’s explore our recent analysis to help readers understand what to expect next in precious metals.

Weekly Custom Valuations Index Chart

The first thing that caught my attention was the very clear decline in the weekly Custom Valuations Index recently, as can be seen in the chart below. The second peak on the Custom Valuations Index chart occurred on the week of August 3, 2020. Gold also peaked at this very same time. This alignment started an exploratory analysis of the Custom Valuations Index and the potential alignment with the precious metals sector....Read More Here.

Weekly Custom Valuations Index Chart

The first thing that caught my attention was the very clear decline in the weekly Custom Valuations Index recently, as can be seen in the chart below. The second peak on the Custom Valuations Index chart occurred on the week of August 3, 2020. Gold also peaked at this very same time. This alignment started an exploratory analysis of the Custom Valuations Index and the potential alignment with the precious metals sector....Read More Here.

Labels:

Chris Vermeulen,

gold,

investing,

money,

precious metals,

Silver,

stocks,

The Technical Traders

Sunday, December 13, 2020

Custom Index Charts Suggest U.S. Stock Market Ready for a Pause

Weeks after the Election Rally initiated a moderately strong upside breakout rally, our Custom Index charts suggest the US stock market may be ready for a brief pause in trending before any new trends continue. Global traders and investors jumped into the US stock market just days before the US elections expecting something big to take place. The rally that initiated just days before the US election pushed our Custom Index charts well into the upper range of the 2016 to 2018 upward sloping price channel. This suggests the US stock markets have ended the downward price reversion and are now attempting to extend into the upward price channel....attempting to resume the upward trending that started after the 2016 elections.

Weekly Smart Cash and Volatility Indexes

The Weekly Smart Cash Index, below, highlights the impressive rally recently and the upward sloping price channel that is back in play for price. The highlighted range of the upward sloping price channel is actually the lower half of the std deviation range of the 2016 to 2018 price channel. So, as of right now, the Smart Cash Index price level has yet to really breach the middle of this channel and is still only within the lower half of the channel. Still, the support near the lower boundary of this level has been retested two or three times over the past six months and held. This suggests the lower channel level (the lower heavy BLUE line) is now acting as moderate price support....Continue Reading Here.

Weekly Smart Cash and Volatility Indexes

The Weekly Smart Cash Index, below, highlights the impressive rally recently and the upward sloping price channel that is back in play for price. The highlighted range of the upward sloping price channel is actually the lower half of the std deviation range of the 2016 to 2018 price channel. So, as of right now, the Smart Cash Index price level has yet to really breach the middle of this channel and is still only within the lower half of the channel. Still, the support near the lower boundary of this level has been retested two or three times over the past six months and held. This suggests the lower channel level (the lower heavy BLUE line) is now acting as moderate price support....Continue Reading Here.

Labels:

cash,

Chris Vermeulen,

daytrading,

investing,

money,

SPY,

stocks,

The Technical Traders,

volatility

Friday, October 2, 2020

Massive Dark Cloud Cover Pattern Above Critical Support - Will It Hold?

Research Highlights....

- A Dark Cloud Cover pattern is a Japanese Candlestick Pattern that is typically associated with major top setups.

- Critical Support on the SPY highlighted by multiple technical analysis strategies suggests 335~335.25 is acting as a major support level.

- If price stays below the $339.95 level, then we interpret the trend as being Bearish. If price moves above the $343.55 level, it is Bullish.

My advanced price modeling systems and Fibonacci Price Amplitude Arcs (originating from the 2009 bottom) have clearly identified this area as a critical resistance/support zone....Continue Reading Here.

Labels:

Candlestick,

Chris Vermeulen,

fibonacci,

investing,

money,

SP500,

stocks,

The Technical Traders

Monday, September 21, 2020

Global Markets Break Hard to the Downside - Watch These Support Levels

Research Highlights....

My research team and I warned followers to “stay cautious” throughout much of the price rally as our proprietary price modeling systems suggests the rally was isolated and not organic. The U.S. Fed has spewed capital into the markets and speculative traders piled into the “excess phase” of the market to drive price levels higher. Take a moment to review these recent research posts to learn more....Continue Reading Here.

- New reports of widespread financial corruption likely triggered the current sell off.

- Watch out for market support levels to see if this is a short term correction or the start of a downtrend.

- Support for the DOW is just above 26,000.

- Support for the SP500 is around 3,100.

My research team and I warned followers to “stay cautious” throughout much of the price rally as our proprietary price modeling systems suggests the rally was isolated and not organic. The U.S. Fed has spewed capital into the markets and speculative traders piled into the “excess phase” of the market to drive price levels higher. Take a moment to review these recent research posts to learn more....Continue Reading Here.

Labels:

banks,

Chris Vermeulen,

corruption,

gold,

investing,

money,

stocks,

The Technical Traders

Monday, September 14, 2020

It’s Go Time for Gold - Next Stop $2,250

Research Highlights....

* Gold Pennant/Flag formation is now complete and setting

* Gold Pennant/Flag formation is now complete and setting

up new momentum base near $1,925.

* Our Adaptive Fibonacci Models suggest support will prompt

* Our Adaptive Fibonacci Models suggest support will prompt

new Gold rally to $2,250.

* The rally in Gold will continue to extend higher over the next

* The rally in Gold will continue to extend higher over the next

4+ weeks.

The U.S. Dollar may move lower and/or the US stock market may break recent support to prompt this new rally in Gold. If you are a follower of my research, then you know I follow gold and silver closely. I believe Gold has completed a Pennant/Flag formation and has completed the Pennant Apex.

The U.S. Dollar may move lower and/or the US stock market may break recent support to prompt this new rally in Gold. If you are a follower of my research, then you know I follow gold and silver closely. I believe Gold has completed a Pennant/Flag formation and has completed the Pennant Apex.

Further, a new momentum base has setup near $1,925 - $1,930, near the upper range of our Adaptive Fibonacci Price Modeling System’s support range. My team and I believe the current upside price move after the Pennant Apex may be the start of a momentum base rally targeting the $2,250 level or higher.....Continue Reading Here.

Labels:

Chris Vermeulen,

daytrading,

gold,

investing,

money,

Silver,

stocks,

The Technical Traders

Sunday, September 6, 2020

Traders Dreams Come True - Big Technical Price Swings Pending on the SP500

Research Highlights....

* A potentially critical price inflection point and technical

pattern setup that has nearly completed and validated over

the past few days, weeks, and months.

* Potential flag/pennant formation on our Custom Valuations

Index Weekly Chart shows a possible 11% to 16% 9 or

more) downside price correction in SPY.

* Fibonacci Price Modeling system’s projects SPY downside

target level near $284.50 before a bounce.

Over the past few weeks and months, my team and I have published a series of research articles suggesting the continued market melt up was driven by speculation and the U.S. Fed’s policies and support for the markets. We’ve also highlighted a number of technical patterns that have setup within various symbols that have generated strong warnings of a potential price reversal over the past few weeks. The biggest pattern has been the Head-and-Shoulders price patterns. The sudden downside price move in the NASDAQ, and other markets, last week caught many traders/investors off-guard. One day after a very strong rally in the US stock markets, the price reversed and sold-off nearly 6% – a shocking reversal of trend. Red Skys in the mornings – Sailors Take Warning....Continue Reading Here.

Over the past few weeks and months, my team and I have published a series of research articles suggesting the continued market melt up was driven by speculation and the U.S. Fed’s policies and support for the markets. We’ve also highlighted a number of technical patterns that have setup within various symbols that have generated strong warnings of a potential price reversal over the past few weeks. The biggest pattern has been the Head-and-Shoulders price patterns. The sudden downside price move in the NASDAQ, and other markets, last week caught many traders/investors off-guard. One day after a very strong rally in the US stock markets, the price reversed and sold-off nearly 6% – a shocking reversal of trend. Red Skys in the mornings – Sailors Take Warning....Continue Reading Here.

Labels:

Chris Vermeulen,

fibonacci,

how to trade,

investing,

money,

stocks

Friday, July 24, 2020

Silver Begins Big Upside Rally Attempt

The move we saw in Silver early this week to new 6-year high price levels, above $22.60, is quite likely the biggest upside move in Silver since the bottom in March 2020 – after the US stock market collapsed because of the COVID-19 virus event. This new rally in Silver is likely the move we’ve been suggesting to our followers relating to a series of measured upside price moves totaling approximately $5.30 in each advance.

We wrote about these measured price moves in Gold and Silver in this article – Click Here

As traders, watching bonds accelerate moderately higher as the US Dollar falls and the stock market attempts new lofty levels, we are intrigued by the move in metals because it suggests a large segment of investors believe a bubble is nearing very peak valuation levels. The only reason metals, particularly Silver, would be accelerating as it has recently is that traders have suddenly adopted a stronger demand for second stage hedging of risk....Continue Reading Here.

We wrote about these measured price moves in Gold and Silver in this article – Click Here

As traders, watching bonds accelerate moderately higher as the US Dollar falls and the stock market attempts new lofty levels, we are intrigued by the move in metals because it suggests a large segment of investors believe a bubble is nearing very peak valuation levels. The only reason metals, particularly Silver, would be accelerating as it has recently is that traders have suddenly adopted a stronger demand for second stage hedging of risk....Continue Reading Here.

Wednesday, March 11, 2020

Revisiting Our July 2019 Crude Oil Predictions & Our 2020 Forecast

When it comes to our Adaptive Dynamic Learning (ADL) predictive modeling system, we get asked questions from our friends and followers about how it could predict a virus event or how it could predict a price event so far out into the future. The truth of the matter is the ADL predictive modeling system doesn’t predict unknown virus, banking or other types of events.

What it does do, quite well we might add, is identify historically accurate price events (almost like unique DNA markers) and attempts to identify future price events that align with recent price bar (DNA) setups. In other words, it maps the markets highest probability outcomes by studying past price activity and using a unique DNA like mapping system. Once this analysis is complete for any chart, we can ask it what is likely to happen in the future.

On July 8, 2019, our researchers did exactly that and posted an article regarding our findings that many people continue to write us about. Some, at first, in total disbelief that Crude Oil could fall to levels below $40 ever again and others that wanted to know how we came up with these numbers. We set our ADL system to show us what is expected on a Monthly Crude Oil chart going forward and it draws the likely outcome and volatility (highs & Lows).

If our ADL predictive modeling is correct, we will see rotation between $47 and $64 over the next 3+ months before a breakdown in price hits in November 2019. This will be followed by two fairly narrow price range months (December 2019 and January 2020) where oil prices will tighten near $45 to $50. After that tightening, we believe an extremely volatile price move will happen in February through April 2020 that could see oil prices trade as low as $22 and as high as $51 over a two to three-month span.

The most critical component of this early research is the statement we have timed perfectly with our system was “we believe an extremely volatile price move will happen in February through April 2020” and the following price predictions.

The ADL predictive modeling system provided us with a hint that volatility would skyrocket throughout this time in Crude Oil. And, as we all know, this next Daily Crude Oil chart highlights the incredible collapse from early January 2020 (near $65.00) to levels just below $50 in early February. After that, the high price level was near $54.50 and the current low price level is $27.34. We believe this downward price rotation in Crude Oil completely validates our earlier ADL predictive analysis.

Imagine having this type of forecast for our trading and investing! Be sure to opt-in to our free market trend signals newsletter before closing this page so you don’t miss our next special report!

Based on short term Fibonacci price momentum targets we could see fall as low as $17 per barrel, but this price target will change dramatically over the next few days depending on if oil bounces higher from here it is now.

If our research is correct, Crude oil may find a bottom somewhere near $17 to $24, the potential rally back up to somewhere above $37 - $41 ppb before staging another massive selloff. The massive volatility suggested by the ADL system also suggests a broad price range over the next 60+ days.

Thus, we believe crude oil will attempt to form a bottom below $30, then attempt a brief rally to “fill the gap” (or partially fill the gap). After that, supply side economics will take over and crude oil should begin to move back towards the to $30 price level again – just as our ADL predictive modeling system suggested.

As of today, we are getting dozens of emails asking about what we see for the US major markets and global markets with our systems. Everyone wants to know “what’s next?”. Most of that research is delivered to our active subscribers/members and you can gain access to that information simply by visiting my website. You really don’t want to miss these next huge moves.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for short term swing traders.

Visit my ETF Wealth Building Newsletter and if you like what I offer, and ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

The Technical Traders

What it does do, quite well we might add, is identify historically accurate price events (almost like unique DNA markers) and attempts to identify future price events that align with recent price bar (DNA) setups. In other words, it maps the markets highest probability outcomes by studying past price activity and using a unique DNA like mapping system. Once this analysis is complete for any chart, we can ask it what is likely to happen in the future.

On July 8, 2019, our researchers did exactly that and posted an article regarding our findings that many people continue to write us about. Some, at first, in total disbelief that Crude Oil could fall to levels below $40 ever again and others that wanted to know how we came up with these numbers. We set our ADL system to show us what is expected on a Monthly Crude Oil chart going forward and it draws the likely outcome and volatility (highs & Lows).

Here is a link to the original article....Just Visit Here

This Screen Capture From The Original July 2019 Article Clearly States

If our ADL predictive modeling is correct, we will see rotation between $47 and $64 over the next 3+ months before a breakdown in price hits in November 2019. This will be followed by two fairly narrow price range months (December 2019 and January 2020) where oil prices will tighten near $45 to $50. After that tightening, we believe an extremely volatile price move will happen in February through April 2020 that could see oil prices trade as low as $22 and as high as $51 over a two to three-month span.

The most critical component of this early research is the statement we have timed perfectly with our system was “we believe an extremely volatile price move will happen in February through April 2020” and the following price predictions.

The ADL predictive modeling system provided us with a hint that volatility would skyrocket throughout this time in Crude Oil. And, as we all know, this next Daily Crude Oil chart highlights the incredible collapse from early January 2020 (near $65.00) to levels just below $50 in early February. After that, the high price level was near $54.50 and the current low price level is $27.34. We believe this downward price rotation in Crude Oil completely validates our earlier ADL predictive analysis.

Imagine having this type of forecast for our trading and investing! Be sure to opt-in to our free market trend signals newsletter before closing this page so you don’t miss our next special report!

What's Next With The Price of Crude Oil?

If our research is correct, Crude oil may find a bottom somewhere near $17 to $24, the potential rally back up to somewhere above $37 - $41 ppb before staging another massive selloff. The massive volatility suggested by the ADL system also suggests a broad price range over the next 60+ days.

Thus, we believe crude oil will attempt to form a bottom below $30, then attempt a brief rally to “fill the gap” (or partially fill the gap). After that, supply side economics will take over and crude oil should begin to move back towards the to $30 price level again – just as our ADL predictive modeling system suggested.

As of today, we are getting dozens of emails asking about what we see for the US major markets and global markets with our systems. Everyone wants to know “what’s next?”. Most of that research is delivered to our active subscribers/members and you can gain access to that information simply by visiting my website. You really don’t want to miss these next huge moves.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for short term swing traders.

Visit my ETF Wealth Building Newsletter and if you like what I offer, and ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

The Technical Traders

Labels:

Chris Vermeulen,

commodities,

Crude Oil,

gold,

money,

Natural Gas,

Silver,

stocks,

The Technical Traders,

traders

Saturday, January 18, 2020

Energy Continues Basing Setup - Next Breakout Expected Near January 24th

After watching crude oil fall from the $65 ppb level to the $58 ppb level (-10.7%) over the past few weeks, we still believe the energy sector is setting up for another great trade for skilled investors/traders.

We are all keenly aware that winter is still here and that heating oil demands may continue to push certain energy prices higher. Yet winter is also a time when people don’t travel as much and, overall, energy prices tend to weaken throughout Winter.

Over the past 37 years, the historical monthly breakdown for crude oil is as follows....

December: Generally lower by -$0.33 to -$0.86. Averages to the downside: -3.65 to +3.08

January: Generally lower by -$4.57 to -$6.72. Averages to the downside: -2.68 to +2.27

February: Generally higher by +$8.41 to +13.73. Averages to the upside +3.07 to -2.54

March: Generally higher by +7.33 to +$15.62. Averages to the upside by +2.84 to -2.14

Over the past 25 years, the historical monthly breakdown for natural gas is as follows....

December: Generally lower by -$2.34 to -$5.26. Averages to the downside: -0.81 to +0.69

January: Generally lower by -$5.14 to -$7.97. Averages to the downside: -0.69 to +0.45

February: Generally lower by -$1.48 to -$3.62. Averages to the downside -0.50 to +0.49

March: Generally higher by +0.63 to +$1.88. Averages to the upside by +0.41 to -0.70

Over the past 35 years, the historical monthly breakdown for heating oil is as follows....

December: Generally lower by -$0.16 to -$0.37. Averages to the downside: -0.14 to +0.09

January: Generally lower by -$0.52 to -$0.96. Averages to the downside: -0.09 to +0.10

February: Generally higher by +$0.48 to +$1.06. Averages to the upside +0.11 to -0.08

March: Generally higher by +0.03 to +$0.11. Averages to the upside by +0.09 to -0.10

This data suggests an extended winter in the U.S. may prompt further contraction in certain segments of the energy sector that may prompt an exaggerated downside price move in crude oil and natural gas. heating oil may rise a bit if the cold weather continues well past March/April 2019.

Conversely, if an early spring sets up in the U.S., then crude oil may begin to base a bit as people begin to traveling more, but heating oil and natural gas may decline as cold weather demands abate.

Heating oil has almost mirrored crude oil in price action recently. Our modeling systems are suggesting that crude oil may attempt to move below $40 ppb. This move would be a result of a number of factors – mostly slowing global demand and a shift to electric vehicles. We authored this research post early in January 2020 – please review it.

January 8, 2020: Is The Energy Sector Setting Up Another Great Entry?

We believe any price level below $40 in ERY is setting up for a very strong basing level going forward. We have identified two “pullback zones”. The first is what we call the “Deep Pullback Zone”. The second is what we call the “Deeper Pullback Zone”. Any upside price move from below $40 to recent upside target levels (above $50) would represent a 25%+ price rotation.

Historically, February is a very strong month for ERY. The data going back over the past 12 years suggests February produces substantially higher upside price gains (+1899.30 to -394.28) – translating into a 4.8:1 upside price ratio over 12 years. Both January and March reflect overall price weakness in ERY over the past 12 years. Thus, the real opportunity is the setup of the “February price advance”.

We believe any opportunity to take advantage of this historical technical price pattern is advantageous for skilled traders/investors.

This is a pure technical pattern based on price bar data mining. This is something you may not have ever considered unless you had the tools to search for historical price anomalies and rotation patterns. We have created a suite of tools and price modeling systems we use to help our members find incredible opportunities – this being one of them.

Get ready, February will likely prompt a very nice rally in ERY if historical price triggers confirm future price activity. The price pattern in February suggests a large upside price move is likely in ERY and we believe these low price basing patterns are an excellent opportunity for skilled traders.

Join my Wealth Building Newsletter if you like what you read here and ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own.

Chris Vermeulen

The Technical Traders

We are all keenly aware that winter is still here and that heating oil demands may continue to push certain energy prices higher. Yet winter is also a time when people don’t travel as much and, overall, energy prices tend to weaken throughout Winter.

Over the past 37 years, the historical monthly breakdown for crude oil is as follows....

December: Generally lower by -$0.33 to -$0.86. Averages to the downside: -3.65 to +3.08

January: Generally lower by -$4.57 to -$6.72. Averages to the downside: -2.68 to +2.27

February: Generally higher by +$8.41 to +13.73. Averages to the upside +3.07 to -2.54

March: Generally higher by +7.33 to +$15.62. Averages to the upside by +2.84 to -2.14

Over the past 25 years, the historical monthly breakdown for natural gas is as follows....

December: Generally lower by -$2.34 to -$5.26. Averages to the downside: -0.81 to +0.69

January: Generally lower by -$5.14 to -$7.97. Averages to the downside: -0.69 to +0.45

February: Generally lower by -$1.48 to -$3.62. Averages to the downside -0.50 to +0.49

March: Generally higher by +0.63 to +$1.88. Averages to the upside by +0.41 to -0.70

Over the past 35 years, the historical monthly breakdown for heating oil is as follows....

December: Generally lower by -$0.16 to -$0.37. Averages to the downside: -0.14 to +0.09

January: Generally lower by -$0.52 to -$0.96. Averages to the downside: -0.09 to +0.10

February: Generally higher by +$0.48 to +$1.06. Averages to the upside +0.11 to -0.08

March: Generally higher by +0.03 to +$0.11. Averages to the upside by +0.09 to -0.10

This data suggests an extended winter in the U.S. may prompt further contraction in certain segments of the energy sector that may prompt an exaggerated downside price move in crude oil and natural gas. heating oil may rise a bit if the cold weather continues well past March/April 2019.

Conversely, if an early spring sets up in the U.S., then crude oil may begin to base a bit as people begin to traveling more, but heating oil and natural gas may decline as cold weather demands abate.

Heating oil has almost mirrored crude oil in price action recently. Our modeling systems are suggesting that crude oil may attempt to move below $40 ppb. This move would be a result of a number of factors – mostly slowing global demand and a shift to electric vehicles. We authored this research post early in January 2020 – please review it.

January 8, 2020: Is The Energy Sector Setting Up Another Great Entry?

We believe any price level below $40 in ERY is setting up for a very strong basing level going forward. We have identified two “pullback zones”. The first is what we call the “Deep Pullback Zone”. The second is what we call the “Deeper Pullback Zone”. Any upside price move from below $40 to recent upside target levels (above $50) would represent a 25%+ price rotation.

Historically, February is a very strong month for ERY. The data going back over the past 12 years suggests February produces substantially higher upside price gains (+1899.30 to -394.28) – translating into a 4.8:1 upside price ratio over 12 years. Both January and March reflect overall price weakness in ERY over the past 12 years. Thus, the real opportunity is the setup of the “February price advance”.

We believe any opportunity to take advantage of this historical technical price pattern is advantageous for skilled traders/investors.

This is a pure technical pattern based on price bar data mining. This is something you may not have ever considered unless you had the tools to search for historical price anomalies and rotation patterns. We have created a suite of tools and price modeling systems we use to help our members find incredible opportunities – this being one of them.

Get ready, February will likely prompt a very nice rally in ERY if historical price triggers confirm future price activity. The price pattern in February suggests a large upside price move is likely in ERY and we believe these low price basing patterns are an excellent opportunity for skilled traders.

Join my Wealth Building Newsletter if you like what you read here and ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own.

Chris Vermeulen

The Technical Traders

Sunday, October 20, 2019

Revisiting Black Monday 1987

Back in the day, for those of you that are old enough to remember and have experienced one of the most incredible trader psychology driven stock market decline in recent history. The difference between “Black Monday” and most of the other recent stock market declines is that October 19, 1987, was driven by a true psychological panic, what we consider true price exploration, after an incredible price rally.

It is different than the DOT COM (2001) decline and vastly different than the Credit Market Crisis (2008-09) because both of those events were related to true fundamental and technical evaluations. In both of those instances, prices have been rising for quite some time, but the underlying fundamentals of the economics of the markets collapsed and the markets collapsed with future expectations. Before we get too deep, be sure to opt-in to our free market trend signals newsletter.

Our researchers believe the setup prior to the Black Monday collapse is strangely similar to the current setup across the global markets. In 1982, Ronald Reagan was elected into his second term as the US President. Since his election in 1980, the US stock market has risen over 300% by August 1987.

Reagan, much like President Trump, was elected after a long period of U.S. economic malaise and ushered in an economic boom cycle that really began to accelerate near August 1983 – near the end of his first term. The expansion from the lows of 1982, near 102.20, to the highs of 1987, near 337.90, in the S&P 500 prompted an incredible rally in the US markets for all global investors.

This is very similar to what has happened since 2015/16 in the markets and particularly after the November 2016 elections when the S&P500 bottomed near 1807.5 and has recently set hew highs near 3026.20 – a 67.4% price rally in just over 3 years.

One can simply make the assumption that global investors poured capital in the US markets in 1983 to 1986 as the US markets entered a rally mode just like we suspect global investors have poured capital into the US markets after the 2016 US elections and have continued to seek value, safety, and returns in the US markets since. These incredible price rallies setup a very real potential for “true price exploration” when investors suddenly realize valuations may be out of control.

So, what actually happened on October 19th, 1987 that was different than the last few market collapse events and why is it so similar to what is happening today?

On October 19, 1987, a different set of circumstances took place. This was almost a perfect storm of sorts for the markets. The US markets had risen nearly 44% by August 1987 from the previous yearly close – a huge rally had taken place. Computer trading, which some people suspected may have been a reason for the price decline on October 19, was largely in its infancy.

Floor traders were running the show in New York and Chicago. The London markets closed early the Friday, October 16, because of a weather event that was taking place. The “setup” of these events may have played a roll in the liquidity issues that became evident on Black Monday and pushed the US markets down 22.61% by the end of trading.

The US markets had set up a top near 2,722 in early August 1987 after rising nearly 44% from the 1986 end of year closing price level of 1,895. The SPX rotated lower from this peak to set up a sideways price channel near 315 throughout the end of August and through most of September. On October 5, 1987, the SPX started a downward price move that attempted to test the lower support channel near 312. On October 12, one week later, the SPX broke below this support channel and closed at 298.10 (below the psychological 300 level). The very next weekend was October 17 & 18 – the weekend before Black Monday.

Sunday night, October 18, in the US, the Asian markets opened for trading and a price sell-off began taking place in Hong Kong. Because the London markets has closed early on the 16th due to the storm, by the time they opened the UK markets began tanking almost immediately. Early in the day on Monday, October 19, the FTSE100 had collapsed over 136 points.

Our researchers believe the declines in the US markets in early October 1987 set up a breakdown event that, once support was broken, prompted a collapse event where liquidity issues accelerated the price decline volatility – much like the “flash crash”. Global investors were unprepared for the scale and scope of the price decline event and panicked at the speed of the price collapse.

In fact, at the height of the 1987 crash, systemic problems (mostly solvency and brokerage house operations) continued to threaten a much larger financial market collapse. Within days of Black Monday, it became evident that margin accounts and solvency issues related to operating capital, large scale risks and continued fear that the markets may continue to collapse presented a very real problem for the US and for the world. Have we re-entered another Black Monday type of setup across the global markets?

As new economic data continues to suggest the global markets are economically contracting and stagnating, the US Federal Reserve has started buying assets again while the foreign central banks continue to push negative interest rates while attempting to spark any signs of real economic growth. The US stock market has continued to push higher – almost attempting new all-time highs again just recently. The US stock market is up nearly 68% over the past 3.5 years since Trump was elected and as of Friday, October 18, 2019, the US stock markets fell nearly 0.75% on economic fears.

In Part II of this article, we’ll explore the potential of another Black Monday type of setup that may be playing out before our very eyes right now in the US stock market.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short term swing trading and long-term investment capital. The opportunities are massive/life changing if handled properly.

I urge you visit my ETF Wealth Building Newsletter and if you like what I offer, join me with the 1-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

The Technical Traders

It is different than the DOT COM (2001) decline and vastly different than the Credit Market Crisis (2008-09) because both of those events were related to true fundamental and technical evaluations. In both of those instances, prices have been rising for quite some time, but the underlying fundamentals of the economics of the markets collapsed and the markets collapsed with future expectations. Before we get too deep, be sure to opt-in to our free market trend signals newsletter.

Our researchers believe the setup prior to the Black Monday collapse is strangely similar to the current setup across the global markets. In 1982, Ronald Reagan was elected into his second term as the US President. Since his election in 1980, the US stock market has risen over 300% by August 1987.

Reagan, much like President Trump, was elected after a long period of U.S. economic malaise and ushered in an economic boom cycle that really began to accelerate near August 1983 – near the end of his first term. The expansion from the lows of 1982, near 102.20, to the highs of 1987, near 337.90, in the S&P 500 prompted an incredible rally in the US markets for all global investors.

This is very similar to what has happened since 2015/16 in the markets and particularly after the November 2016 elections when the S&P500 bottomed near 1807.5 and has recently set hew highs near 3026.20 – a 67.4% price rally in just over 3 years.

One can simply make the assumption that global investors poured capital in the US markets in 1983 to 1986 as the US markets entered a rally mode just like we suspect global investors have poured capital into the US markets after the 2016 US elections and have continued to seek value, safety, and returns in the US markets since. These incredible price rallies setup a very real potential for “true price exploration” when investors suddenly realize valuations may be out of control.

So, what actually happened on October 19th, 1987 that was different than the last few market collapse events and why is it so similar to what is happening today?

On October 19, 1987, a different set of circumstances took place. This was almost a perfect storm of sorts for the markets. The US markets had risen nearly 44% by August 1987 from the previous yearly close – a huge rally had taken place. Computer trading, which some people suspected may have been a reason for the price decline on October 19, was largely in its infancy.

Floor traders were running the show in New York and Chicago. The London markets closed early the Friday, October 16, because of a weather event that was taking place. The “setup” of these events may have played a roll in the liquidity issues that became evident on Black Monday and pushed the US markets down 22.61% by the end of trading.

The US markets had set up a top near 2,722 in early August 1987 after rising nearly 44% from the 1986 end of year closing price level of 1,895. The SPX rotated lower from this peak to set up a sideways price channel near 315 throughout the end of August and through most of September. On October 5, 1987, the SPX started a downward price move that attempted to test the lower support channel near 312. On October 12, one week later, the SPX broke below this support channel and closed at 298.10 (below the psychological 300 level). The very next weekend was October 17 & 18 – the weekend before Black Monday.

Sunday night, October 18, in the US, the Asian markets opened for trading and a price sell-off began taking place in Hong Kong. Because the London markets has closed early on the 16th due to the storm, by the time they opened the UK markets began tanking almost immediately. Early in the day on Monday, October 19, the FTSE100 had collapsed over 136 points.

Our researchers believe the declines in the US markets in early October 1987 set up a breakdown event that, once support was broken, prompted a collapse event where liquidity issues accelerated the price decline volatility – much like the “flash crash”. Global investors were unprepared for the scale and scope of the price decline event and panicked at the speed of the price collapse.

In fact, at the height of the 1987 crash, systemic problems (mostly solvency and brokerage house operations) continued to threaten a much larger financial market collapse. Within days of Black Monday, it became evident that margin accounts and solvency issues related to operating capital, large scale risks and continued fear that the markets may continue to collapse presented a very real problem for the US and for the world. Have we re-entered another Black Monday type of setup across the global markets?

As new economic data continues to suggest the global markets are economically contracting and stagnating, the US Federal Reserve has started buying assets again while the foreign central banks continue to push negative interest rates while attempting to spark any signs of real economic growth. The US stock market has continued to push higher – almost attempting new all-time highs again just recently. The US stock market is up nearly 68% over the past 3.5 years since Trump was elected and as of Friday, October 18, 2019, the US stock markets fell nearly 0.75% on economic fears.

In Part II of this article, we’ll explore the potential of another Black Monday type of setup that may be playing out before our very eyes right now in the US stock market.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short term swing trading and long-term investment capital. The opportunities are massive/life changing if handled properly.

I urge you visit my ETF Wealth Building Newsletter and if you like what I offer, join me with the 1-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

The Technical Traders

Sunday, July 21, 2019

Crude Oil Breaks Down - Target $40

Our incredible ADL predictive modeling system predicted a moderate price anomaly on July 10th, 2019 in Crude Oil. We wrote about this oil set up on July 10th. Within this article, we suggested that Crude Oil would rotate to levels near $47~$48 rather quickly, then find some moderate support in December and January where support is likely to be found near $45 to $50. After that, the price of Oil should weaken dramatically where price could fall to levels below $30 ppb on extreme price weakness.

We are writing to you today to suggest that Oil prices may attempt to find very brief support near $55.25 as this level represents a key price trigger level which acts as support/resistance. After such a big downside move for the week, it is our opinion that Oil will briefly hold near this $55.25 level as oil tries to hold support for a couple of days.

We believe the selling may abate or weaken slightly early next week as earnings continue to hit the news cycle and future expectations are adjusted based on this data. Quite a bit of data will be released next week with the world's biggest firms releasing Q2 data and Q3 expectations. We believe this news/data will result in a brief pause in the decline of oil prices and allow traders to set up for the next move lower.

This Daily Crude Oil Chart highlights the downside price action this week as oil collapsed from the $60 upside target called from our early June oil video forecast. The chart below also highlights our Fibonacci price modeling tool that is currently suggesting support will be found just above $51 ppb – which is aligned with the previous price bottom in early June 2019. Mild resistance is also found near $56.70 (the BLUE projected price level). This level will likely act as a “congestion range” as price rotates and attempts another downside leg.

This Weekly Crude Oil chart highlights the bigger picture for oil. The recent breakdown in price has just crossed the Bearish Fibonacci trigger level (RED LINE near $55.20) and this breach suggests the downside price move may just be starting. Ultimate downside targets near $40 to $44 are where we believe the price will find support over the next 30 to 60+ days. Beyond these levels, the price may continue much lower and eventually breach the sub $30 level in Q1 or Q2 of 2020, which would likely be a strong cause of the pending bear market.

Any deep downside price move like this in Crude Oil would suggest that economic weakness and supply/demand issues are the root causes of a Crude Oil price collapse.

If the downside move continues as we are suggesting, many foreign nations will come under extreme economic pressures and currency levels/support could become threatened as the foundation for many oil based economies will begin to crumble. This could create an extreme debt/credit issue for many nations throughout the planet and could push the US Dollar well above $100. The implications for extended trends and trades is incredible when you consider the scope of the economic shift that will take place if Crude Oil does begin trading below $30 in early 2020.

$30-$40 crude oil could spark or further deeping the pending bear market which has been a long time coming. Almost all the signs are showing that it’s about to start so get ready. If you want someone to guide you through the next 12-24 months complete with detailed market analysis and trade alerts (entry, targets and exit price levels) join my ETF Trading Newsletter.

As a technical analyst since 1997 having lost a fortune and made fortunes from bull and bear markets I have a good understanding of how to best attack the market during its various stages. The opportunities starting to present themselves will be life changing if handled properly.

Be prepared for these incredible price swings before they happen and learn how you can identify and trade these fantastic trading opportunities in 2019, 2020, and beyond with our Wealth Building & Global Financial Reset Newsletter. You won’t want to miss this big move, folks. As you can see from our research, everything has been setting up for this move for many months – most traders/investors have simply not been looking for it.

Join me with a 1 or 2-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis.

So kill two birds with one stone and subscribe for two years to get your FREE PRECIOUS METAL and get enough trades to profit through the next metals bull market and financial crisis!

Chris Vermeulen @ The Technical Traders

We are writing to you today to suggest that Oil prices may attempt to find very brief support near $55.25 as this level represents a key price trigger level which acts as support/resistance. After such a big downside move for the week, it is our opinion that Oil will briefly hold near this $55.25 level as oil tries to hold support for a couple of days.

We believe the selling may abate or weaken slightly early next week as earnings continue to hit the news cycle and future expectations are adjusted based on this data. Quite a bit of data will be released next week with the world's biggest firms releasing Q2 data and Q3 expectations. We believe this news/data will result in a brief pause in the decline of oil prices and allow traders to set up for the next move lower.

This Daily Crude Oil Chart highlights the downside price action this week as oil collapsed from the $60 upside target called from our early June oil video forecast. The chart below also highlights our Fibonacci price modeling tool that is currently suggesting support will be found just above $51 ppb – which is aligned with the previous price bottom in early June 2019. Mild resistance is also found near $56.70 (the BLUE projected price level). This level will likely act as a “congestion range” as price rotates and attempts another downside leg.

This Weekly Crude Oil chart highlights the bigger picture for oil. The recent breakdown in price has just crossed the Bearish Fibonacci trigger level (RED LINE near $55.20) and this breach suggests the downside price move may just be starting. Ultimate downside targets near $40 to $44 are where we believe the price will find support over the next 30 to 60+ days. Beyond these levels, the price may continue much lower and eventually breach the sub $30 level in Q1 or Q2 of 2020, which would likely be a strong cause of the pending bear market.

CONCLUDING THOUGHTS

Any deep downside price move like this in Crude Oil would suggest that economic weakness and supply/demand issues are the root causes of a Crude Oil price collapse.

If the downside move continues as we are suggesting, many foreign nations will come under extreme economic pressures and currency levels/support could become threatened as the foundation for many oil based economies will begin to crumble. This could create an extreme debt/credit issue for many nations throughout the planet and could push the US Dollar well above $100. The implications for extended trends and trades is incredible when you consider the scope of the economic shift that will take place if Crude Oil does begin trading below $30 in early 2020.

$30-$40 crude oil could spark or further deeping the pending bear market which has been a long time coming. Almost all the signs are showing that it’s about to start so get ready. If you want someone to guide you through the next 12-24 months complete with detailed market analysis and trade alerts (entry, targets and exit price levels) join my ETF Trading Newsletter.

As a technical analyst since 1997 having lost a fortune and made fortunes from bull and bear markets I have a good understanding of how to best attack the market during its various stages. The opportunities starting to present themselves will be life changing if handled properly.

Be prepared for these incredible price swings before they happen and learn how you can identify and trade these fantastic trading opportunities in 2019, 2020, and beyond with our Wealth Building & Global Financial Reset Newsletter. You won’t want to miss this big move, folks. As you can see from our research, everything has been setting up for this move for many months – most traders/investors have simply not been looking for it.

Join me with a 1 or 2-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis.

FREE GOLD OR SILVER WITH MEMBERSHIP!

So kill two birds with one stone and subscribe for two years to get your FREE PRECIOUS METAL and get enough trades to profit through the next metals bull market and financial crisis!

Chris Vermeulen @ The Technical Traders

Labels:

Chris Vermeulen,

Crude Oil,

gold,

money,

newsletter,

precious metals,

Silver,

stocks,

The Technical Traders

Subscribe to:

Posts (Atom)