Trade ideas, analysis and low risk set ups for commodities, Bitcoin, gold, silver, coffee, the indexes, options and your retirement. We'll help you keep your emotions out of your trading.

Sunday, December 6, 2015

Another Elephant Trade is Setting Up

It’s a bit unusual for us to reach out to you on the weekend during family time, but this is pretty important. We want to give you a heads up so you don’t miss out on this again. Here’s the situation. Pressure in the markets is building for a big move in the next few weeks. If it hits, this could drive the trends for the coming year.

And I can tell you firsthand that many professional traders and hedge funds will be blindsided by this. They just don’t get what’s driving the markets today. And as you know, that means this set up could be unusually intense (and potentially very profitable) as everyone panics when they discover they’re on the wrong side of the move.

Listen, if you want to grow a small account quickly, then this is the kind of move you need to catch and they only happen about once a year. Now, we want to take a minute to apologize. Here’s why. Our trading partner John Carter released a great free video [click here to watch it] then a special webinar training last week and he went into full detail about this elephant trade set up and how to ride it. And the feedback has been just amazing. Which is why we feel bad.

A whole ton of you missed out because we only sent out one email invitation to register for the webinar. So on Tuesday December 8th at 8 p.m. est John is going to do an encore training for you. Since this message is going out to everyone who missed last time, we strongly encourage you to grab your spot as soon as possible because space is limited.

Click Here to Register

This is NOT a replay. The training will be live so you can use what you learn the next day. John will cover any new market developments and tell you how he is trading them in his own account. I think you’ll agree, anyone can identify a big move in hindsight, but that doesn’t do you much good, right?

That’s why we think it’s so important to be transparent and show you John's positions and results in real time. To join us for this special training, grab your spot now.

Click Here to Register

By the way, in last week’s training John mentioned a Netflix set up that was forming and several attendees jumped on that and did very, very well. Now, quick trades like that don’t always happen in a live training, but sometimes they do. Remember though, the point of this training is really about how to grow your account fast by catching these big elephant trades.

If you missed the recent big move in the Euro, or AMZN, then you don’t want to miss what we believe will be the big trade of the next 12 months.

So Click Here to Register for this special training now before you forget.

See you Tuesday evening,

Ray C. Parrish

aka the Crude Oil Trader

Get John's latest FREE eBook "Understanding Options"....Just Click Here!

Wednesday, December 2, 2015

How Big the Gig Economy Really Is

By John Mauldin

There is growing awareness of what is being called the “gig economy.” It’s not just Uber driving or Airbnb. There are literally scores of websites and apps where you can advertise your services, get temporary or part time work, and do so from anywhere you happen to be.Some “gigs” actually pay pretty good money, but they are for people with specialized skills who prefer to live a somewhat different lifestyle than the typical 9 to 5’er does. My hedge fund friend Murat Köprülü has been busy researching and documenting this phenomenon and regularly regales me with what he finds.

He goes and spends evenings and weekends with young gig workers, trying to figure out what it is they really do and how they make ends meet in New York City. It turns out they need a lot less to support their lifestyle than you might imagine, and they prefer working intermittent gigs, being able to do what they want, and having no boss.

A close look at the data indicates that the gig economy is indeed big and growing. But there is a great deal of debate among economists about how big it really is.

It’s Much Bigger Than the Employment Data Suggests

Gig workers don’t seem to show up clearly in the BLS employment data. Typically, we would expect those working in the gig economy to appear in the self employed category, but that category is actually drifting downward in numbers—relatively speaking.But Harvard economist Larry Katz and Princeton’s Alan Krueger, who are working on research to document the rise of the gig economy in America, says that our current measures ignore the bulk of the gig economy.

From a story at fusion.net:

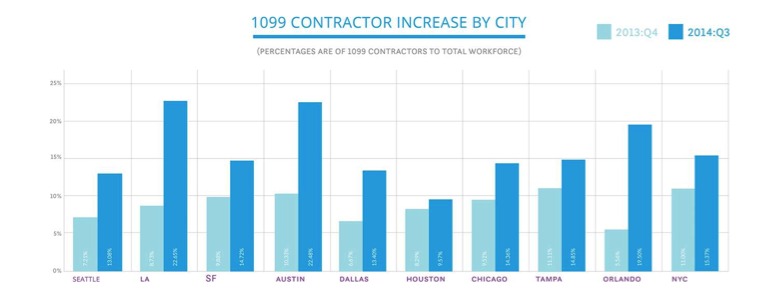

Katz said two pieces of evidence suggest current measures of self-employment and multiple-job holding are “missing a large part of the gig economy.” The first is that the share of the employed (and of the adult population) filing a 1099 form, the tax document “gig economy” workers must file, increased in the 2000s, even as standard measures of self-employment declined in the 2000s. Other groups have confirmed this: Zen Payroll, a site that tracks the sharing economy, found increases in the share of 1099 workers across many major U.S. metros.

Source: Zen Payroll via Small Business Labs

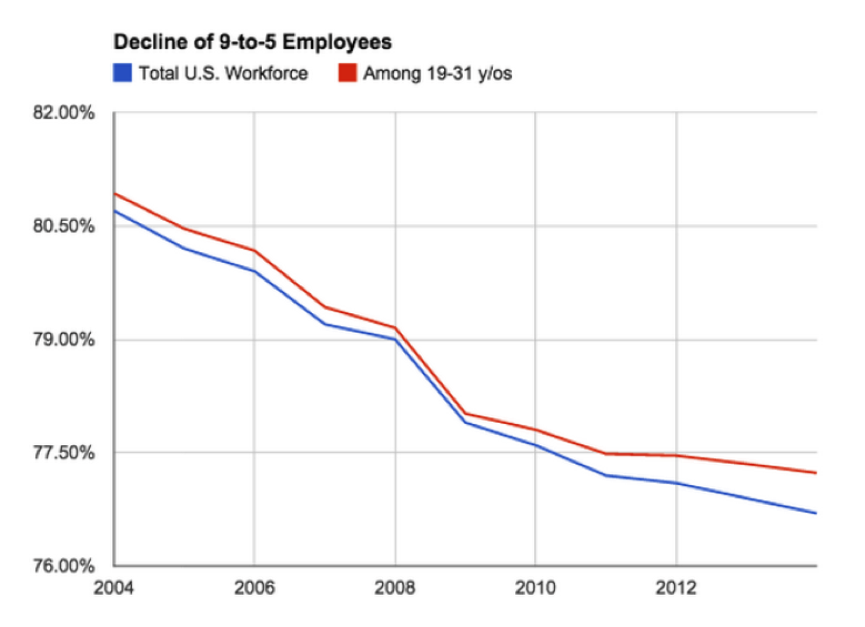

And data from research group EconomicModeling.com show the share of traditional, 9-to-5 workers in the labor force has declined…..

Source: Fusion, data via EconomicModeling.com

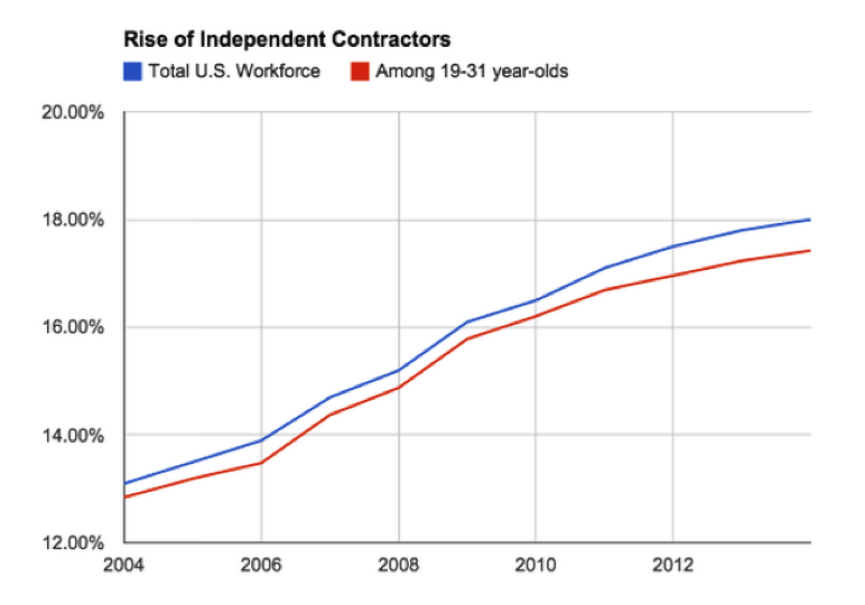

… while those who categorize themselves as “miscellaneous proprietors” is climbing.

Source: Fusion, data via EconomicModeling.com

A recent survey found 60 percent of such workers get at least 25 percent of their income from gig economy work.

And this report absolutely squares with what my friend Murat’s research is showing: that gig economy is not shrinking. On the contrary, it’s on the rise, and a quite rapid rise.

Subscribe to Thoughts from the Frontline

Follow Mauldin as he uncovers the truth behind, and beyond, the financial headlines in his free publication, Thoughts from the Frontline. The publication explores developments overlooked by mainstream news to help you understand what’s happening in the economy and navigate the markets with confidence.The article was excerpted from John F. Mauldin’s Thoughts from the Frontline. Follow John Mauldin on Twitter. The article How Big the Gig Economy Really Is was originally published at mauldineconomics.com.

Get our latest FREE eBook "Understanding Options"....Just Click Here!

Labels:

apps,

data,

employment,

financial,

Frontline,

John Mauldin,

markets,

Mauldin Economics,

money,

Uber

Saturday, November 28, 2015

John Carter's Next Free Webinar "How to Grow Your Account and Grow it Fast"

Our trading partner John Carter of Simpler Options is back with another one of his wildly popular free webinars. And as always this class will fill up fast so get your reserved seat asap, sign up here.

John always comes to us with a game changing timely trading method for current market conditions that we can put to work immediately, and this class is no different. John gave us a taste of what he has in store for us with a new free video this week. If you have not seen it watch "John's Proven Strategies for Q4 and 2016" here.

This weeks free webinar is Tuesday evening December 1st at 8 p.m. eastern time.

Reserve Your Seat to "How to Grow Your Account Fast" Now!

Here’s what you’ll learn from our free webinar:

* How to find stocks that are bucking the trend of the general market

* What are the key market internals to watch every day for early signals

* How to know which options to buy and when

* How to trade from the road

* How to trade for multiple account sizes

and much more

Get your seat now and we'll see you Tuesday evening,

Ray C. Parrish

aka the Crude Oil Trader

P.S. Don’t worry if you can’t attend live. We’ll send you a link to the recorded webinar within 24-48 hours.

Get your reserved seat now....Just Visit Here!

John always comes to us with a game changing timely trading method for current market conditions that we can put to work immediately, and this class is no different. John gave us a taste of what he has in store for us with a new free video this week. If you have not seen it watch "John's Proven Strategies for Q4 and 2016" here.

This weeks free webinar is Tuesday evening December 1st at 8 p.m. eastern time.

Reserve Your Seat to "How to Grow Your Account Fast" Now!

Here’s what you’ll learn from our free webinar:

* How to find stocks that are bucking the trend of the general market

* What are the key market internals to watch every day for early signals

* How to know which options to buy and when

* How to trade from the road

* How to trade for multiple account sizes

and much more

Get your seat now and we'll see you Tuesday evening,

Ray C. Parrish

aka the Crude Oil Trader

P.S. Don’t worry if you can’t attend live. We’ll send you a link to the recorded webinar within 24-48 hours.

Get your reserved seat now....Just Visit Here!

Labels:

account,

class,

John Carter,

Market,

options,

Simpler Options,

stocks,

trade,

trader,

webinar

Tuesday, November 24, 2015

New Video: John Carter's Proven Strategies for Q4 and 2016

There have been lots of bumps, direction changes, and heartbreak along the way. But through time John has learned that if you want to have a 6 figure trading account like his, options are your best way to get there.

Today John is sharing with us his latest free video that will give us an insight into how he will be using options to close out the year and moving forward into 2016.

Watch > John's Proven Strategies for Q4 and 2016

In this FREE video from John will give you two proven strategies he's using in 2016 that are sure to work for you. Now, when a trader like John Carter says "hey, here are my two best strategies" you'd be nuts not to at least hear him out and see if it can be applied to what you are doing.

So click here for his best two 2016 strategies

And here's what else he's showing you in this free video:

* His two proven Strategies John used to make 30k last week!

* How to make and find successful trades from your phone

* How to Successfully Trade 2016 Economic Disasters

* How to find trades that won't run your stops

John even shows you exactly what he's currently trading. This is my favorite part.....just watch!

See you in the markets putting this to work!

Ray C. Parrish

aka the Crude Oil Trader

While you are here get John's latest FREE eBook "Understanding Options"....Just Click Here!

Saturday, November 21, 2015

Mike Seerys Weekly Recap of the Crude Oil, Gold, Coffee, Sugar and Markets

Over the past few weeks, the likelihood of a December rate hike by the Federal Reserve Bank has grown substantially. Both economic data and hints from a number of Federal Reserve policymakers now point towards a December rate hike and now on Wall Street 70% of investors polled believe a rate hike in December is possible.

So let us take a look at the data and what Fed officials are saying that is making investors believe a hike is coming. Our trading partner Mike Seery is back to give our us a recap of this weeks trading and help us put together a plan for the upcoming week.

So let us take a look at the data and what Fed officials are saying that is making investors believe a hike is coming. Our trading partner Mike Seery is back to give our us a recap of this weeks trading and help us put together a plan for the upcoming week.

Crude oil futures in the January contract are up 90 cents this Friday afternoon in New York settling at 42.00 last Friday while currently trading at 42.60 as this market has been on the defensive for quite some time due to the fact of massive worldwide supplies as I’ve been sitting on the sidelines at the current time. Oil prices are trading below their 20 and 100 day moving average hitting a double top at the 52 dollar level with the next major level of support at the contract low which was hit in late August around 40.00 as we could be entering a short position next week as the chart structure is starting to improve dramatically on a daily basis. Crude oil has stabilized in recent days due to the fact of terrorism and especially the possibility of that spreading to the Middle East, however worldwide supplies are massive and that is the real problem coupled with the fact of a strong U.S dollar which is higher once again today as the Federal Reserve basically will raise interest rates in the month of December which is also another negative, but as a trader I look for risk/reward to be in your favor and that could be in next week’s trade to the short side as I’m not convinced that prices are headed lower. In my opinion think if the oil market moves higher you’re going to need OPEC to cut production and I’m not sure if they are willing to do that at the current time, but if that does happen that would certainly put the short term bottom into this market.

Trend: Lower

Chart Structure: Improving

Become a Part of Our Elite Group of Traders....Join Us Here and Now

Gold futures in the December contract settled in New York last Friday at 1,081 an ounce while currently trading at 1,081 unchanged for the trading week still trading below its 20 and 100 day moving average telling you that the short term trend is to the downside, however I’m sitting on the sidelines in this market as prices have dropped $100 in the last three weeks as the chart structure is awful at the current time. Earlier in the week prices traded at a new contract low of 1,062 and now has rallied for the 2nd straight day as I still see no reason to own gold at current time as money flows are coming out of the precious metals once again and into the equity markets as I think that trend will continue for the rest of 2015. Gold prices have stabilized here in recent days due to the fact of all the terrorism that is occurring throughout the world and it looks to me that that probably could continue here in the short term, but the easy money to the downside has been made in gold as I think you will start to see a consolidation of the recent downdraft in prices so avoid this market at the current time and look at other markets that are beginning to trend with less risk.

Trend: Lower

Chart Structure: Poor

Coffee futures in the March contract settled in New York last Friday at 115.80 a pound while currently trading at 122.75 up nearly 700 points for the trading week having one of the strongest weeks in quite some time bottoming out at the 115 level. As I’ve written about in previous blogs as I think coffee is in the process of bottoming, however at the current time I’m sitting on the sidelines waiting for a trend to develop as prices are trading above their 20 day but still below their 100 day moving average telling you that the trend currently is mixed. The contract low was hit around the 115 level as prices are getting very cheap in my opinion as we are starting to enter the volatile season as I think we are squeezing blood out of a turnip at these levels, but I will be patient and wait for better chart structure to develop therefore lowering monetary risk as I think over the long haul prices are headed higher. The next major resistance is at 125 which is just an eyelash away as the soft commodity markets except for cotton have rallied over the last several weeks as traders remember in early 2014 a drought hit key coffee growing regions in the country of Brazil sending prices sharply higher in just a matter of weeks.

Trend: Mixed

Chart Structure: Poor

Sugar futures in the March contract settled last Friday in New York at 15.04 a pound while currently trading at 15.04 unchanged for the trading week still in a very volatile trade as prices are swinging up and down on a daily basis as the chart still looks bullish in my opinion, however I am sitting on the sidelines as the chart structure is poor at the current time. Sugar prices are actually trading above their 20 and 100 day moving average which is one of the only few commodities you can say that about as the trend still remains higher with major resistance at 15.50 as strong demand continues to prop up prices here in the short term coupled with the fact of lower production numbers coming out of Brazil. Sugar prices have rallied around 35% over the last three months as this was a very bearish trend for the several years as prices used to trade in the 30’s in 2011 as that’s how far prices have come down due to over production in Brazil, but that scenario has changed going into 2016 as weather is now the main focus to drive prices higher.

Trend: Higher - Mixed

Chart Structure: Poor

Mike Seerys Trading Theory

What Does Risk Management Mean To You? I generally tell people that the reason people lose money in commodities is not due to the fact that they are bad at predicting where prices are headed, however they are bad when it comes to losing trades and refusing to take a loss which results for heavy monetary losses that are difficult to come back from. For example if a customer has $100,000 account in my opinion on any given trade he or she should risk 2% – 3% of the account value meaning if you are wrong the worst case scenario is still a $97,000 remaining balance, however what I always see is traders risking ridiculous amounts of money and instead of the 3% stop loss will risk 20% to 30% on any given trade or even higher therefore if you are wrong on two or three trades that $100,000 dollar account could dwindle down to nothing very quickly and I’ve seen it many times throughout my career. What many traders forget to realize is they might have 4 or 5 commodity positions on and if you have too many contracts on all at the same time and all of those trades go against you which is very possible the losses can add up to be staggering so what I am suggesting to you is if you have $100,000 account risk between $2,000 – $3,000 per trade so if you lose on five straight trades the worst case scenario is that your down $15,000 and still have an $85,000 balance which is very possible to still come back from and your still in the game.

Mike has been a senior analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets. Get more of Mike's calls on this Weeks Commodity Markets

Make sure you get our latest FREE eBook "Understanding Options"....Just Click Here!

Labels:

bullish,

coffee,

commodities,

copper,

corn,

Crude Oil,

Dollar,

downside,

gold,

Mike Seery,

Natural Gas,

Oil,

Silver,

stop,

sugar,

trading,

volatility

Wednesday, November 18, 2015

The World's First Cashless Society Is Here - A Totalitarian's Dream Come True

By Nick Giambruno

Central planners around the world are waging a War on Cash. In just the last few years:

In the U.S., central planners ratchet up the War on Cash every time the government declares a made-up war on something else…a war on crime, a war on drugs, a war on poverty, a war on terror…..

They all end with more government intrusion into your financial affairs. Thanks to these made-up wars, the U.S. government is imposing an increasing number of regulations on cash transactions. Try withdrawing more than $10,000 in cash from your bank. They’ll treat you like a criminal or terrorist. The Federal Reserve is at the center of the War on Cash. Its weapons are inflation and control over the currency denominations.

Take the $100 note, for example. It’s the largest bill in circulation today. This was not always the case. At one point, the U.S. had $500, $1,000, $5,000, and even $10,000 notes. But the government eliminated these large notes in 1969 under the pretext of fighting the War on Some Drugs. Since then, the $100 note has been the largest. But it has far less purchasing power than it did in 1969. Decades of rampant money printing have inflated the dollar. Today, a $100 note buys less than a $20 note did in 1969.

Even though the Federal Reserve has devalued the dollar over 80% since 1969, it still refuses to issue notes larger than $100. This makes it inconvenient to use cash for large transactions, which forces people to use electronic payment methods. This, of course, is what the U.S. government wants. It’s exactly like Ron Paul said: “The cashless society is the IRS’s dream: total knowledge of, and control over, the finances of every single American.”

To help you think more clearly, I suggest substituting “central planners” every time you see “policymakers.”

Sweden’s supply of physical currency has dropped over 50% in the last six years. A couple of major Swedish banks no longer carry cash. Virtually all Swedes pay for candy bars and coffee electronically. Even homeless street vendors use mobile card readers. Plus, an increasing number of government restrictions are encouraging Swedes to dump cash. The pretexts are familiar…fighting terrorism, money laundering, etc. In effect, these restrictions make it inconvenient to use cash, so people don’t.

So far, Swedes have passively accepted the government and banks’ drive to eliminate cash. The push to destroy their financial privacy doesn’t seem to bother them. This is likely because the average Swede places an unreasonable amount of trust in government and financial institutions. Their trust is certainly misplaced. On top of the obvious privacy concerns, eliminating cash enables the central planners’ latest gimmick to goose the economy: Negative interest rates.

When you deposit money in a bank, you are lending money to the bank. However, with negative rates you don’t earn interest. Instead, you pay the bank. If you don’t like that plan, you can certainly stash your cash under the mattress. As a practical matter, this limits how far governments and central banks can go with negative interest rates. The more it costs to store money at the bank, the less inclined people are to do it.

Of course, central planners don’t want you to withdraw money from the bank. This is a big reason why they want to eliminate cash…so you can’t. As long as your money stays in the bank, it’s vulnerable to the sting of negative interest rates and also helps to prop up the unsound fractional reserve banking system. If you can’t withdraw your money as cash, you have two choices: You can deal with negative interest rates...or you can spend your money.

Ultimately, that’s what our Keynesian central planners want. They are using negative interest rates and the War on Cash to force you to spend and “stimulate” the economy. If you ask me, these radical and insane measures are a sign of desperation. The War on Cash and negative interest rates are huge threats to your financial security. Central planners are playing with fire and inviting a currency catastrophe.

Most people have no idea what really happens when a currency collapses, let alone how to prepare. How will you protect your savings in the event of a currency crisis? This just-released video will show you exactly how. Click here to watch it now.

- Italy made cash transactions over €1,000 illegal;

- Switzerland proposed banning cash payments in excess of 100,000 francs;

- Russia banned cash transactions over $10,000;

- Spain banned cash transactions over €2,500;

- Mexico made cash payments of more than 200,000 pesos illegal;

- Uruguay banned cash transactions over $5,000; and

- France made cash transactions over €1,000 illegal, down from the previous limit of €3,000.

In the U.S., central planners ratchet up the War on Cash every time the government declares a made-up war on something else…a war on crime, a war on drugs, a war on poverty, a war on terror…..

They all end with more government intrusion into your financial affairs. Thanks to these made-up wars, the U.S. government is imposing an increasing number of regulations on cash transactions. Try withdrawing more than $10,000 in cash from your bank. They’ll treat you like a criminal or terrorist. The Federal Reserve is at the center of the War on Cash. Its weapons are inflation and control over the currency denominations.

Take the $100 note, for example. It’s the largest bill in circulation today. This was not always the case. At one point, the U.S. had $500, $1,000, $5,000, and even $10,000 notes. But the government eliminated these large notes in 1969 under the pretext of fighting the War on Some Drugs. Since then, the $100 note has been the largest. But it has far less purchasing power than it did in 1969. Decades of rampant money printing have inflated the dollar. Today, a $100 note buys less than a $20 note did in 1969.

Even though the Federal Reserve has devalued the dollar over 80% since 1969, it still refuses to issue notes larger than $100. This makes it inconvenient to use cash for large transactions, which forces people to use electronic payment methods. This, of course, is what the U.S. government wants. It’s exactly like Ron Paul said: “The cashless society is the IRS’s dream: total knowledge of, and control over, the finances of every single American.”

Policymakers or Central Planners?

On stories related to the War on Cash, you may have noticed that the mainstream media often uses the word “policymakers,” as in “policymakers have decided to keep interest rates at record low levels.” When the media uses “policymakers,” they are often referring to central bank officials. It’s a curious word choice. As far as I can tell, there is no difference between a policymaker and central planner. Most people who want to live in a free society agree that central planning is not a good idea. So the media uses a different word to put a more neutral spin on things.To help you think more clearly, I suggest substituting “central planners” every time you see “policymakers.”

The World’s First Cashless Society

In 1661, Sweden became the first country in Europe to issue paper money. Now it’s probably going to be the first in the world to eliminate it. Sweden has already phased out most cash transactions. According to Credit Suisse, 80% of all purchases in Sweden are electronic and don’t involve cash. And that figure is rising. If the trend continues - and there is nothing to suggest it won’t - Sweden could soon be the world’s first cashless society.Sweden’s supply of physical currency has dropped over 50% in the last six years. A couple of major Swedish banks no longer carry cash. Virtually all Swedes pay for candy bars and coffee electronically. Even homeless street vendors use mobile card readers. Plus, an increasing number of government restrictions are encouraging Swedes to dump cash. The pretexts are familiar…fighting terrorism, money laundering, etc. In effect, these restrictions make it inconvenient to use cash, so people don’t.

So far, Swedes have passively accepted the government and banks’ drive to eliminate cash. The push to destroy their financial privacy doesn’t seem to bother them. This is likely because the average Swede places an unreasonable amount of trust in government and financial institutions. Their trust is certainly misplaced. On top of the obvious privacy concerns, eliminating cash enables the central planners’ latest gimmick to goose the economy: Negative interest rates.

Making The Negative Interest Rate Scam Possible

Sweden, Denmark, and Switzerland all have negative interest rates. Negative interest rates mean the lender literally pays the borrower for the privilege of lending him money. It’s a bizarre, upside down concept. But negative rates are not some European anomaly. The Federal Reserve discussed the possibility of using negative interest rates in the U.S. at its last meeting. Negative rates could not exist in a free market. They destroy the impetus to save and build capital, which is the basis of prosperity.When you deposit money in a bank, you are lending money to the bank. However, with negative rates you don’t earn interest. Instead, you pay the bank. If you don’t like that plan, you can certainly stash your cash under the mattress. As a practical matter, this limits how far governments and central banks can go with negative interest rates. The more it costs to store money at the bank, the less inclined people are to do it.

Of course, central planners don’t want you to withdraw money from the bank. This is a big reason why they want to eliminate cash…so you can’t. As long as your money stays in the bank, it’s vulnerable to the sting of negative interest rates and also helps to prop up the unsound fractional reserve banking system. If you can’t withdraw your money as cash, you have two choices: You can deal with negative interest rates...or you can spend your money.

Ultimately, that’s what our Keynesian central planners want. They are using negative interest rates and the War on Cash to force you to spend and “stimulate” the economy. If you ask me, these radical and insane measures are a sign of desperation. The War on Cash and negative interest rates are huge threats to your financial security. Central planners are playing with fire and inviting a currency catastrophe.

Most people have no idea what really happens when a currency collapses, let alone how to prepare. How will you protect your savings in the event of a currency crisis? This just-released video will show you exactly how. Click here to watch it now.

The article was originally published at internationalman.com.

Get our latest FREE eBook "Understanding Options"....Just Click Here!

Labels:

cash,

currency,

Federal Reserve,

finances,

France,

International Man,

IRS,

Italy,

levels,

money,

Nick Giambruno,

Ron Paul,

Switzerland,

U.S.

Sunday, November 15, 2015

Mike Seerys Weekly Recap of the Crude Oil, Coffee, Sugar and Corn Markets

Last week U.S. retail sales were reported and rose less than expected in October. One of the big surprises was the automobile sector and the decline in the purchases of new cars. All of this weighed on the markets, pushing back the bulls once again. So our trading partner Mike Seery is back to give our us a recap of this weeks trading and help us put together a plan for the upcoming week.

Crude oil futures in the December contract are trading below their 20 and 100 day moving average telling you that the short term trend is to the downside hitting a 10 week low as prices settled last Friday in New York at 44.90 while currently trading at 40.50 a barrel down around $4 for the trading week continuing its longer term bearish trend. At the current time I’m sitting on the sidelines as the chart structure is very poor which means that the 10 day high is too far away risking too much money in my opinion, however keep a close eye on this market as the chart structure will start to improve in next week's trade therefore lowering monetary risk. In my opinion it looks to me that prices are going to test the August 24th low of 39.22 as high inventories continue to pressure prices coupled with the fact of a strong U.S dollar hampering many commodity markets in 2015 and unless OPEC cuts production prices will probably remain on the defensive for some time to come. The weather in much of the United States has been above normal which is putting pressure on heating oil futures because of the lack of demand and therefore putting pressure on crude oil, but we are starting to enter the winter months as that could change very quickly but at the present time the 7/10 day weather forecast remains warm.

Trend: Lower

Chart Structure: Poor

Become a Part of Our Elite Group of Traders....Join Us Here and Now

Coffee futures in the March contract are trading below their 20 and 100 day moving average settling in New York last Friday at 121.15 while currently trading at 118.80 down over 200 points for the trading week continuing its short term bearish trend. Prices look to retest the contract low which was hit on September 24th at 117.80 as coffee is acting nonvolatile at the current time as historically speaking coffee is one of the most volatile commodities in the world, but there is very little fresh fundamental news to dictate short term price action. At the current time I'm sitting on the sidelines waiting for better chart structure to develop, however I do think prices are limited to the downside as I think you're starting to squeeze blood out of a turnip as we start to enter the volatile winter season as in 2014 a drought hit the country of Brazil sending prices sharply higher so keep a close eye on this market for a possible bullish pattern to develop in the coming weeks. Coffee prices have been extremely choppy over the last six months as I've had a couple recommendations that fizzled out but as a trader you can't give up because the trend always comes back it's just a matter of time and patience.

Trend: Lower

Chart Structure: Solid

Sugar futures in the March contract settled last Friday in New York at 14.46 a pound while currently trading at 15.08 up about 60 points for the trading week as I'm currently sitting on the sidelines waiting for another trend to develop and at the current time I’m advising clients to avoid this market. Sugar prices are highly volatile with many sharply higher and sharply lower trading sessions with major resistance at the peak high around 15.50 and support around the three week low at 14.00 which was hit in Monday's trade as production numbers out of Brazil continue to swing prices on a daily basis. Sugar prices are still trading above their 20 and 100 day moving average telling you that the short term trend is still higher as this has been one of the few commodities that continue to have a bullish trend due to less production in Brazil and key growing regions throughout the world coupled with the fact of very strong demand pushing prices up around 35% from lows hit just 3 months ago. If you’re looking to pick a top I would sell a futures contract at today’s price while placing your stop at 15.55 risking around 45 points or $500 per contract plus slippage and commission, but I am currently involved in other markets with better risk/reward parameters.

Trend: Higher

Chart Structure: Poor

Corn futures in the December contract settled last Friday in Chicago at 3.73 a bushel while currently trading at 3.60 down around $.13 for the trading week as I've been recommending a short position from the 3.79 level and if you took that trade continue to place your stop loss above the 10 day high which currently stands at 3.84, however the chart structure will start to improve on a daily basis therefore lowering monetary risk next week. Prices are trading below their 20 and 100 day moving average telling you that the trend is to the downside as prices reacted to the USDA crop report which raised carryover and production numbers sending prices to a new contract low so continue to play this to the downside in my opinion as lower prices are ahead. Many of the commodity markets continue to move lower especially crude oil which is also putting pressure on corn prices as I think the next major level of support is 3.50 as volatility is relatively low, but if you have missed this trade move on and look at other markets that are beginning to trend. At the current time I’m recommending many short positions including soybeans and corn as I think oversupply issues will continue to keep a lid on prices for the rest of 2015.

Trend: Lower

Chart Structure: Improving

What does Mike mean when he talks about chart structure and why does he think it’s so important when deciding to enter or exit a trade?

Mike tells us "I define chart structure as a slow grinding up or down trend with low volatility and no chart gaps. Many of the great trends that develop have very good chart structure with many low percentage daily moves over a course of at least 4 weeks thus allowing you to enter a market allowing you to place a stop loss relatively close due to small moves thus reducing risk. Charts that have violent up and down swings are not considered to have solid chart structure as I like to place my stops at 10 day highs or 10 day lows and if the charts have a tight pattern that will allow the trader to minimize risk which is what trading is all about and if the chart has big swings your stop will be further away allowing the possibility of larger monetary loss."

Mike has been a senior analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets. Get more of Mike's calls on this Weeks Commodity Markets

Make sure you get our latest FREE eBook "Understanding Options"....Just Click Here!

Labels:

bullish,

coffee,

commodities,

copper,

corn,

Crude Oil,

Dollar,

downside,

gold,

Mike Seery,

Natural Gas,

Oil,

Silver,

stop,

sugar,

trading,

volatility

The “Bloodbath” in Canada Is Far From Over

By Justin Spittler

The oil price crash continues to claim victims…and many of them are in Canada.The price of oil hovered around $100 for most of last summer. Today, it’s trading for less than $45. Weak oil prices have pummeled huge oil companies. The SPDR S&P Oil & Gas Exploration & Production ETF (XOP), which tracks the performance of major U.S. oil producers, has declined 36% over the past year. The Market Vectors Oil Services ETF (OIH), which tracks U.S. oil services companies, has declined 30% since last November. Weak oil prices have even pushed entire countries to the brink. Saudi Arabia, which produces more oil than any country in the world, is on track to post its first budget deficit since 2009 this year. If oil prices stay low, the country could burn through its massive $650 million pile of foreign reserves within five years.Oil’s collapse is also creating big problems for Canada’s economy.....

Canada is the world’s sixth largest oil producer. Oil makes up 25% of its exports. Last month, The Conference Board of Canada said it expects sales for Canada’s energy sector to fall 22% this year. It also expects the industry to record a net loss of about C$2.1 billion ($1.6 billion) in 2015. That’s a drastic change from last year, when the industry booked a C$6 billion ($4.5 billion) profit.

Major oil firms are slashing spending to cope with low prices. Last month, oil giant Royal Dutch Shell plc (RDS.A) said it would stop construction on an 80,000 barrels per day (bpd) project in western Canada. The company had already abandoned another 200,000 bpd project in northern Canada earlier this year. The Canadian Association of Petroleum Producers estimates that Canadian oil and gas companies have laid off 36,000 workers since last summer. Most of these layoffs happened in the province of Alberta.

For the past decade, Alberta was Canada’s fastest growing province.....

Its economy exploded, thanks to the booming market for Canadian tar sands. Tar sand is a gooey sand and oil mixture that melts down with heat from burning natural gas. More than half of Canada’s oil production comes from tar sands. In Alberta, they account for 75% of oil production.

Tar sand is generally more expensive to produce than conventional crude oil. Canadian tar sand projects made sense when oil hovered around $100. But many of these projects can’t make money when oil trades for $45/barrel. Last year, Scotiabank (BNS) said the average breakeven point for new Canadian oil sand projects was around $65/barrel. This is why giant oil companies are walking away from projects they’ve spent years and billions of dollars developing.

All these cancelled oil projects are making Alberta’s economy unravel.....

Alberta lost 63,500 jobs from the start of year through August. It hasn’t lost that many jobs during the first eight months of the year since the Great Recession. The decline in oil production is also draining government resources. Last month, Reuters reported that Alberta was on track to post a $4.6 billion budget deficit this year. Economists say it could be another five years before Alberta runs a budget surplus. The crisis isn’t confined to the oil patches either.

A real estate crisis is unfolding in Calgary.....

Calgary is home to 1.2 million people. It’s the largest city in Alberta and the third largest in Canada. On Tuesday, Bloomberg Business reported that Calgary’s property market is starting to crack:

Vacancy is already at a five-year high in Calgary and rents are the lowest since 2006 after thousands of office jobs were cut. In downtown Calgary, the vacancy rate jumped to 14 percent in the third quarter, the highest since 2010 and compared with 5 percent for downtown Toronto, according to CBRE Group Inc. .... That doesn’t include as much as 2 million square feet of so-called "shadow vacancy" or space leased but sitting empty, which would push vacancy to 16 percent, the most since the mid-1980s.

Demand for office space is falling because of massive layoffs in the oil industry. That’s because oil companies didn’t just lay off roughnecks. They also laid off oil traders and middle managers, which means they need a lot less office space. According to Bloomberg Business, a principal at one Calgary real estate office called the situation “a bloodbath” and said “we’re at the highest point of fear and uncertainty now.”Casey readers know the time to buy is when there’s blood in the streets.....

But it looks like Calgary’s property crisis is just getting started. Bloomberg Business reports that the city has five new office towers in the works. These projects will add about 3.8 million square feet to Calgary’s office market over the next three years. More office space will only put more pressure on rents and occupancy rates. Real estate developers likely planned these projects because they thought Canada’s oil boom would last. It’s that same thinking that made oil companies invest billions of dollars in projects that can’t make money when oil trades for less than $100/barrel.

Doug Casey saw this coming.....

In September, Doug went to Alberta to assess the damage first-hand. E.B. Tucker, editor of The Casey Report, joined Doug on the trip. Doug and E.B. spoke with the locals. They even tried to buy a Ferrari. They shared their experience in the October issue of The Casey Report.

E.B. went on record saying Canada was in for “a major wakeup call.” He still thinks that’s the case. In fact, he thinks the situation is going to get a lot worse.

When we were in Alberta, we heard over and over again "It'll come right back...it always does." It's not coming back. I expect the situation to get worse. And I see the Canadian dollar going much lower.

When that happens, E.B. thinks Canada’s central bank might do something it’s never done before:

Vacancy rates are rising in Canada’s heartland cities. Jobs in Alberta are disappearing. Unemployment is climbing. And there’s still a global oversupply in oil. None of this bodes well for Canada’s economy. Canada’s economy is in a midair stall. The locals certainly didn’t grasp this when we visited Alberta last month. That's usually the case when things are going from bad to a lot worse. If you’re a central banker in Canada looking at the data, there’s only one decision: print.

QE is when a central bank creates money and pumps it into the financial system. It’s basically another term for money printing. Since 2008, the Fed has used QE to inject $3.5 trillion into the U.S. financial system. If the Fed’s experience with QE is any indication, money printing wouldn’t help Canada’s “real” economy much. But it would inflate asset prices. That, in turn, would only make Canada’s economy even more fragile. E.B. is confident the situation in Canada will get worse. And he can’t wait to go back to Canada to collect on bets he made during his last visit:

Doug and I made a lot of side bets with business owners during our visit. One of them promised to sell us a Ferrari if things got worse...that's how sure he was that we were wrong. Looks like we'll be headed back to collect on that one.

The article The “Bloodbath” in Canada Is Far From Over was originally published at caseyresearch.com.

Get our latest FREE eBook "Understanding Options"....Just Click Here!

Labels:

Alberta,

Bank,

Canada,

casey research,

Dollar,

Doug Casey,

economy,

Exploration,

Fed,

Justin Spittler,

Oil,

production,

rates,

RSD.A,

XOP

Friday, November 13, 2015

Investing Inspiration from the World of Sports

By John Mauldin

By John Mauldin

One of the most successful investors in the world is Howard Marks of Oaktree Capital Management. One of the things I look forward to every quarter is the letter he writes to his clients – it goes right to the top of my reading list. Not only is it always full of generally brilliant investment counsel, Howard is also a really great writer. He has an easy style that pulls you through his letter effortlessly.

I have never sent his letter to you as an Outside the Box, as the copies I get are clearly watermarked and copyrighted. So I was surprised and delighted to learn that the letter is free when I listened to a speech by Howard in which he encouraged everyone to get it. Unlike another hundred billion dollar hedge fund company that shall go unnamed, Oaktree evidently thinks that brilliance should be shared.

I am especially pleased to be able to pass on this latest issue, in which Howard returns to a theme he has used in the past, which is the parallels between investing and sports. He recounts the career of Yogi Berra, who sadly passed away in September. Yogi was always a fan favorite, and he was certainly one of mine; but it was his consistency, both on offense and defense, that made him great.

Marks goes on to defend the seemingly indefensible: in last year’s Super Bowl, Pete Carroll, coach of the Seattle Seahawks, called for a passing play on the one yard line as time was running out, which as anyone who watched that game would remember, was one of the most spectacularly unsuccessful decisions of all time. But Howard asks us, “His decision was unsuccessful, but was it wrong?”

Can we judge a career on one play? I am grateful that my investment and writing careers are not judged solely by my many mistakes.

This past weekend at the T3 Conference in Miami was enlightening. Todd Harrison put together a great lineup of speakers who represented a wide range of investment styles and strategies. Perhaps because I have been looking at alternative income strategies in a world of low interest rates, I was particularly intrigued by how investors are finding reasonable yield income. I wrote seven years ago that I thought private credit would become a very large part of the investment spectrum in the future, and it is certainly turning out that way. The whole burgeoning world of “shadow banks” has been an unintended consequence of Dodd-Frank.

That overreaching regulation, coupled with enhanced liquidity requirements, has severely limited the ability of small banks to lend. Private credit funds are being set up to go where banks can’t or won’t, and frankly they have a natural advantage. Their cost of money is lower than banks’, and their overhead is even less. They typically don’t leverage as much as banks do, but they can still produce returns that any bank would be happy with. There is more and more interest in making these investment vehicles more accessible to the public, and I applaud anyone who tries.

Plus, it was just good to see so many friends, then sit by the pool for an afternoon after the conference was over. It was supposed to rain, but we got lucky and caught some sunshine in Florida.

Now I’m back in Dallas and working away on the new book. I am told we have all the volunteer research assistants we need, so if you haven’t contacted us yet, my staff has asked me to suggest that we are full up.

Have a great week, and go to your favorite spot to read and think as you enjoy Howard Marks’ latest memo.

Your glad to be back home analyst,

Memo to: Oaktree Clients

I’m constantly intrigued by the parallels between investing and sports. They’re illuminating as well as fun, and thus they’ve prompted two past memos: “How the Game Should Be Played” (May 1995) and “What’s Your Game Plan?” (September 2003). In the latter memo, I listed five ways in which investing is like sports:

Yogi was selected to play in the All-Star Game every year from 1948 through 1962. He was among the top three vote-getters for American League Most Valuable Player every year from 1950 through 1956, and he was chosen as MVP in three of those years. The Yankee teams on which he played won the American League pennant and thus represented the league in the World Series fourteen times, and they won the World Series ten times. He was an important part of one of the greatest dynasties in the history of sports. To me, the thing that stands out most is Yogi’s consistency. Not only did he perform well in so many different categories, but also:

Consistency and minimization of error are two of the attributes that characterized Yogi’s career, and they can also be key assets for superior investors. They aren’t the only ways for investors to excel: some great ones strike out a lot but hit home runs in bunches the way Reggie Jackson did. Reggie – nicknamed “Mr. October” because of his frequent heroics in the World Series – was one of the top home run hitters of all time. But he also holds the record for the most career strikeouts, and his ratio of strikeouts to home runs was four times Yogi’s: 4.61 versus 1.16. Consistency and minimization of error have always ranked high among my priorities and Oaktree’s, and they still do.

“Baseball is ninety percent mental and the other half is physical.” That was another of Yogi’s dicta, and I think it’s highly useful when thinking about investing. Ninety percent of the effort to outperform may consist of financial analysis, but you need to put another fifty percent into understanding human behavior. The market is made up of people, and to beat it you have to know them as well as you do the thing you’re considering investing in.

I sometimes give a presentation called, “The Human Side of Investing.” Its main message surrounds just that: while investing draws on knowledge of accounting, economics and finance, it also requires insight into psychology. Why? Because investors’ objectivity and rationality rarely prevail as much as investment theory assumes, and emotion and “human nature” often take over instead. That’s why my presentation is subtitled, “In theory there’s no difference between theory and practice. In practice there is.” Yogi said that, too, and I think it’s absolutely wonderful.

Things often fail to work the way investment theory says they should. Markets are supposed to be efficient, with no underpricings to find or overpricings to avoid, making it impossible to outperform. But exceptions arise all the time, and they’re usually attributable more to human failings than to math mistakes or overlooked data.

And that leads me to one of the most thought-provoking Yogi-isms, concerning his choice of restaurant: “Nobody goes there anymore because it’s too crowded.” What could be more nonsensical? If nobody goes there, how can it be crowded? And if it’s crowded, how can you say nobody goes there?

But as I wrote last month in “It’s Not Easy,” a lot of accepted investment wisdom makes similarly little sense. And perhaps the greatest – and most injurious – of all is the near unanimous enthusiasm that’s behind most bubbles.

“Everyone knows it’s a great buy,” they say. That, too, makes no sense. If everyone believes it’s a bargain, how can it not have been bought up by the crowd and had its price lifted to non bargain status as a result? You and I know the things all investors find desirable are unlikely to represent good investment opportunities. But aren’t most bubbles driven by the belief that they do?

Because proponents were able to convince the authorities that the act of picking a team for fantasy football qualifies it as a game of skill, not chance. But last week, Nevada became the sixth state to ban daily fantasy sports, concluding that it’s really nothing but gambling.) The commercials for fantasy football say things like, “Sign up, make your picks, and collect your winnings.” That sounds awfully easy . . . and not that different from discount brokers’ ads during bull markets.

In daily fantasy football, the challenge comes from the fact that the participants have a limited amount of money to spend and want to acquire the best possible team for it. If all players were priced the same regardless of their ability (a completely inefficient market), the prize would go to the participant who’s most able to identify talented players. And if all players were priced precisely in line with their ability (a completely efficient market), it would be impossible to acquire a more talented team for the same budget, so winning would hinge on random developments.

The market for players in fantasy football appears to be less than completely efficient. Thus participants have the possibility of finding mispricings. A star may be overpriced, so that he produces few fantasy points per dollar spent on him. And a journeyman might be underpriced, able to produce more rushing (i.e., running) yards, catches, tackles or touchdowns than are reflected by his price. That’s where the parallel to investing comes in.

Smart fantasy football participants understand that the goal isn’t to acquire the best players, or players with the lowest absolute price tags, but players whose “salaries” understate their merit – those who are underpriced relative to their potential and might amass more points in the next game than the cost to draft them reflects. Likewise, smart investors know the goal isn’t to find the best companies, or stocks with the lowest absolute dollar prices or p/e ratios, but the ones whose potential isn’t fully reflected in their price. In both of these competitive arenas, the prize goes to those who see value others miss.

There’s another similarity. Sports media employ “experts” to cover this imaginary football league, and it’s their job to attract viewers and readers by offering advice on which players to draft. (What other talking heads does that remind you of?) My musings on fantasy football started in late September, when I heard a TV commentator urge that participants take a look at Lance Dunbar, a running back for the Dallas Cowboys, based on the belief that Dunbar’s price might understate his potential to earn fantasy points. The commentator’s thesis was that the Cowboys’ star quarterback was injured and, because of the replacement quarterback’s playing style, Dunbar might get more opportunities – and run up more yardage – than his price implied. Thus, Dunbar might represent an underappreciated investment opportunity.

Or not. Dunbar tore his anterior cruciate ligament in the next game, meaning he won’t produce any more points – real or virtual – this season. It just proves that even if your judgment is sound, randomness has a lot of influence on outcomes. You never know which way the ball will bounce.

“Sign up, make your picks, and collect your winnings.” If only everyone – fantasy football entrants and investors alike – understood it’s not that easy.

The New York Post’s sports writers opine weekly as to which professional football games readers should bet on (real games, not fantasy). Each week, the Post reports on the results of the prognostications for the season to date. When they published the results last December 28, they might have thought they demonstrated the value of those helpers. But I think that tabulation – nearly at the end of the football season – showed something very different.

By the time December 28 had rolled around, the eleven forecasters had tried to predict the winner of each of the 237 games that had been played to date, as well as what they thought were their 47 or so “best bets.” By “the winner,” I assume they meant the team that would win net of the bookies’ “point spread.” (Without doing something to even the odds, it would be too easy for bettors to win by backing the favorites. To make betting more of a challenge, the bookies establish a spread for each game: the number of points by which the favored team has to beat the underdog in order to be deemed the winner for betting purposes.) How often were the Post’s picks correct? Here’s the answer:

An incorrigible optimist – or perhaps the Post – might say these results show what a good job the forecasters did as a group, since some were right more often than they were wrong. But that’s not the important thing. For me, the key conclusions are these:

My favorite quotation on the subject of forecasts comes from John Kenneth Galbraith: “We have two classes of forecasters: Those who don’t know – and those who don’t know they don’t know.” Clearly these forecasters don’t know. But do they know it? And do their readers?

The bottom line on picking football winners seems to be that the average forecaster is right half the time, with exceptions that are relatively few in number, insignificant in degree and possibly the result of luck. He might as well flip a coin. And that brings us back to investing, since I find this analogous to the observation that the average investor’s return equals the market average. He, too, might as well flip a coin . . . or invest in an index fund.

And by the way, the average participant’s average result – in both fields – is before transaction costs and fees. After costs, the average investor’s return is below that of the market. In that same vein, after costs the average football bettor doesn’t break even.

What costs? In sports betting, we’re not talking about management fees or brokerage commissions, but “vigorish” or “the vig.” Wikipedia says it’s “also known as juice, the cut or the take . . . the amount charged by a bookmaker . . . for taking a bet from a gambler.” This obscure term refers to the fact that to try to win $10 from a bookie, you have to put up $11. You’re paid $10 if you win, but you’re out $11 if you lose. N.b.: bookies and sports betting parlors aren’t in business to provide a public service.

If you bet against a friend and win half the time, you end up even. But if you bet against a bookie or a betting parlor and win half the time, on average you lose 10% of the amount wagered on every other bet. So at $10 per game, a bettor following the Post’s football helpers through December 28, 2014 would have won $13,280 on the 1,328 correct picks but lost $14,069 on the 1,279 losers. Overall, he would have lost $789 even though slightly more than half the picks were right. That’s what happens when you play in a game where the costs are high and the edge is insufficient or non-existent.

They lost largely because – in something other than the obvious choice – the coach elected to go for it rather than punt the ball away, and they were stopped a yard short. UT got the ball and went on to score the winning touchdown. Before the game, USC had widely been considered one of the greatest teams in college football history. Afterwards there was no more talk along those lines. Its loss hinged on that one very controversial play . . . controversial primarily because it was unsuccessful. (Had USC made the two yards and earned a first down, they would have retained the ball and been able to run out the clock, sealing a victory.)

Something very similar happened in this year’s Super Bowl. The Seattle Seahawks were trailing the New England Patriots by a few points. On second down, with just 26 seconds to go and one timeout remaining, the Seahawks had the ball on the Patriots’ one-yard line. Everyone was sure they would try a run by Marshawn Lynch (who in the regular season had ranked first in the league in rushing touchdowns and fourth in rushing yards), and that he would score the winning touchdown. But the Seahawks’ maverick coach, Pete Carroll – ironically, also the coach of USC’s losing Rose Bowl team – tried a pass play instead. The Patriots intercepted the pass, and the Seahawks’ dreams of a championship ended.

“What an idiot Carroll is,” the fans screamed. “Everyone knows that when you throw a pass, only three things can happen (it’s caught, it’s dropped or it’s intercepted) and two of them are bad.” The Seahawks lost a game they seemed to be on the verge of winning, and Carroll was vilified for being too bold and wrong . . . again. His decision was unsuccessful. But was it wrong?

With assistance from Warren Min in Oaktree’s Real Estate Department, I want to point out some of the considerations that Carrol may have taken into account in making his decision:

The second level thinker sees that the obvious call – to run – was far from sure to work, and that doing the less than obvious – passing – might put the element of surprise on the Seahawks’ side and represent better clock management. Carroll made his decision and it was unsuccessful. But that doesn’t prove he was wrong.

Here’s what my colleague Warren wrote me:

In his book, Taleb talks about “alternative histories,” which I describe as “the other things that reasonably could have happened but didn’t.” Sure, the Seahawks lost the game. But they could have won, and Carroll’s decision would have made the difference in that case, too, making him the hero instead of the goat. So rather than judge a decision solely on the basis of the outcome, you have to consider (a) the quality of the process that led to the decision, (b) the a priori probability that the decision would work (which is very different from the question of whether it did work), (c) the other decisions that could have been made, (d) all of the events that reasonably could have unfolded, and thus (e) which of the decisions had the highest probability of success.

Here’s the bottom line:

Djokovic’s statement reminded me of a conversation I had earlier this month, on a subject I’ve written about rarely if ever: self confidence. It ranks high among the attributes that must be present if one is to achieve superior results.

To be above average, an athlete has to separate from the pack. To win at high level tennis, a player has to hit “winners” – shots his opponents can’t return. They’re hit so hard, so close to the lines or so low over the net that they have the potential to end up as “unforced errors.” In the absence of skill, they’re unlikely to be executed successfully, meaning it’s unwise to try them. But people who possess the requisite skill are right in attempting them in order to “play the winner’s game” (see “What’s Your Game Plan”).

These may be analogous to investment actions that Yale’s David Swensen would describe as “uncomfortably idiosyncratic.” The truth is, most great investments begin in discomfort – or, perhaps better said, they involve doing things with which most people are uncomfortable. To achieve great performance you have to believe in value that isn’t apparent to everyone else (or else it would already be reflected in the price); buy things that others think are risky and uncertain; and buy them in amounts large enough that if they don’t work out they can lead to embarrassment. What are examples of actions that require self confidence?

It’s great for investors to have self confidence, and it’s great that it permits them to behave boldly, but only when that self confidence is warranted. This final qualification means that investors must engage in brutally candid self assessment. Hubris or over confidence is far more dangerous than a shortage of confidence and a resultant unwillingness to act boldly. That must be what Mark Twain had in mind when he said, “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” And it also has to be what Novak Djokovic meant when he said, “It’s a fine line.”

So there you have some of the key lessons from sports:

Like Outside the Box? Sign up today and get each new issue delivered free to your inbox.

It's your opportunity to get the news John Mauldin thinks matters most to your finances.

I have never sent his letter to you as an Outside the Box, as the copies I get are clearly watermarked and copyrighted. So I was surprised and delighted to learn that the letter is free when I listened to a speech by Howard in which he encouraged everyone to get it. Unlike another hundred billion dollar hedge fund company that shall go unnamed, Oaktree evidently thinks that brilliance should be shared.

I am especially pleased to be able to pass on this latest issue, in which Howard returns to a theme he has used in the past, which is the parallels between investing and sports. He recounts the career of Yogi Berra, who sadly passed away in September. Yogi was always a fan favorite, and he was certainly one of mine; but it was his consistency, both on offense and defense, that made him great.

Marks goes on to defend the seemingly indefensible: in last year’s Super Bowl, Pete Carroll, coach of the Seattle Seahawks, called for a passing play on the one yard line as time was running out, which as anyone who watched that game would remember, was one of the most spectacularly unsuccessful decisions of all time. But Howard asks us, “His decision was unsuccessful, but was it wrong?”

Can we judge a career on one play? I am grateful that my investment and writing careers are not judged solely by my many mistakes.

This past weekend at the T3 Conference in Miami was enlightening. Todd Harrison put together a great lineup of speakers who represented a wide range of investment styles and strategies. Perhaps because I have been looking at alternative income strategies in a world of low interest rates, I was particularly intrigued by how investors are finding reasonable yield income. I wrote seven years ago that I thought private credit would become a very large part of the investment spectrum in the future, and it is certainly turning out that way. The whole burgeoning world of “shadow banks” has been an unintended consequence of Dodd-Frank.

That overreaching regulation, coupled with enhanced liquidity requirements, has severely limited the ability of small banks to lend. Private credit funds are being set up to go where banks can’t or won’t, and frankly they have a natural advantage. Their cost of money is lower than banks’, and their overhead is even less. They typically don’t leverage as much as banks do, but they can still produce returns that any bank would be happy with. There is more and more interest in making these investment vehicles more accessible to the public, and I applaud anyone who tries.

Plus, it was just good to see so many friends, then sit by the pool for an afternoon after the conference was over. It was supposed to rain, but we got lucky and caught some sunshine in Florida.

Now I’m back in Dallas and working away on the new book. I am told we have all the volunteer research assistants we need, so if you haven’t contacted us yet, my staff has asked me to suggest that we are full up.

Have a great week, and go to your favorite spot to read and think as you enjoy Howard Marks’ latest memo.

Your glad to be back home analyst,

John Mauldin, Editor

Outside the Box

Outside the Box

Stay Ahead of the Latest Tech News and Investing Trends...

Each day, you get the three tech news stories with the biggest potential impact.

Memo to: Oaktree Clients

From: Howard Marks

Re: Inspiration from the World of Sports

I’m constantly intrigued by the parallels between investing and sports. They’re illuminating as well as fun, and thus they’ve prompted two past memos: “How the Game Should Be Played” (May 1995) and “What’s Your Game Plan?” (September 2003). In the latter memo, I listed five ways in which investing is like sports:

- It’s competitive – some succeed and some fail, and the distinction is clear.

- It’s quantitative – you can see the results in black and white.

- It’s a meritocracy – in the long term, the better returns go to the superior investors.

- It’s team-oriented – an effective group can accomplish more than one person.

- It’s satisfying and enjoyable – but much more so when you win.

Yogi Berra, Baseball Player

Lawrence “Yogi” Berra was a catcher on New York Yankees baseball teams for eighteen years, from 1946 to 1963. Although he was rarely number one in any offensive category, he often ranked among the top ten players in runs batted in, home runs, extra base hits (doubles, triples and home runs), total bases gained and slugging percentage (total bases gained per at bat). He excelled even more on defense: in the 1950s he was regularly among the top three or four catchers in terms of putouts, assists, double plays turned, stolen bases allowed and base stealers thrown out.Yogi was selected to play in the All-Star Game every year from 1948 through 1962. He was among the top three vote-getters for American League Most Valuable Player every year from 1950 through 1956, and he was chosen as MVP in three of those years. The Yankee teams on which he played won the American League pennant and thus represented the league in the World Series fourteen times, and they won the World Series ten times. He was an important part of one of the greatest dynasties in the history of sports. To me, the thing that stands out most is Yogi’s consistency. Not only did he perform well in so many different categories, but also:

- He led the American League in number of games played at the grueling catcher position eight years in a row.

- He was regularly among the catchers with the fewest passed balls and errors committed.

- He had around 450-650 at bats most years, but over his entire career he averaged only 24 strikeouts per year, and there was never one in which he struck out more than 38 times. (In 1950 he did so only 12 times in nearly 600 at bats.) Thus, ten times between 1948 and 1959 he was among the ten players with the fewest strikeouts per plate appearance.

Consistency and minimization of error are two of the attributes that characterized Yogi’s career, and they can also be key assets for superior investors. They aren’t the only ways for investors to excel: some great ones strike out a lot but hit home runs in bunches the way Reggie Jackson did. Reggie – nicknamed “Mr. October” because of his frequent heroics in the World Series – was one of the top home run hitters of all time. But he also holds the record for the most career strikeouts, and his ratio of strikeouts to home runs was four times Yogi’s: 4.61 versus 1.16. Consistency and minimization of error have always ranked high among my priorities and Oaktree’s, and they still do.

Yogi Berra, Philosopher

Although Yogi was one of the all time greats, his baseball achievements may be little-remembered by the current generation of fans, and few non-sports lovers are aware of them. He’s probably far better known for the things he said:- It’s like déjà vu all over again.

- When you come to a fork in the road, take it.

- You can observe a lot by just watching.

- Always go to other people’s funerals, otherwise they won’t come to yours.

- I knew the record would stand until it was broken.

- The future ain’t what it used to be.

- You wouldn’t have won if we’d beaten you.

- I never said most of the things I said.

“Baseball is ninety percent mental and the other half is physical.” That was another of Yogi’s dicta, and I think it’s highly useful when thinking about investing. Ninety percent of the effort to outperform may consist of financial analysis, but you need to put another fifty percent into understanding human behavior. The market is made up of people, and to beat it you have to know them as well as you do the thing you’re considering investing in.

I sometimes give a presentation called, “The Human Side of Investing.” Its main message surrounds just that: while investing draws on knowledge of accounting, economics and finance, it also requires insight into psychology. Why? Because investors’ objectivity and rationality rarely prevail as much as investment theory assumes, and emotion and “human nature” often take over instead. That’s why my presentation is subtitled, “In theory there’s no difference between theory and practice. In practice there is.” Yogi said that, too, and I think it’s absolutely wonderful.

Things often fail to work the way investment theory says they should. Markets are supposed to be efficient, with no underpricings to find or overpricings to avoid, making it impossible to outperform. But exceptions arise all the time, and they’re usually attributable more to human failings than to math mistakes or overlooked data.

And that leads me to one of the most thought-provoking Yogi-isms, concerning his choice of restaurant: “Nobody goes there anymore because it’s too crowded.” What could be more nonsensical? If nobody goes there, how can it be crowded? And if it’s crowded, how can you say nobody goes there?

But as I wrote last month in “It’s Not Easy,” a lot of accepted investment wisdom makes similarly little sense. And perhaps the greatest – and most injurious – of all is the near unanimous enthusiasm that’s behind most bubbles.

“Everyone knows it’s a great buy,” they say. That, too, makes no sense. If everyone believes it’s a bargain, how can it not have been bought up by the crowd and had its price lifted to non bargain status as a result? You and I know the things all investors find desirable are unlikely to represent good investment opportunities. But aren’t most bubbles driven by the belief that they do?

- In 1968, everyone knew the Nifty Fifty stocks of the best companies in America represented compelling value, even after their p/e ratios had reached 80 or 90. That belief kept them there . . . for a while.

- In 2000, everyone thought tech investing was infallible and tech stocks could only rise. And they were sure the Internet would change the world and the stocks of Internet companies were good buys at any price. That’s what took the TMT boom to its zenith.

- And here in 2015, everyone knows social media companies will own the future. But will their valuations turn out to be warranted?

Looking for Lance Dunbar

There may be a few folks in America who, like the rest of the world’s population, are unaware of the growing popularity of daily fantasy football. In this on-line game, contestants assemble imaginary football teams staffed by real professional players. When that week’s actual football games are played, the participants receive “fantasy points” based on their players’ real world accomplishments, and the participants with the most points win cash prizes. (Why is it okay to engage in interstate betting on fantasy football but not on football itself?Because proponents were able to convince the authorities that the act of picking a team for fantasy football qualifies it as a game of skill, not chance. But last week, Nevada became the sixth state to ban daily fantasy sports, concluding that it’s really nothing but gambling.) The commercials for fantasy football say things like, “Sign up, make your picks, and collect your winnings.” That sounds awfully easy . . . and not that different from discount brokers’ ads during bull markets.

In daily fantasy football, the challenge comes from the fact that the participants have a limited amount of money to spend and want to acquire the best possible team for it. If all players were priced the same regardless of their ability (a completely inefficient market), the prize would go to the participant who’s most able to identify talented players. And if all players were priced precisely in line with their ability (a completely efficient market), it would be impossible to acquire a more talented team for the same budget, so winning would hinge on random developments.

The market for players in fantasy football appears to be less than completely efficient. Thus participants have the possibility of finding mispricings. A star may be overpriced, so that he produces few fantasy points per dollar spent on him. And a journeyman might be underpriced, able to produce more rushing (i.e., running) yards, catches, tackles or touchdowns than are reflected by his price. That’s where the parallel to investing comes in.

Smart fantasy football participants understand that the goal isn’t to acquire the best players, or players with the lowest absolute price tags, but players whose “salaries” understate their merit – those who are underpriced relative to their potential and might amass more points in the next game than the cost to draft them reflects. Likewise, smart investors know the goal isn’t to find the best companies, or stocks with the lowest absolute dollar prices or p/e ratios, but the ones whose potential isn’t fully reflected in their price. In both of these competitive arenas, the prize goes to those who see value others miss.

There’s another similarity. Sports media employ “experts” to cover this imaginary football league, and it’s their job to attract viewers and readers by offering advice on which players to draft. (What other talking heads does that remind you of?) My musings on fantasy football started in late September, when I heard a TV commentator urge that participants take a look at Lance Dunbar, a running back for the Dallas Cowboys, based on the belief that Dunbar’s price might understate his potential to earn fantasy points. The commentator’s thesis was that the Cowboys’ star quarterback was injured and, because of the replacement quarterback’s playing style, Dunbar might get more opportunities – and run up more yardage – than his price implied. Thus, Dunbar might represent an underappreciated investment opportunity.

Or not. Dunbar tore his anterior cruciate ligament in the next game, meaning he won’t produce any more points – real or virtual – this season. It just proves that even if your judgment is sound, randomness has a lot of influence on outcomes. You never know which way the ball will bounce.