The Fibonacci extension on the SP500 chart shows that it has reached the 618 halfway move and then blasted past the 100% measured move. So what will happen next? When hot terms like A.I. are used to advertise, say, toothbrushes, have we finally hit the peak? Is this a sign of exhaustion, or are we just getting started?

Watch Chris’ Video Analysis Here

Trade ideas, analysis and low risk set ups for commodities, Bitcoin, gold, silver, coffee, the indexes, options and your retirement. We'll help you keep your emotions out of your trading.

Showing posts with label Technology. Show all posts

Showing posts with label Technology. Show all posts

Monday, March 25, 2024

Monday, January 25, 2021

Technology & Energy Sectors Are Hot – Are You Missing Out?

One of the biggest movers over the past few months has been the recovery of the Oil/Gas/Energy sector after quite a bit of sideways/lower price trending. You can see from this XOP chart, below, a 44% upside price rally has taken place since early November, and XOP has recently rotated moderately downward – setting up another potential trade setup if this rally continues. Traders know, the trend if your friend. Another upside price swing in the XOP, above $72, would suggest this rally mode is continuing.

Recently, we published a research article suggesting a lower U.S. Dollar would prompt major sector rotations in the US and global markets where we highlighted the fact that the Materials, Industrials, Technology, and Discretionary sectors had been the hottest sectors of the past 180 days, but the Energy, Financials, Materials, and Industrials had shown the best strength over the past 90 days....Read More Here.

Recently, we published a research article suggesting a lower U.S. Dollar would prompt major sector rotations in the US and global markets where we highlighted the fact that the Materials, Industrials, Technology, and Discretionary sectors had been the hottest sectors of the past 180 days, but the Energy, Financials, Materials, and Industrials had shown the best strength over the past 90 days....Read More Here.

Labels:

Chris Vermeulen,

Crude Oil,

Dollar,

energy,

NASDAQ,

SP500,

Technology,

The Technical Traders,

traders,

XOP

Monday, May 13, 2019

How Chinese Trade Issues Will Drive Market Trends

It is becoming evident that the US/Chinese trade issues are going to become a point of contention for the markets going forward. We’ve been review as much news as possible in an attempt to build a consensus for the future of the U.S. markets and global markets. As of last week, it appears any potential trade deal with China has reset back to square one. The news we are reading suggests that China wants to reset their commitments with the US, remove all tariffs and wants the US to commit to buying certain levels of Chinese goods in the future. Additionally, China has yet to commit to stopping the IP/Technology theft from U.S. companies – which is a very big contention for the US.

This suggests the past 6+ months of trade talks have completely broken down and that this trade issue will likely become a market driver over the next 12+ months. The global markets had anticipated a deal to be reached by the end of March 2019. At that time, Trump announced that he was extending talks with China without installing any new tariffs. The intent was to show commitment with China to reach a deal at that time – quickly.

It appears that China had different plans – the intention to delay and ignore U.S. requests. It is very likely that China has worked to secure some type of “plan B” type of scenario over the past 6+ months and they may feel they are negotiating from a position of power at this time. Our assumption is that both the U.S. and China feel their interests are best served by holding their cards close to their chests while pushing the other side to breakdown through prolonged negotiations.

Our observations are that an economic shift is continuing to take place throughout the globe that may see these US/China trade issues become the forefront issue over the next 12 to 24 months – possibly lasting well past the November 2020 US Presidential election cycle. It seems obvious that China is digging in for a prolonged negotiation process while attempting to hold off another round of tariffs from the US. Additionally, China is dealing with an internal process of trying to shift away from “shadow banking” to eliminate the risks associated with unreported corporate and private debt issues.

The limited, yet still valid, resources we have from within China are suggesting that layoffs are very common right now and that companies are not hiring as they were just a few months ago. One of our friends/sources suggested the company he worked for has been laying off employees for over 30 days now and he just found out he was laid off last week. He works in the financial field.

We believe the long term complications resulting from a prolonged U.S./China trade war may create a foundational shift within the global markets over the next 16 to 24+ months headed into the November 2020 U.S. Elections. We’ve already authored articles about how the prior 24 months headed into major U.S. elections tend to be filled with price rotation while an initial downside price move is common within about 16+ months of a major US election event. This year may turn out to prompt an even bigger price rotation.

U.S. Stock Market volatility just spiked to levels well above 20 – levels not seen since October/November 2018, when the markets fell nearly 20% before the end of 2018. The potential for increased price volatility over the next 12+ months seems rather high with all of the foreign positioning and expectations that are milling around. It seems like the next 16+ months could be filled with incredibly high volatility, price rotation and opportunity for skilled traders.

Our primary concern is that the continued trade war between the U.S. and China spills over into other global markets as a constricted price range based trading environment. Most of the rest of the world is still trying to spark some increased levels of economic growth after the 2008-09 market crisis. The current market environment does not settle well for investor confidence, growth, and future success. The combination of a highly contested U.S. Presidential election, US/China trade issues, a struggling general foreign market, currency fluctuations attempting to mitigate capital risks and other issues, it seems the global stock markets are poised for a very big increase in volatility and price rotation over the next 2 years or so.

Our first focus is on the Hang Seng Index. This Weekly chart shows just how dramatic the current price rotation has been over the past few weeks and how a defined price channel could be setting up in the HSI to prompt a much larger downside objective. Should continue trade issues persist and should China, through the course of negotiating with the U.S., expose any element of risk perceived by the rest of the world, the potential for further price contraction is very real. China is walking a very fine line right now as Trump is pushing issues (trade issues and IP/Technology issues) to the forefront of the trade negotiations. In our opinion, the very last thing China wants is their dirty laundry, shady deals and political leadership strewn across the global news cycles over the next 24+ months.

The DAX Weekly Index is showing a similar price pattern. A very clear upper price trend channel which translates into a very clear downside price objective is price continues lower. Although the DAX is not related directly to the US/China trade negotiations, the global markets are far more interconnected now than ever before. Any rotation lower in China will likely result in a moderate price decrease in many of the major global market indexes.

As we’ve suggested within our earlier research posts, U.S. election cycles tend to prompt massive price rotations when the election cycles are intense. In our next post PART II of this report, we talk about what happened in the past election cycles reviewing the monthly charts and weekly SP500 index charts which are very telling in what could be about to happen next for the stock market from an investors standpoint.

For active swing traders, you are going to love our daily trading analysis. On May 1st we talked about the old saying goes, “Sell in May and Go Away!” and that is exactly what is happening now right on queue. In fact, we closed out our SDS position on Thursday for a quick 3.9% profit and our other new trade started Thursday is up 18% already.

Second, my birthday is only three days away and I think it's time I open the doors for a once a year opportunity for everyone to get a gift that could have some considerable value in the future.

Right now I am going to give away and shipping out silver rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. I only have 7 left as they are going fast so be sure to upgrade your membership to a longer term subscription or if you are new, join one of these two plans, and you will receive:

Chris Vermeulen

Stay tuned for PART II next!

This suggests the past 6+ months of trade talks have completely broken down and that this trade issue will likely become a market driver over the next 12+ months. The global markets had anticipated a deal to be reached by the end of March 2019. At that time, Trump announced that he was extending talks with China without installing any new tariffs. The intent was to show commitment with China to reach a deal at that time – quickly.

It appears that China had different plans – the intention to delay and ignore U.S. requests. It is very likely that China has worked to secure some type of “plan B” type of scenario over the past 6+ months and they may feel they are negotiating from a position of power at this time. Our assumption is that both the U.S. and China feel their interests are best served by holding their cards close to their chests while pushing the other side to breakdown through prolonged negotiations.

Our observations are that an economic shift is continuing to take place throughout the globe that may see these US/China trade issues become the forefront issue over the next 12 to 24 months – possibly lasting well past the November 2020 US Presidential election cycle. It seems obvious that China is digging in for a prolonged negotiation process while attempting to hold off another round of tariffs from the US. Additionally, China is dealing with an internal process of trying to shift away from “shadow banking” to eliminate the risks associated with unreported corporate and private debt issues.

The limited, yet still valid, resources we have from within China are suggesting that layoffs are very common right now and that companies are not hiring as they were just a few months ago. One of our friends/sources suggested the company he worked for has been laying off employees for over 30 days now and he just found out he was laid off last week. He works in the financial field.

We believe the long term complications resulting from a prolonged U.S./China trade war may create a foundational shift within the global markets over the next 16 to 24+ months headed into the November 2020 U.S. Elections. We’ve already authored articles about how the prior 24 months headed into major U.S. elections tend to be filled with price rotation while an initial downside price move is common within about 16+ months of a major US election event. This year may turn out to prompt an even bigger price rotation.

U.S. Stock Market volatility just spiked to levels well above 20 – levels not seen since October/November 2018, when the markets fell nearly 20% before the end of 2018. The potential for increased price volatility over the next 12+ months seems rather high with all of the foreign positioning and expectations that are milling around. It seems like the next 16+ months could be filled with incredibly high volatility, price rotation and opportunity for skilled traders.

Our primary concern is that the continued trade war between the U.S. and China spills over into other global markets as a constricted price range based trading environment. Most of the rest of the world is still trying to spark some increased levels of economic growth after the 2008-09 market crisis. The current market environment does not settle well for investor confidence, growth, and future success. The combination of a highly contested U.S. Presidential election, US/China trade issues, a struggling general foreign market, currency fluctuations attempting to mitigate capital risks and other issues, it seems the global stock markets are poised for a very big increase in volatility and price rotation over the next 2 years or so.

Our first focus is on the Hang Seng Index. This Weekly chart shows just how dramatic the current price rotation has been over the past few weeks and how a defined price channel could be setting up in the HSI to prompt a much larger downside objective. Should continue trade issues persist and should China, through the course of negotiating with the U.S., expose any element of risk perceived by the rest of the world, the potential for further price contraction is very real. China is walking a very fine line right now as Trump is pushing issues (trade issues and IP/Technology issues) to the forefront of the trade negotiations. In our opinion, the very last thing China wants is their dirty laundry, shady deals and political leadership strewn across the global news cycles over the next 24+ months.

The DAX Weekly Index is showing a similar price pattern. A very clear upper price trend channel which translates into a very clear downside price objective is price continues lower. Although the DAX is not related directly to the US/China trade negotiations, the global markets are far more interconnected now than ever before. Any rotation lower in China will likely result in a moderate price decrease in many of the major global market indexes.

As we’ve suggested within our earlier research posts, U.S. election cycles tend to prompt massive price rotations when the election cycles are intense. In our next post PART II of this report, we talk about what happened in the past election cycles reviewing the monthly charts and weekly SP500 index charts which are very telling in what could be about to happen next for the stock market from an investors standpoint.

For active swing traders, you are going to love our daily trading analysis. On May 1st we talked about the old saying goes, “Sell in May and Go Away!” and that is exactly what is happening now right on queue. In fact, we closed out our SDS position on Thursday for a quick 3.9% profit and our other new trade started Thursday is up 18% already.

Second, my birthday is only three days away and I think it's time I open the doors for a once a year opportunity for everyone to get a gift that could have some considerable value in the future.

Right now I am going to give away and shipping out silver rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. I only have 7 left as they are going fast so be sure to upgrade your membership to a longer term subscription or if you are new, join one of these two plans, and you will receive:

One Year Subscription Gets One 1oz Silver Round FREE

(Could be worth hundreds of dollars)

Two Year Subscription Gets TWO 1oz Silver Rounds FREE

(Could be worth a lot in the future)

I only have 13 more silver rounds I’m giving away

so upgrade or join now before it's too late!

Happy May Everyone!

Stay tuned for PART II next!

Labels:

China,

Chris Vermeulen,

crisis,

CYB,

Hang Seng Index,

SDS,

stocks,

Technology,

trade,

Trump,

US,

volatility

Thursday, November 30, 2017

Capital Repositioning Driving Volatility Higher

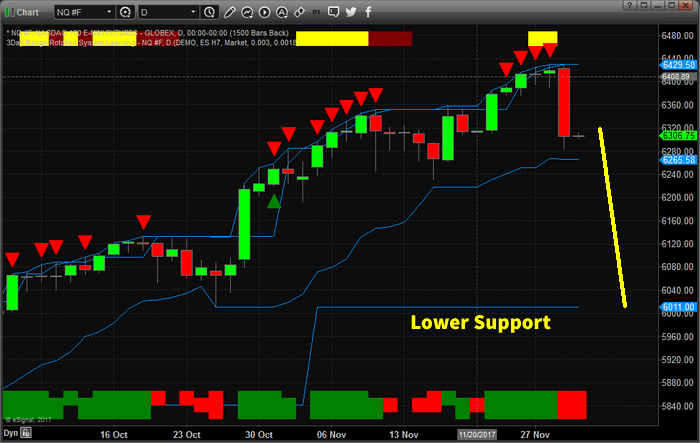

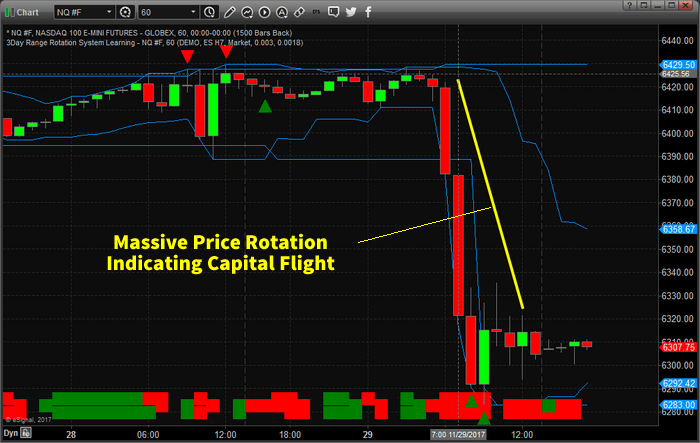

Recent moves in the FANG stocks shows that capital is starting to reposition within the global market. As the end of the year approaches, expect more of this type of capital control to drive greater volatility within the markets. At this time of year, especially after such a fantastic bullish run, it is not uncommon to see capital move out of high flying equities and into cash or other investments.

The recent move lower in the NQ has taken many by surprise, but the bullish run in the FANG stocks has been tremendous. Facebook was higher +59% for 2017 (600% 2016 levels). Amazon was up +61% for 2017 (550% 2016 levels). Netflix was up +64.75% for 2017 (600% 2016 levels) and Google was higher by +37% for 2017 (1000% 2016 levels). These are huge increases in capital valuation.

In early 2017, we authored an article about how capital works and always seeks out the best returns in any environment. It was obvious from the moves this year that capital rushed into the US markets with the President Trump’s win and is now concerned that the end of the year may be cause to pull away from the current environment.

The current decline in the NQ, -2.25% so far, is not a huge decline in price yet. Lower price support is found near the $6000 level. Should this “Price Flight” continue in the NASDAQ, we could be looking at a 6~8% decline, or greater, going into the end of this year.

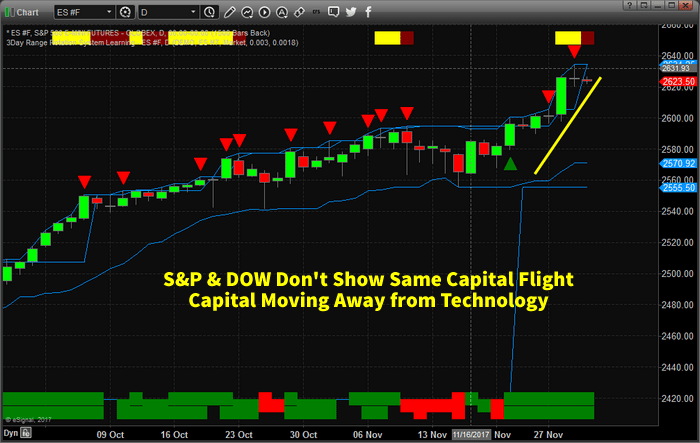

The price swing, this week, was very fast and aggressive. In terms of capital, this was a massive price rotation away from Technology. While the S&P and DOW Industrials continue higher, this presents a cause for concern with regards to the end of year expectations.

Will capital continue to rush into the US markets and specifically Technology stocks? Or will capital rush out of these equities and into other sources of “safety” as technology melts down into the end of 2017? Has the 40~60%+ price rally of 2017 been enough for investors to take their profits and run?

It is quite possible that capital will move to the sidelines through the end of this year and reenter the markets early next year as investors find a better footing for the markets. The facts are, currently, that financials and transportation seem to be doing much better than the FANG stocks. If this continues, we could be looking at a broader shift in the global markets – almost like a second technology bubble burst.

If you want to learn more about how we can assist you with your investment needs, visit The Technical Traders Here to learn more. Our researchers are dedicated to assisting you and in helping you learn to profit from these moves. 2018 is certain to be a dynamic trading year – so don’t miss out.

Labels:

Amazon,

bullish,

capital,

equities,

Gas,

investment,

NASDAQ,

Oil,

President Trump,

profit,

Technology,

trading

Monday, April 15, 2013

The Gold Meltdown – What Happened?

In today’s Trade School video, we’re going to be looking into what caused the recent meltdown in gold prices. How could gold drop so precipitously in such a short time, given what’s going on in the world? Did it have anything to do with the ETF GLD or was a country forced to sell its precious metals to satisfy creditors?

We will share with you how you could have systematically made money in gold using our Trade Triangle technology, which has produced some very positive results over the years.

Since 1975, there have been 13 bear markets with an average drop around 14%. This would put gold below the $1,300 level, around $1,280.

In this short 4 minute video on gold, we will illustrate the importance of having a solid game plan and a market proven approach. We will go through each trade in gold and share with you the results of using our Trade Triangle approach from the beginning of the year.

This approach is not for everyone, but we think you will agree that the results certainly speak for themselves.

For more information on the tools we use in this video just click here to > visit The MarketClub

We will share with you how you could have systematically made money in gold using our Trade Triangle technology, which has produced some very positive results over the years.

Since 1975, there have been 13 bear markets with an average drop around 14%. This would put gold below the $1,300 level, around $1,280.

In this short 4 minute video on gold, we will illustrate the importance of having a solid game plan and a market proven approach. We will go through each trade in gold and share with you the results of using our Trade Triangle approach from the beginning of the year.

This approach is not for everyone, but we think you will agree that the results certainly speak for themselves.

For more information on the tools we use in this video just click here to > visit The MarketClub

Labels:

bear,

gld,

gold,

MarketClub,

markets,

Technology,

trade triangle

Wednesday, September 14, 2011

Musings: Trying To Solve Mystery Of Missing Marcellus Resource

A tenant of America's gas shale revolution is that shale is ubiquitous and uniformly spread under our oil and gas producing basins. That belief has translated into growing estimates of the resource's potential and how it has radically changed the long term outlook for America's, and potentially the world's energy future. Is it possible this tenant has been knocked into a cocked hat by the latest estimate of the resource potential of one of our largest gas shale basins.... the Marcellus Shale?

The recent assessment by the U.S. Geological Survey (USGS) that the Marcellus Shale contains 84 trillion cubic feet (Tcf) of undiscovered natural gas and 3.4 billion barrels of undiscovered natural gas liquids was greeted with both joy and consternation. The joy came from the recognition that the USGS estimate was a huge increase from its prior assessment made in 2002 that said there was only about 2 Tcf of gas reserves in the shale formation that stretches from Alabama to New York.

The consternation stems from the assessment being about 80% less than an estimate promoted earlier this year by the Energy Information Administration (EIA) that there was 410 Tcf of gas in the basin. Talk about a gap wide enough to drive a truck through, how about a whole fleet of pickups?

First, it is important to understand that the USGS estimate is the mean of various estimates the agency prepared. Each estimate was assigned a confidence level based on how sure the agency was that the estimated volume actually is present. The estimates ranged from a very highly confident (95%) estimate of 43 Tcf to the estimate with the lowest confidence (5%) of 144 Tcf. The 50% confidence scenario estimated total gas reserves of 78.7 Tcf, or somewhat below the mean estimate the agency decided to publish.

Second, it is important to understand that these estimates reflect a view that the resources are technically recoverable, which, to quote from the agency's press release, means "are those quantities of oil and gas producible using currently available technology and industry practices, regardless of economic or accessibility considerations." The USGS went on to say, "…these estimates include resources beneath both onshore and offshore areas (such as Lake Erie) and beneath areas where accessibility may be limited by policy and regulations imposed by land managers and regulatory agencies."

Importantly, the USGS attributed the increase in its undiscovered resource estimate to the "new geologic information and engineering data, as technological developments in producing unconventional resources have been significant in the last decade." Clearly, the USGS was referring to the improvements in horizontal drilling and hydraulic fracturing, which the petroleum industry has embraced wholeheartedly in driving the gas shale revolution......Read the entire article.

The recent assessment by the U.S. Geological Survey (USGS) that the Marcellus Shale contains 84 trillion cubic feet (Tcf) of undiscovered natural gas and 3.4 billion barrels of undiscovered natural gas liquids was greeted with both joy and consternation. The joy came from the recognition that the USGS estimate was a huge increase from its prior assessment made in 2002 that said there was only about 2 Tcf of gas reserves in the shale formation that stretches from Alabama to New York.

The consternation stems from the assessment being about 80% less than an estimate promoted earlier this year by the Energy Information Administration (EIA) that there was 410 Tcf of gas in the basin. Talk about a gap wide enough to drive a truck through, how about a whole fleet of pickups?

First, it is important to understand that the USGS estimate is the mean of various estimates the agency prepared. Each estimate was assigned a confidence level based on how sure the agency was that the estimated volume actually is present. The estimates ranged from a very highly confident (95%) estimate of 43 Tcf to the estimate with the lowest confidence (5%) of 144 Tcf. The 50% confidence scenario estimated total gas reserves of 78.7 Tcf, or somewhat below the mean estimate the agency decided to publish.

Second, it is important to understand that these estimates reflect a view that the resources are technically recoverable, which, to quote from the agency's press release, means "are those quantities of oil and gas producible using currently available technology and industry practices, regardless of economic or accessibility considerations." The USGS went on to say, "…these estimates include resources beneath both onshore and offshore areas (such as Lake Erie) and beneath areas where accessibility may be limited by policy and regulations imposed by land managers and regulatory agencies."

Importantly, the USGS attributed the increase in its undiscovered resource estimate to the "new geologic information and engineering data, as technological developments in producing unconventional resources have been significant in the last decade." Clearly, the USGS was referring to the improvements in horizontal drilling and hydraulic fracturing, which the petroleum industry has embraced wholeheartedly in driving the gas shale revolution......Read the entire article.

Labels:

EIA,

fracking,

Musings,

Technology,

USGS

Tuesday, April 26, 2011

EIA Examines Alternate Scenarios for the Future of U.S. Energy

The U.S. Energy Information Administration (EIA) today released the complete version of Annual Energy Outlook 2011 (AEO2011), which includes 57 sensitivity cases that show how different assumptions regarding market, policy, and technology drivers affect the previously released Reference case projections of energy production, consumption, technology, and market trends and the direction they may take in the future.

"EIA's projections indicate strong growth in shale gas production, growing use of natural gas and renewables in electric power generation, declining reliance on imported liquid fuels, and projected slow growth in energy-related carbon dioxide emissions in the absence of new policies designed to reduce them," said EIA Administrator Richard Newell. "But variations in key assumptions can have a significant impact on the projected outcomes."

In addition to considering alternative scenarios for oil prices, economic growth, and the uptake of more energy efficient technologies, the AEO2011 sensitivity cases explore important areas of uncertainty for markets, technologies, and policies in the U.S. energy economy.

Key results highlighted in AEO2011 include:

U.S. reliance on imported liquid fuels falls due to increased domestic production ¿ including biofuels ¿ and greater fuel efficiency. Although U.S. consumption of liquid fuels continues to grow through 2035 in the Reference case, reliance on petroleum imports as a share of total liquids consumption decreases. Total U.S. consumption of liquid fuels, including both fossil fuels and biofuels, rises from about 18.8 million barrels per day in 2009 to 21.9 million barrels per day in 2035 in the Reference case. The import share, which reached 60 percent in 2005 and 2006 before falling to 51 percent in 2009, falls to 42 percent in 2035. Sensitivity cases illustrate opportunities for further reductions in U.S. reliance on imported liquid fuels through additional increases in fuel efficiency or domestic liquid fuels production.

Domestic shale gas resources support increased natural gas production with moderate prices, but assumptions about resources and recoverability are key uncertain factors. Shale gas production continues to increase strongly through 2035 in the AEO2011 Reference case, growing almost fourfold from 2009 to 2035 when it makes up 47 percent of total U.S. production¿up considerably from the 16 percent share in 2009.

Although more information on shale resources has become available as a result of increased drilling activity in developing shale gas plays, estimates of technically recoverable resources and well productivity remain highly uncertain. Over the past decade, as more shale formations have gone into commercial production, the estimate of technically and economically recoverable shale gas resources has skyrocketed.

However, the increases in recoverable shale gas resources embody many assumptions that might prove to be incorrect over the long term. Alternative cases in AEO2011 examine the potential impacts of variation in the estimated ultimate recovery per shale gas well and the assumed recoverability factor used to estimate how much of the play acreage contains recoverable shale gas.

Proposed environmental regulations could alter the power generation fuel mix. The EPA is expected to enact several key regulations in the coming decade that will have an impact on the U.S. power sector, particularly the fleet of coal fired power plants. Because the rules have not yet been finalized, their impacts cannot be fully analyzed, and they are not included in the Reference case.

However, AEO2011 does include several alternative cases that examine the sensitivity of power generation markets to various assumed requirements for environmental retrofits. The range of coal plant retirements varies considerably across the cases, with a low of 9 gigawatts (3 percent of the coal fleet) in the Reference case and a high of 73 gigawatts (over 20 percent of the coal fleet) in the most extreme case.

Electricity generation from natural gas is higher in 2035 in all the environmental regulation sensitivity cases than in the Reference case. The faster growth in electricity generation with natural gas is supported by low natural gas prices and relatively low capital costs for new natural gas plants, which improve the relative economics of gas when regulatory pressure is placed on the existing coal fleet. In the alternative cases, natural gas generation in 2035 varies from 1,323 billion kilowatthours to 1,797 billion kilowatthours, compared with 1,288 billion kilowatthours in the Reference case.

Assuming no changes in policy related to greenhouse gas emissions, carbon dioxide emissions grow slowly. Energy related CO2 emissions grow slowly in the AEO2011 Reference case due to a combination of modest economic growth, growing use of renewable technologies and fuels, efficiency improvements, slow growth in electricity demand, and more use of natural gas, which is less carbon intensive than other fossil fuels.

In the Reference case, which assumes no explicit regulations to limit greenhouse gas (GHG) emissions beyond vehicle GHG standards, energy related CO2 emissions do not return to 2005 levels (5,996 million metric tons) until 2027, growing by an average of 0.6 percent per year from 2009 to 2027, or a total of 10.6 percent. CO2 emissions then rise by an additional 5 percent from 2027 to 2035, to 6,311 million metric tons in 2035. The projections for CO2 emissions are sensitive to many factors, including economic growth, policies aimed at stimulating renewable fuel use or low carbon power sources, and any policies that may be enacted to reduce GHG emissions, all of which are explained in sensitivity cases.

The projections from the complete AEO2011, including the Reference case, all of the alternative cases, supplemental tables showing the regional projections, as well as a report on the major assumptions underlying the projections, can be accessed on EIA's Internet site at: www.eia.gov/forecasts/aeo

Share

"EIA's projections indicate strong growth in shale gas production, growing use of natural gas and renewables in electric power generation, declining reliance on imported liquid fuels, and projected slow growth in energy-related carbon dioxide emissions in the absence of new policies designed to reduce them," said EIA Administrator Richard Newell. "But variations in key assumptions can have a significant impact on the projected outcomes."

In addition to considering alternative scenarios for oil prices, economic growth, and the uptake of more energy efficient technologies, the AEO2011 sensitivity cases explore important areas of uncertainty for markets, technologies, and policies in the U.S. energy economy.

Key results highlighted in AEO2011 include:

U.S. reliance on imported liquid fuels falls due to increased domestic production ¿ including biofuels ¿ and greater fuel efficiency. Although U.S. consumption of liquid fuels continues to grow through 2035 in the Reference case, reliance on petroleum imports as a share of total liquids consumption decreases. Total U.S. consumption of liquid fuels, including both fossil fuels and biofuels, rises from about 18.8 million barrels per day in 2009 to 21.9 million barrels per day in 2035 in the Reference case. The import share, which reached 60 percent in 2005 and 2006 before falling to 51 percent in 2009, falls to 42 percent in 2035. Sensitivity cases illustrate opportunities for further reductions in U.S. reliance on imported liquid fuels through additional increases in fuel efficiency or domestic liquid fuels production.

Domestic shale gas resources support increased natural gas production with moderate prices, but assumptions about resources and recoverability are key uncertain factors. Shale gas production continues to increase strongly through 2035 in the AEO2011 Reference case, growing almost fourfold from 2009 to 2035 when it makes up 47 percent of total U.S. production¿up considerably from the 16 percent share in 2009.

Although more information on shale resources has become available as a result of increased drilling activity in developing shale gas plays, estimates of technically recoverable resources and well productivity remain highly uncertain. Over the past decade, as more shale formations have gone into commercial production, the estimate of technically and economically recoverable shale gas resources has skyrocketed.

However, the increases in recoverable shale gas resources embody many assumptions that might prove to be incorrect over the long term. Alternative cases in AEO2011 examine the potential impacts of variation in the estimated ultimate recovery per shale gas well and the assumed recoverability factor used to estimate how much of the play acreage contains recoverable shale gas.

Proposed environmental regulations could alter the power generation fuel mix. The EPA is expected to enact several key regulations in the coming decade that will have an impact on the U.S. power sector, particularly the fleet of coal fired power plants. Because the rules have not yet been finalized, their impacts cannot be fully analyzed, and they are not included in the Reference case.

However, AEO2011 does include several alternative cases that examine the sensitivity of power generation markets to various assumed requirements for environmental retrofits. The range of coal plant retirements varies considerably across the cases, with a low of 9 gigawatts (3 percent of the coal fleet) in the Reference case and a high of 73 gigawatts (over 20 percent of the coal fleet) in the most extreme case.

Electricity generation from natural gas is higher in 2035 in all the environmental regulation sensitivity cases than in the Reference case. The faster growth in electricity generation with natural gas is supported by low natural gas prices and relatively low capital costs for new natural gas plants, which improve the relative economics of gas when regulatory pressure is placed on the existing coal fleet. In the alternative cases, natural gas generation in 2035 varies from 1,323 billion kilowatthours to 1,797 billion kilowatthours, compared with 1,288 billion kilowatthours in the Reference case.

Assuming no changes in policy related to greenhouse gas emissions, carbon dioxide emissions grow slowly. Energy related CO2 emissions grow slowly in the AEO2011 Reference case due to a combination of modest economic growth, growing use of renewable technologies and fuels, efficiency improvements, slow growth in electricity demand, and more use of natural gas, which is less carbon intensive than other fossil fuels.

In the Reference case, which assumes no explicit regulations to limit greenhouse gas (GHG) emissions beyond vehicle GHG standards, energy related CO2 emissions do not return to 2005 levels (5,996 million metric tons) until 2027, growing by an average of 0.6 percent per year from 2009 to 2027, or a total of 10.6 percent. CO2 emissions then rise by an additional 5 percent from 2027 to 2035, to 6,311 million metric tons in 2035. The projections for CO2 emissions are sensitive to many factors, including economic growth, policies aimed at stimulating renewable fuel use or low carbon power sources, and any policies that may be enacted to reduce GHG emissions, all of which are explained in sensitivity cases.

The projections from the complete AEO2011, including the Reference case, all of the alternative cases, supplemental tables showing the regional projections, as well as a report on the major assumptions underlying the projections, can be accessed on EIA's Internet site at: www.eia.gov/forecasts/aeo

Share

Labels:

barrels,

Crude Oil,

EIA,

Technology

Tuesday, February 2, 2010

New Video: Crude Oil…What Does the Chart Say?

It appears as though crude oil has an amazing cyclic quality that can be timed quite accurately with MarketClub’s “Triangle” technology. In this new short video, I showcase this cycle and how you can take advantage of it.

Just click here to watch the new video and as always our videos are free to watch and there are no registration requirements. All we ask for is that you comment on this video if you find it interesting and informative.

Enjoy the video and let us know what you think.

Crude Oil....What Does the Chart Say?

Share

Labels:

Crude Oil,

MarketClub,

Technology,

trade triangle,

video

Thursday, November 26, 2009

Oil Stock Valuations Increasing....and Not Just From Higher Oil Prices

I have noticed valuations in the junior oil sector creeping up, sometimes to the point where I have to blink. But it’s not just the increase in the price of oil this year that has driven up valuations. Technology is increasing how much oil or gas companies can produce from a well in a day, and in the overall amount of oil or gas they can recover from a given formation, essentially how fast and how much they produce. Technology is giving investors more leverage to the price of oil.

This is especially true of the hot new “tight” plays that are being developed in western Canada and the US, where I have been focusing the subscriber portfolio.

(“Tight” just means the oil is held in rocks like shale or sandstone, as opposed to the more conventional type of looser sands that hold hydrocarbons, and from which almost all the world’s production has come from in the last 100 years.

Get 10 Trading Lessons FREE

As an example of valuations increasing, in August 2009 TriStar Oil and Gas merged with Petrobank’s Canadian operations, and was valued at about $109,000 per flowing barrel, which was almost double its average peer group valuation at the time. They were a 20,000+ bopd producer, and the larger the company, generally, the larger the valuation.

But now I am seeing junior producers one tenth that size, 2000 bopd or even 1000 bopd producers, get valuations in the $90,000 – $110,000 per flowing boe (barrels of oil equivalent) range. Most of these are in the 3 year old Bakken play in Saskatchewan, or the several months old Cardium play in Alberta. Several Canadian brokerage firms have issued reports saying these two oil plays have the best economics of any in Canada.....Read the entire article.

Share

Labels:

Crude Oil,

investors,

Keith Schaefer,

Technology,

valuations

Wednesday, August 26, 2009

Imagine Not Having Access to Any Financial News

Imagine not having access to any financial news stories. The only information you have about the market is the market itself.

Would you be a better trader or a less successful trader?

I think you would be a better trader. I have often said that the market is the best news provider in the world. It’s up to the minute and it reflects both domestic and international issues. The success of our “Trade Triangle” technology is based upon market action.

In our new short video, we’ll take a big look at the S&P 500 market and where we expect it will head in the months to come.

We all need to be prepared for what lies ahead, and this video is worth watching for that very reason.

Would you be a better trader or a less successful trader?

I think you would be a better trader. I have often said that the market is the best news provider in the world. It’s up to the minute and it reflects both domestic and international issues. The success of our “Trade Triangle” technology is based upon market action.

In our new short video, we’ll take a big look at the S&P 500 market and where we expect it will head in the months to come.

We all need to be prepared for what lies ahead, and this video is worth watching for that very reason.

Labels:

financial,

Technology,

trade triangle,

trader,

video

Wednesday, July 1, 2009

New Video: S&P 500 Update

How are you trading the S&P 500 right now? In this new video you will get a chance to see how the Market Club technology works and see just exactly how we are trading this market. As always, the video is free with no registration.

Please feel free to leave a comment to let us know what you think of the video and how you are trading the SP 500 right now.

Just Click Here To Watch The Video

Labels:

inventories,

Market Club,

SP 500,

Stochastics,

Technology

Subscribe to:

Comments (Atom)